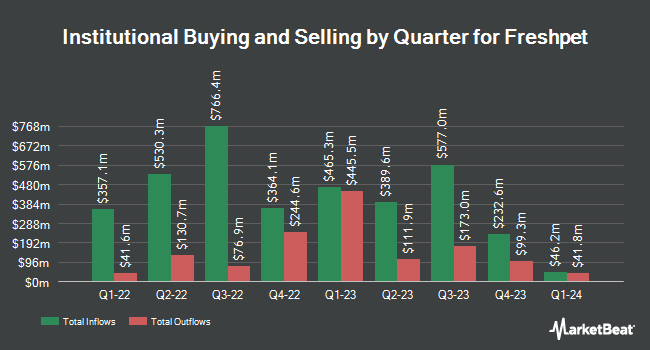

Geode Capital Management LLC boosted its holdings in Freshpet, Inc. (NASDAQ:FRPT - Free Report) by 4.7% during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 835,663 shares of the company's stock after acquiring an additional 37,287 shares during the quarter. Geode Capital Management LLC owned about 1.72% of Freshpet worth $115,650,000 as of its most recent SEC filing.

Other institutional investors and hedge funds have also added to or reduced their stakes in the company. WCM Investment Management LLC lifted its position in Freshpet by 749.7% in the 3rd quarter. WCM Investment Management LLC now owns 2,771,377 shares of the company's stock worth $376,187,000 after buying an additional 2,445,199 shares in the last quarter. Point72 Asset Management L.P. raised its position in Freshpet by 391.5% in the third quarter. Point72 Asset Management L.P. now owns 234,626 shares of the company's stock worth $32,090,000 after purchasing an additional 186,889 shares in the last quarter. Charles Schwab Investment Management Inc. boosted its stake in shares of Freshpet by 54.4% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 439,681 shares of the company's stock valued at $60,135,000 after purchasing an additional 154,909 shares in the last quarter. Driehaus Capital Management LLC increased its holdings in shares of Freshpet by 24.4% during the second quarter. Driehaus Capital Management LLC now owns 721,288 shares of the company's stock worth $93,327,000 after buying an additional 141,615 shares in the last quarter. Finally, Renaissance Technologies LLC acquired a new stake in Freshpet during the 2nd quarter valued at $8,902,000.

Freshpet Price Performance

Shares of NASDAQ FRPT opened at $146.38 on Wednesday. The stock has a market cap of $7.10 billion, a price-to-earnings ratio of 164.47 and a beta of 1.41. The company has a debt-to-equity ratio of 0.41, a quick ratio of 3.91 and a current ratio of 4.72. Freshpet, Inc. has a fifty-two week low of $82.16 and a fifty-two week high of $160.91. The firm's 50-day simple moving average is $146.84 and its 200 day simple moving average is $136.53.

Freshpet (NASDAQ:FRPT - Get Free Report) last posted its earnings results on Monday, November 4th. The company reported $0.24 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.14 by $0.10. Freshpet had a net margin of 4.75% and a return on equity of 3.67%. The firm had revenue of $253.40 million during the quarter, compared to analyst estimates of $248.36 million. During the same quarter in the prior year, the business posted ($0.15) EPS. The business's revenue was up 26.3% compared to the same quarter last year. As a group, research analysts anticipate that Freshpet, Inc. will post 0.9 earnings per share for the current fiscal year.

Insiders Place Their Bets

In related news, President Scott James Morris sold 5,000 shares of the stock in a transaction dated Tuesday, November 26th. The stock was sold at an average price of $158.13, for a total transaction of $790,650.00. Following the sale, the president now owns 122,380 shares of the company's stock, valued at approximately $19,351,949.40. This represents a 3.93 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider Thembeka Machaba sold 2,500 shares of the company's stock in a transaction on Thursday, November 7th. The stock was sold at an average price of $153.85, for a total transaction of $384,625.00. The disclosure for this sale can be found here. Insiders have sold a total of 12,500 shares of company stock valued at $1,962,175 in the last 90 days. 3.70% of the stock is currently owned by corporate insiders.

Wall Street Analysts Forecast Growth

Several equities research analysts have recently commented on FRPT shares. Truist Financial lifted their price target on shares of Freshpet from $160.00 to $170.00 and gave the stock a "buy" rating in a research report on Tuesday, November 5th. DA Davidson increased their target price on Freshpet from $183.00 to $189.00 and gave the stock a "buy" rating in a report on Tuesday, November 5th. JPMorgan Chase & Co. increased their target price on shares of Freshpet from $126.00 to $154.00 and gave the stock a "neutral" rating in a report on Tuesday, November 5th. StockNews.com cut Freshpet from a "hold" rating to a "sell" rating in a research report on Wednesday, November 20th. Finally, Robert W. Baird boosted their price target on Freshpet from $157.00 to $170.00 and gave the stock an "outperform" rating in a research report on Tuesday, November 5th. One research analyst has rated the stock with a sell rating, three have given a hold rating and twelve have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average target price of $157.80.

Check Out Our Latest Analysis on Freshpet

Freshpet Company Profile

(

Free Report)

Freshpet, Inc, together with its subsidiaries, manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe. It sells dog food, cat food, and dog treats under the Freshpet brand name; and Dognation and Dog Joy labels through various classes of retail, including grocery, mass, club, pet specialty, and natural, as well as online.

Featured Articles

Before you consider Freshpet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Freshpet wasn't on the list.

While Freshpet currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.