Geode Capital Management LLC trimmed its holdings in shares of Okta, Inc. (NASDAQ:OKTA - Free Report) by 0.4% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 2,565,106 shares of the company's stock after selling 9,562 shares during the period. Geode Capital Management LLC owned about 1.51% of Okta worth $190,227,000 as of its most recent SEC filing.

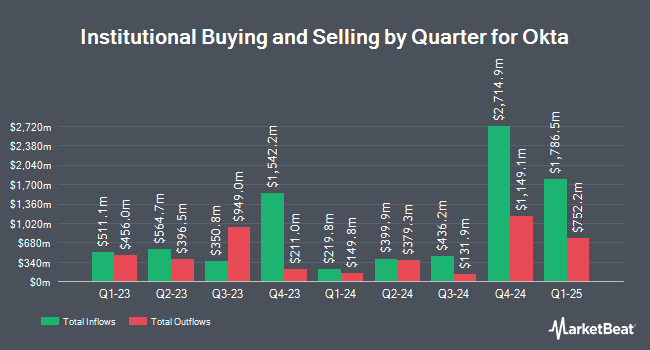

A number of other institutional investors also recently made changes to their positions in OKTA. Marshall Wace LLP boosted its stake in shares of Okta by 117.4% in the second quarter. Marshall Wace LLP now owns 2,273,700 shares of the company's stock valued at $212,841,000 after purchasing an additional 1,227,890 shares during the period. Point72 Asset Management L.P. bought a new position in Okta during the 3rd quarter valued at $49,373,000. Eminence Capital LP grew its holdings in Okta by 18.1% during the second quarter. Eminence Capital LP now owns 1,989,375 shares of the company's stock worth $186,225,000 after acquiring an additional 305,381 shares during the period. Robeco Institutional Asset Management B.V. boosted its stake in shares of Okta by 232.0% during the 3rd quarter. Robeco Institutional Asset Management B.V. now owns 396,538 shares of the company's stock worth $29,479,000 after acquiring an additional 277,084 shares in the last quarter. Finally, Truist Financial Corp lifted its position in shares of Okta by 62.5% in the 2nd quarter. Truist Financial Corp now owns 522,057 shares of the company's stock valued at $48,870,000 after acquiring an additional 200,770 shares in the last quarter. 86.64% of the stock is owned by institutional investors and hedge funds.

Insider Transactions at Okta

In related news, insider Larissa Schwartz sold 2,791 shares of the stock in a transaction dated Monday, November 4th. The shares were sold at an average price of $71.50, for a total value of $199,556.50. Following the completion of the transaction, the insider now directly owns 22,125 shares in the company, valued at $1,581,937.50. This trade represents a 11.20 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, Director Jacques Frederic Kerrest sold 131,426 shares of the company's stock in a transaction that occurred on Monday, December 2nd. The stock was sold at an average price of $80.68, for a total value of $10,603,449.68. Following the completion of the sale, the director now owns 1,622 shares in the company, valued at $130,862.96. The trade was a 98.78 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 604,425 shares of company stock worth $46,098,322. Insiders own 7.00% of the company's stock.

Analysts Set New Price Targets

Several research firms recently issued reports on OKTA. DA Davidson lifted their price objective on shares of Okta from $75.00 to $90.00 and gave the company a "neutral" rating in a research note on Wednesday, December 4th. Westpark Capital reiterated a "buy" rating and issued a $140.00 price objective on shares of Okta in a research note on Wednesday, December 4th. BMO Capital Markets lifted their price target on Okta from $103.00 to $105.00 and gave the company a "market perform" rating in a report on Wednesday, December 4th. Barclays boosted their target price on Okta from $81.00 to $96.00 and gave the stock an "equal weight" rating in a research report on Wednesday, December 4th. Finally, Jefferies Financial Group boosted their price objective on shares of Okta from $85.00 to $100.00 and gave the company a "hold" rating in a report on Wednesday, December 4th. One investment analyst has rated the stock with a sell rating, fifteen have assigned a hold rating and fifteen have issued a buy rating to the company. According to MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $104.27.

Check Out Our Latest Report on Okta

Okta Price Performance

OKTA traded up $2.77 on Monday, hitting $84.76. 4,094,158 shares of the company were exchanged, compared to its average volume of 2,147,302. The company has a debt-to-equity ratio of 0.06, a current ratio of 1.34 and a quick ratio of 1.34. The firm has a fifty day simple moving average of $76.84 and a two-hundred day simple moving average of $83.43. Okta, Inc. has a 12 month low of $70.56 and a 12 month high of $114.50.

About Okta

(

Free Report)

Okta, Inc operates as an identity partner in the United States and internationally. The company offers Okta's suite of products and services used to manage and secure identities, such as Single Sign-On that enables users to access applications in the cloud or on-premises from various devices; Adaptive Multi-Factor Authentication provides a layer of security for cloud, mobile, web applications, and data; API Access Management enables organizations to secure APIs; Access Gateway enables organizations to extend Workforce Identity Cloud; and Okta Device Access enables end users to securely log in to devices with Okta credentials.

Read More

Before you consider Okta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Okta wasn't on the list.

While Okta currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.