Geode Capital Management LLC boosted its holdings in shares of Electronic Arts Inc. (NASDAQ:EA - Free Report) by 0.4% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 6,671,657 shares of the game software company's stock after acquiring an additional 26,505 shares during the period. Geode Capital Management LLC owned about 2.54% of Electronic Arts worth $954,358,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

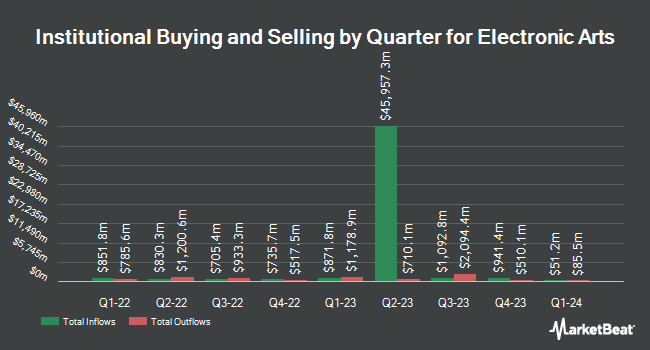

A number of other institutional investors have also added to or reduced their stakes in the business. Ashton Thomas Securities LLC purchased a new stake in shares of Electronic Arts during the third quarter valued at about $25,000. Family Firm Inc. acquired a new position in Electronic Arts during the 2nd quarter valued at approximately $33,000. Reston Wealth Management LLC purchased a new stake in shares of Electronic Arts during the third quarter valued at $36,000. Gradient Investments LLC raised its stake in Electronic Arts by 592.1% in the 2nd quarter. Gradient Investments LLC now owns 263 shares of the game software company's stock worth $37,000 after acquiring an additional 225 shares during the last quarter. Finally, Bruce G. Allen Investments LLC lifted its position in Electronic Arts by 156.6% during the 3rd quarter. Bruce G. Allen Investments LLC now owns 272 shares of the game software company's stock worth $39,000 after acquiring an additional 166 shares during the period. Hedge funds and other institutional investors own 90.23% of the company's stock.

Electronic Arts Stock Performance

Shares of NASDAQ:EA traded down $1.33 during trading hours on Thursday, hitting $162.59. The stock had a trading volume of 2,600,024 shares, compared to its average volume of 2,040,278. The stock's fifty day simple moving average is $155.28 and its 200 day simple moving average is $147.11. The firm has a market capitalization of $42.64 billion, a price-to-earnings ratio of 41.80, a PEG ratio of 2.18 and a beta of 0.79. The company has a debt-to-equity ratio of 0.25, a quick ratio of 1.43 and a current ratio of 1.43. Electronic Arts Inc. has a 1-year low of $124.92 and a 1-year high of $168.50.

Electronic Arts Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Wednesday, December 18th. Stockholders of record on Wednesday, November 27th will be given a $0.19 dividend. This represents a $0.76 annualized dividend and a dividend yield of 0.47%. The ex-dividend date is Wednesday, November 27th. Electronic Arts's dividend payout ratio (DPR) is currently 19.54%.

Wall Street Analyst Weigh In

Several equities analysts have recently weighed in on the stock. Benchmark reaffirmed a "buy" rating and set a $163.00 target price on shares of Electronic Arts in a report on Wednesday, October 30th. Wedbush reiterated an "outperform" rating and set a $170.00 price target on shares of Electronic Arts in a research report on Friday, October 25th. Robert W. Baird boosted their price target on shares of Electronic Arts from $170.00 to $175.00 and gave the stock an "outperform" rating in a report on Wednesday, October 30th. Morgan Stanley reaffirmed an "equal weight" rating and set a $150.00 price objective on shares of Electronic Arts in a report on Wednesday, September 18th. Finally, Argus boosted their target price on shares of Electronic Arts from $161.00 to $183.00 and gave the stock a "buy" rating in a research note on Thursday, November 7th. Eight research analysts have rated the stock with a hold rating, twelve have assigned a buy rating and two have assigned a strong buy rating to the stock. According to data from MarketBeat, Electronic Arts currently has an average rating of "Moderate Buy" and an average target price of $165.37.

View Our Latest Analysis on EA

Insider Activity

In other Electronic Arts news, EVP Jacob J. Schatz sold 1,500 shares of the business's stock in a transaction on Monday, September 16th. The shares were sold at an average price of $146.58, for a total transaction of $219,870.00. Following the completion of the transaction, the executive vice president now owns 26,360 shares of the company's stock, valued at $3,863,848.80. The trade was a 5.38 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Andrew Wilson sold 5,000 shares of the stock in a transaction on Wednesday, November 20th. The shares were sold at an average price of $166.47, for a total transaction of $832,350.00. Following the completion of the sale, the chief executive officer now directly owns 52,615 shares of the company's stock, valued at approximately $8,758,819.05. This trade represents a 8.68 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 20,000 shares of company stock worth $3,086,270. 0.22% of the stock is owned by corporate insiders.

Electronic Arts Profile

(

Free Report)

Electronic Arts Inc develops, markets, publishes, and distributes games, content, and services for game consoles, PCs, mobile phones, and tablets worldwide. It develops and publishes games and services across various genres, such as sports, racing, first-person shooter, action, role-playing, and simulation primarily under the Battlefield, The Sims, Apex Legends, Need for Speed, and license games from others, including FIFA, Madden NFL, UFC, and Star Wars brands.

Further Reading

Before you consider Electronic Arts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Electronic Arts wasn't on the list.

While Electronic Arts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.