Geode Capital Management LLC raised its stake in AMETEK, Inc. (NYSE:AME - Free Report) by 0.8% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 5,401,656 shares of the technology company's stock after buying an additional 45,459 shares during the period. Geode Capital Management LLC owned 2.34% of AMETEK worth $924,308,000 at the end of the most recent quarter.

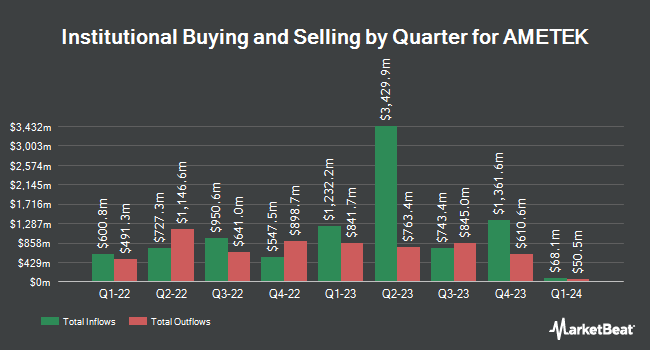

A number of other hedge funds and other institutional investors have also recently modified their holdings of AME. Sequoia Financial Advisors LLC grew its position in AMETEK by 6.1% during the 2nd quarter. Sequoia Financial Advisors LLC now owns 5,151 shares of the technology company's stock worth $859,000 after acquiring an additional 296 shares during the last quarter. Swedbank AB increased its stake in shares of AMETEK by 223.8% in the second quarter. Swedbank AB now owns 67,858 shares of the technology company's stock valued at $11,313,000 after buying an additional 46,903 shares during the period. Assenagon Asset Management S.A. raised its holdings in AMETEK by 68.2% in the 2nd quarter. Assenagon Asset Management S.A. now owns 152,132 shares of the technology company's stock valued at $25,362,000 after buying an additional 61,677 shares during the last quarter. Portside Wealth Group LLC raised its holdings in AMETEK by 8.4% in the 2nd quarter. Portside Wealth Group LLC now owns 2,641 shares of the technology company's stock valued at $440,000 after buying an additional 205 shares during the last quarter. Finally, Sawgrass Asset Management LLC acquired a new stake in AMETEK during the 2nd quarter worth approximately $9,128,000. Institutional investors own 87.43% of the company's stock.

Insider Activity

In related news, insider David F. Hermance sold 6,243 shares of the company's stock in a transaction on Friday, November 8th. The stock was sold at an average price of $190.99, for a total transaction of $1,192,350.57. Following the completion of the sale, the insider now owns 36,731 shares in the company, valued at approximately $7,015,253.69. This represents a 14.53 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, Director Steven W. Kohlhagen sold 1,460 shares of AMETEK stock in a transaction on Wednesday, September 25th. The stock was sold at an average price of $171.59, for a total transaction of $250,521.40. Following the transaction, the director now directly owns 23,349 shares in the company, valued at $4,006,454.91. This represents a 5.88 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 30,660 shares of company stock worth $5,958,141 in the last three months. Company insiders own 0.61% of the company's stock.

Analyst Ratings Changes

Several equities analysts have recently issued reports on the stock. Wolfe Research raised shares of AMETEK to a "hold" rating in a research note on Wednesday, September 18th. Mizuho raised their target price on AMETEK from $190.00 to $200.00 and gave the stock an "outperform" rating in a research report on Friday, November 1st. StockNews.com upgraded AMETEK from a "hold" rating to a "buy" rating in a research report on Wednesday, December 4th. Robert W. Baird raised their price objective on AMETEK from $166.00 to $186.00 and gave the stock a "neutral" rating in a research report on Monday, November 4th. Finally, TD Cowen cut AMETEK from a "hold" rating to a "sell" rating in a report on Monday, October 7th. One equities research analyst has rated the stock with a sell rating, two have issued a hold rating, six have assigned a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $199.29.

View Our Latest Stock Analysis on AMETEK

AMETEK Trading Down 0.1 %

AME stock traded down $0.25 during mid-day trading on Thursday, reaching $188.41. The company's stock had a trading volume of 774,243 shares, compared to its average volume of 1,150,722. AMETEK, Inc. has a 12 month low of $149.03 and a 12 month high of $198.33. The company has a current ratio of 1.39, a quick ratio of 0.84 and a debt-to-equity ratio of 0.18. The business's 50 day moving average price is $182.48 and its 200 day moving average price is $172.84. The company has a market cap of $43.58 billion, a price-to-earnings ratio of 32.89, a price-to-earnings-growth ratio of 3.13 and a beta of 1.15.

AMETEK (NYSE:AME - Get Free Report) last released its quarterly earnings data on Thursday, October 31st. The technology company reported $1.66 earnings per share for the quarter, beating the consensus estimate of $1.62 by $0.04. The company had revenue of $1.71 billion during the quarter, compared to analyst estimates of $1.71 billion. AMETEK had a net margin of 19.27% and a return on equity of 16.88%. AMETEK's revenue for the quarter was up 5.3% compared to the same quarter last year. During the same quarter in the previous year, the business posted $1.64 EPS. On average, equities research analysts predict that AMETEK, Inc. will post 6.8 EPS for the current year.

AMETEK Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, December 20th. Stockholders of record on Friday, December 6th will be paid a $0.28 dividend. The ex-dividend date of this dividend is Friday, December 6th. This represents a $1.12 annualized dividend and a dividend yield of 0.59%. AMETEK's dividend payout ratio is presently 19.51%.

AMETEK Profile

(

Free Report)

AMETEK, Inc manufactures and sells electronic instruments and electromechanical devices in the North America, Europe, Asia, and South America, and internationally. The company's EIG segment offers advanced instruments for the process, aerospace, power, and industrial markets; process and analytical instruments for the oil and gas, petrochemical, pharmaceutical, semiconductor, automation, and food and beverage industries; instruments to the laboratory equipment, ultra-precision manufacturing, medical, and test and measurement markets; power quality monitoring and c devices, uninterruptible power supplies, programmable power and electromagnetic compatibility test equipment, and sensors for gas turbines and dashboard instruments; heavy trucks, instrumentation, and controls for the food and beverage industries; and aircraft and engine sensors, power supplies, embedded computing, monitoring, fuel and fluid measurement, and data acquisition systems for aerospace and defense industry.

Recommended Stories

Before you consider AMETEK, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AMETEK wasn't on the list.

While AMETEK currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report