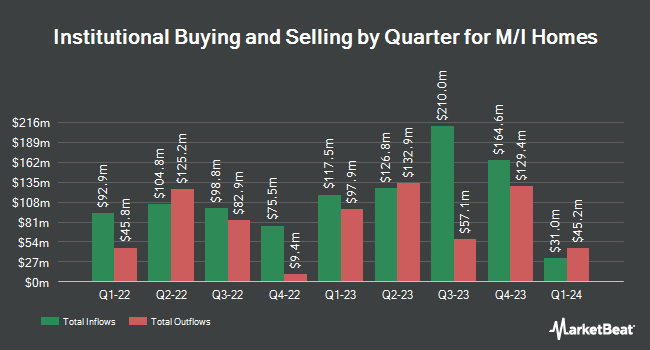

Geode Capital Management LLC increased its holdings in shares of M/I Homes, Inc. (NYSE:MHO - Free Report) by 3.1% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 723,797 shares of the construction company's stock after acquiring an additional 21,575 shares during the quarter. Geode Capital Management LLC owned about 2.61% of M/I Homes worth $124,050,000 as of its most recent SEC filing.

Other large investors have also added to or reduced their stakes in the company. CWM LLC grew its stake in M/I Homes by 184.8% in the 2nd quarter. CWM LLC now owns 507 shares of the construction company's stock valued at $62,000 after buying an additional 329 shares during the last quarter. SummerHaven Investment Management LLC increased its stake in shares of M/I Homes by 1.5% during the second quarter. SummerHaven Investment Management LLC now owns 8,393 shares of the construction company's stock worth $1,025,000 after purchasing an additional 123 shares during the period. Louisiana State Employees Retirement System lifted its holdings in M/I Homes by 1.4% during the 2nd quarter. Louisiana State Employees Retirement System now owns 14,000 shares of the construction company's stock worth $1,710,000 after purchasing an additional 200 shares during the last quarter. Bank of New York Mellon Corp boosted its stake in M/I Homes by 5.5% in the 2nd quarter. Bank of New York Mellon Corp now owns 262,373 shares of the construction company's stock valued at $32,046,000 after purchasing an additional 13,782 shares during the period. Finally, Cambridge Investment Research Advisors Inc. grew its holdings in M/I Homes by 4.9% in the 2nd quarter. Cambridge Investment Research Advisors Inc. now owns 19,660 shares of the construction company's stock valued at $2,401,000 after buying an additional 925 shares in the last quarter. Institutional investors own 95.14% of the company's stock.

Insider Transactions at M/I Homes

In other news, CFO Phillip G. Creek sold 20,000 shares of the firm's stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $160.00, for a total value of $3,200,000.00. Following the sale, the chief financial officer now directly owns 18,545 shares in the company, valued at approximately $2,967,200. This trade represents a 51.89 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. 3.70% of the stock is currently owned by insiders.

M/I Homes Price Performance

Shares of NYSE:MHO traded down $9.34 during trading on Wednesday, reaching $141.39. 339,423 shares of the company traded hands, compared to its average volume of 273,899. The firm has a market capitalization of $3.92 billion, a PE ratio of 7.58 and a beta of 2.23. M/I Homes, Inc. has a 52 week low of $109.92 and a 52 week high of $176.18. The company has a quick ratio of 1.60, a current ratio of 6.81 and a debt-to-equity ratio of 0.33. The company's 50 day moving average is $160.42 and its two-hundred day moving average is $151.13.

Wall Street Analyst Weigh In

MHO has been the topic of several research reports. StockNews.com downgraded shares of M/I Homes from a "strong-buy" rating to a "buy" rating in a research note on Thursday, October 31st. Wedbush raised shares of M/I Homes from a "neutral" rating to an "outperform" rating and raised their target price for the stock from $155.00 to $185.00 in a report on Monday, November 4th.

Read Our Latest Stock Report on MHO

M/I Homes Company Profile

(

Free Report)

M/I Homes, Inc, together with its subsidiaries, engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee. The company operates through Northern Homebuilding, Southern Homebuilding, and Financial Services segments.

Featured Articles

Before you consider M/I Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and M/I Homes wasn't on the list.

While M/I Homes currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.