Geode Capital Management LLC lifted its position in shares of Leonardo DRS, Inc. (NASDAQ:DRS - Free Report) by 2.7% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 1,915,376 shares of the company's stock after purchasing an additional 51,014 shares during the period. Geode Capital Management LLC owned about 0.72% of Leonardo DRS worth $54,061,000 as of its most recent SEC filing.

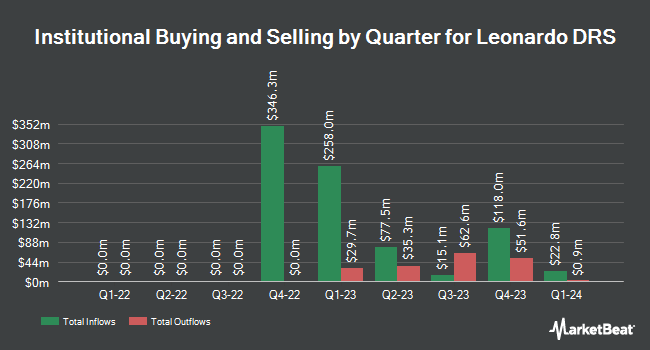

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Dimensional Fund Advisors LP acquired a new stake in shares of Leonardo DRS during the second quarter worth approximately $16,916,000. Van ECK Associates Corp acquired a new stake in shares of Leonardo DRS during the 2nd quarter worth approximately $11,093,000. Jacobs Levy Equity Management Inc. increased its stake in shares of Leonardo DRS by 71.7% in the third quarter. Jacobs Levy Equity Management Inc. now owns 921,156 shares of the company's stock valued at $25,995,000 after purchasing an additional 384,522 shares during the period. Victory Capital Management Inc. boosted its position in shares of Leonardo DRS by 1,133.6% during the third quarter. Victory Capital Management Inc. now owns 116,438 shares of the company's stock worth $3,286,000 after buying an additional 106,999 shares during the period. Finally, Barclays PLC raised its position in Leonardo DRS by 148.5% in the third quarter. Barclays PLC now owns 178,331 shares of the company's stock worth $5,032,000 after acquiring an additional 106,565 shares in the last quarter. 18.76% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling

In other news, CFO Michael Dippold sold 25,880 shares of the firm's stock in a transaction dated Monday, December 2nd. The stock was sold at an average price of $34.08, for a total transaction of $881,990.40. Following the sale, the chief financial officer now owns 47,028 shares of the company's stock, valued at $1,602,714.24. This trade represents a 35.50 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, SVP Pamela Morrow sold 11,100 shares of the business's stock in a transaction on Monday, December 2nd. The shares were sold at an average price of $34.81, for a total transaction of $386,391.00. Following the completion of the sale, the senior vice president now directly owns 12,565 shares in the company, valued at $437,387.65. This represents a 46.90 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 94,554 shares of company stock worth $3,236,679 in the last 90 days. Corporate insiders own 0.12% of the company's stock.

Leonardo DRS Price Performance

Shares of Leonardo DRS stock traded down $0.02 during midday trading on Monday, hitting $32.96. 145,336 shares of the company were exchanged, compared to its average volume of 625,024. The firm has a 50 day simple moving average of $32.98 and a 200-day simple moving average of $29.25. The company has a debt-to-equity ratio of 0.14, a current ratio of 2.11 and a quick ratio of 1.70. The firm has a market cap of $8.71 billion, a P/E ratio of 44.54, a PEG ratio of 1.76 and a beta of 0.97. Leonardo DRS, Inc. has a 52 week low of $18.60 and a 52 week high of $37.99.

Leonardo DRS (NASDAQ:DRS - Get Free Report) last issued its earnings results on Wednesday, October 30th. The company reported $0.24 EPS for the quarter, beating the consensus estimate of $0.20 by $0.04. The company had revenue of $812.00 million for the quarter, compared to the consensus estimate of $775.44 million. Leonardo DRS had a net margin of 6.23% and a return on equity of 9.71%. The firm's revenue for the quarter was up 15.5% compared to the same quarter last year. During the same quarter in the previous year, the company earned $0.20 EPS. Research analysts forecast that Leonardo DRS, Inc. will post 0.92 earnings per share for the current year.

Analyst Ratings Changes

A number of equities analysts recently issued reports on DRS shares. JPMorgan Chase & Co. lifted their target price on Leonardo DRS from $29.00 to $32.00 and gave the stock a "neutral" rating in a report on Monday, November 4th. Robert W. Baird raised their target price on Leonardo DRS from $30.00 to $40.00 and gave the company an "outperform" rating in a report on Thursday, October 31st. Finally, Bank of America cut Leonardo DRS from a "buy" rating to a "neutral" rating and increased their price objective for the company from $26.00 to $30.00 in a research report on Tuesday, September 24th. Three equities research analysts have rated the stock with a hold rating and three have issued a buy rating to the company. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $32.17.

Check Out Our Latest Research Report on DRS

Leonardo DRS Company Profile

(

Free Report)

Leonardo DRS, Inc, together with its subsidiaries, provides defense electronic products and systems, and military support services. It operates through Advanced Sensing and Computing (ASC) segment, and Integrated Mission Systems (IMS) segments. The ASC segment designs, develops, and manufacture sensing and network computing technology that enables real-time situational awareness required for enhanced operational decision making and execution; and offers sensing capabilities span applications, such as missions requiring advanced detection, precision targeting and surveillance sensing, long range electro-optic/infrared, signals intelligence, and other intelligence systems including electronic warfare, ground vehicle sensing, active electronically scanned array tactical radars, dismounted soldier, and space sensing.

See Also

Before you consider Leonardo DRS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Leonardo DRS wasn't on the list.

While Leonardo DRS currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.