Geode Capital Management LLC decreased its position in shares of AerCap Holdings (NYSE:AER - Free Report) by 7.7% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 1,548,717 shares of the financial services provider's stock after selling 129,497 shares during the period. Geode Capital Management LLC owned about 0.78% of AerCap worth $145,429,000 at the end of the most recent reporting period.

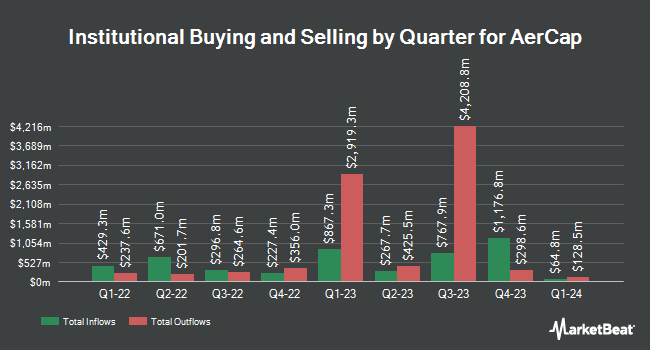

Several other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. State Street Corp increased its stake in AerCap by 8.3% during the 3rd quarter. State Street Corp now owns 4,862,517 shares of the financial services provider's stock worth $460,579,000 after buying an additional 370,906 shares during the period. Donald Smith & CO. Inc. grew its holdings in AerCap by 0.7% during the 3rd quarter. Donald Smith & CO. Inc. now owns 3,525,307 shares of the financial services provider's stock worth $333,917,000 after acquiring an additional 23,994 shares in the last quarter. Barrow Hanley Mewhinney & Strauss LLC grew its holdings in AerCap by 12.6% during the 2nd quarter. Barrow Hanley Mewhinney & Strauss LLC now owns 1,860,757 shares of the financial services provider's stock worth $173,423,000 after acquiring an additional 208,407 shares in the last quarter. FMR LLC grew its holdings in AerCap by 1.3% during the 3rd quarter. FMR LLC now owns 1,737,476 shares of the financial services provider's stock worth $164,574,000 after acquiring an additional 22,346 shares in the last quarter. Finally, Soros Fund Management LLC grew its holdings in AerCap by 2.1% during the 3rd quarter. Soros Fund Management LLC now owns 1,589,896 shares of the financial services provider's stock worth $150,595,000 after acquiring an additional 32,911 shares in the last quarter. Hedge funds and other institutional investors own 96.42% of the company's stock.

Wall Street Analysts Forecast Growth

AER has been the subject of several recent analyst reports. The Goldman Sachs Group reissued a "buy" rating and set a $119.00 price objective on shares of AerCap in a report on Thursday, November 21st. Deutsche Bank Aktiengesellschaft raised their price objective on shares of AerCap from $110.00 to $115.00 and gave the stock a "buy" rating in a report on Tuesday, October 22nd. One equities research analyst has rated the stock with a hold rating and six have assigned a buy rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $112.00.

Get Our Latest Research Report on AER

AerCap Stock Performance

Shares of NYSE AER traded down $2.19 during midday trading on Tuesday, hitting $95.11. The company's stock had a trading volume of 1,046,829 shares, compared to its average volume of 1,402,854. AerCap Holdings has a 1-year low of $70.48 and a 1-year high of $100.81. The firm's fifty day moving average price is $96.45 and its 200-day moving average price is $94.47. The company has a debt-to-equity ratio of 2.89, a quick ratio of 0.67 and a current ratio of 0.67. The firm has a market cap of $18.83 billion, a P/E ratio of 7.54, a P/E/G ratio of 2.17 and a beta of 1.82.

AerCap (NYSE:AER - Get Free Report) last posted its quarterly earnings results on Wednesday, October 30th. The financial services provider reported $2.41 EPS for the quarter, meeting the consensus estimate of $2.41. AerCap had a net margin of 32.38% and a return on equity of 13.98%. The business had revenue of $1.95 billion during the quarter, compared to analyst estimates of $1.92 billion. During the same period in the previous year, the business posted $2.81 EPS. The company's quarterly revenue was up 3.0% on a year-over-year basis. On average, sell-side analysts forecast that AerCap Holdings will post 11.26 EPS for the current fiscal year.

AerCap Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Thursday, December 5th. Investors of record on Wednesday, November 13th were given a $0.25 dividend. The ex-dividend date was Wednesday, November 13th. This represents a $1.00 annualized dividend and a yield of 1.05%. AerCap's dividend payout ratio is presently 7.92%.

AerCap Company Profile

(

Free Report)

AerCap Holdings N.V. engages in the lease, financing, sale, and management of commercial flight equipment in China, Hong Kong, Macau, the United States, Ireland, and internationally. The company offers aircraft asset management services, such as remarketing aircraft and engines; collecting rental and maintenance rent payments, monitoring aircraft maintenance, monitoring and enforcing contract compliance, and accepting delivery and redelivery of aircraft and engines; and conducting ongoing lessee financial performance reviews.

See Also

Before you consider AerCap, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AerCap wasn't on the list.

While AerCap currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.