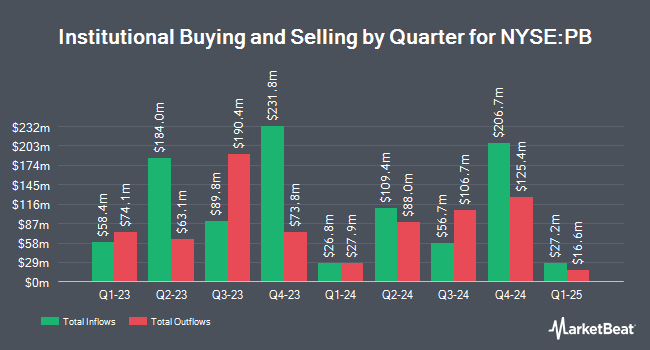

Geode Capital Management LLC grew its position in shares of Prosperity Bancshares, Inc. (NYSE:PB - Free Report) by 0.9% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 1,708,509 shares of the bank's stock after purchasing an additional 15,309 shares during the period. Geode Capital Management LLC owned 1.79% of Prosperity Bancshares worth $123,162,000 at the end of the most recent quarter.

Several other hedge funds also recently modified their holdings of the company. Victory Capital Management Inc. boosted its stake in shares of Prosperity Bancshares by 3.0% during the 2nd quarter. Victory Capital Management Inc. now owns 6,359,165 shares of the bank's stock worth $388,799,000 after purchasing an additional 184,453 shares during the last quarter. Dimensional Fund Advisors LP boosted its position in shares of Prosperity Bancshares by 14.2% in the second quarter. Dimensional Fund Advisors LP now owns 4,287,615 shares of the bank's stock worth $262,141,000 after acquiring an additional 532,241 shares during the last quarter. Charles Schwab Investment Management Inc. boosted its position in shares of Prosperity Bancshares by 0.6% in the third quarter. Charles Schwab Investment Management Inc. now owns 1,183,295 shares of the bank's stock worth $85,280,000 after acquiring an additional 6,518 shares during the last quarter. Bank of New York Mellon Corp boosted its position in shares of Prosperity Bancshares by 2.1% in the second quarter. Bank of New York Mellon Corp now owns 935,420 shares of the bank's stock worth $57,192,000 after acquiring an additional 19,224 shares during the last quarter. Finally, Vaughan Nelson Investment Management L.P. boosted its position in shares of Prosperity Bancshares by 4.6% in the third quarter. Vaughan Nelson Investment Management L.P. now owns 835,565 shares of the bank's stock worth $60,219,000 after acquiring an additional 36,480 shares during the last quarter. 80.69% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several research firms recently issued reports on PB. Wedbush reissued an "outperform" rating and issued a $90.00 target price on shares of Prosperity Bancshares in a research report on Thursday, October 24th. DA Davidson lowered shares of Prosperity Bancshares from a "buy" rating to a "neutral" rating and cut their price target for the company from $80.00 to $78.00 in a report on Tuesday, October 15th. Barclays raised their price target on shares of Prosperity Bancshares from $76.00 to $84.00 and gave the company an "equal weight" rating in a report on Thursday, December 5th. Truist Financial lowered shares of Prosperity Bancshares from a "buy" rating to a "hold" rating and cut their price target for the company from $81.00 to $79.00 in a report on Friday, September 20th. Finally, StockNews.com lowered shares of Prosperity Bancshares from a "hold" rating to a "sell" rating in a report on Friday, November 29th. One research analyst has rated the stock with a sell rating, five have given a hold rating and seven have given a buy rating to the stock. According to MarketBeat, Prosperity Bancshares has an average rating of "Hold" and an average target price of $81.65.

Read Our Latest Stock Analysis on PB

Prosperity Bancshares Stock Down 4.0 %

Shares of PB traded down $3.12 during mid-day trading on Wednesday, reaching $75.30. 661,117 shares of the stock traded hands, compared to its average volume of 561,498. The firm has a market cap of $7.17 billion, a price-to-earnings ratio of 15.99, a P/E/G ratio of 1.19 and a beta of 0.92. The stock has a fifty day simple moving average of $78.49 and a 200 day simple moving average of $71.40. Prosperity Bancshares, Inc. has a 12-month low of $57.16 and a 12-month high of $86.75.

Prosperity Bancshares (NYSE:PB - Get Free Report) last posted its quarterly earnings data on Wednesday, October 23rd. The bank reported $1.34 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.31 by $0.03. The company had revenue of $459.00 million for the quarter, compared to analyst estimates of $299.83 million. Prosperity Bancshares had a net margin of 25.39% and a return on equity of 6.46%. During the same quarter last year, the firm posted $1.20 earnings per share. On average, equities research analysts expect that Prosperity Bancshares, Inc. will post 5.05 earnings per share for the current fiscal year.

Prosperity Bancshares Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Thursday, January 2nd. Investors of record on Friday, December 13th will be issued a $0.58 dividend. The ex-dividend date of this dividend is Friday, December 13th. This is a boost from Prosperity Bancshares's previous quarterly dividend of $0.56. This represents a $2.32 annualized dividend and a yield of 3.08%. Prosperity Bancshares's dividend payout ratio is currently 49.26%.

Insider Activity at Prosperity Bancshares

In other Prosperity Bancshares news, Director Leah Henderson sold 1,100 shares of the business's stock in a transaction on Friday, November 22nd. The shares were sold at an average price of $83.24, for a total transaction of $91,564.00. Following the completion of the sale, the director now owns 7,525 shares in the company, valued at $626,381. The trade was a 12.75 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director Ned S. Holmes sold 500 shares of the business's stock in a transaction on Wednesday, November 20th. The shares were sold at an average price of $81.44, for a total transaction of $40,720.00. Following the sale, the director now owns 113,815 shares of the company's stock, valued at approximately $9,269,093.60. The trade was a 0.44 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 11,600 shares of company stock valued at $965,479 over the last ninety days. Corporate insiders own 4.28% of the company's stock.

Prosperity Bancshares Profile

(

Free Report)

Prosperity Bancshares, Inc operates as bank holding company for the Prosperity Bank that provides financial products and services to businesses and consumers. It accepts various deposit products, such as demand, savings, money market, and time accounts, as well as and certificates of deposit. The company also offers 1-4 family residential mortgage, commercial real estate and multifamily residential, commercial and industrial, agricultural, and non-real estate agricultural loans, as well as construction, land development, and other land loans; consumer loans, including automobile, recreational vehicle, boat, home improvement, personal, and deposit account collateralized loans; term loans and lines of credit; and consumer durables and home equity loans, as well as loans for working capital, business expansion, and purchase of equipment and machinery.

Featured Articles

Before you consider Prosperity Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prosperity Bancshares wasn't on the list.

While Prosperity Bancshares currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report