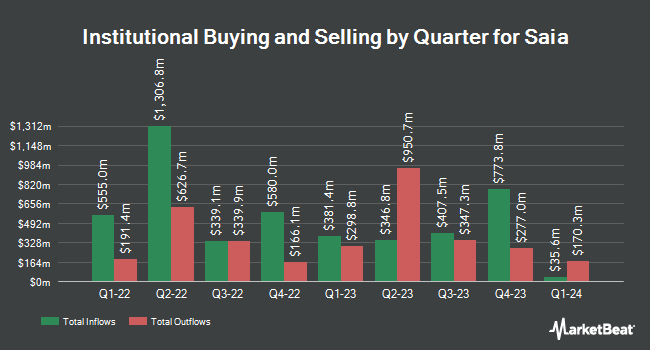

Geode Capital Management LLC boosted its position in Saia, Inc. (NASDAQ:SAIA - Free Report) by 1.4% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 471,667 shares of the transportation company's stock after purchasing an additional 6,456 shares during the quarter. Geode Capital Management LLC owned approximately 1.77% of Saia worth $206,292,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also added to or reduced their stakes in the company. Kayne Anderson Rudnick Investment Management LLC grew its stake in shares of Saia by 2.6% in the 2nd quarter. Kayne Anderson Rudnick Investment Management LLC now owns 869,859 shares of the transportation company's stock worth $412,566,000 after buying an additional 22,143 shares during the last quarter. State Street Corp boosted its holdings in Saia by 3.1% in the third quarter. State Street Corp now owns 805,597 shares of the transportation company's stock worth $352,255,000 after acquiring an additional 24,351 shares in the last quarter. Wasatch Advisors LP boosted its holdings in Saia by 10.2% in the third quarter. Wasatch Advisors LP now owns 692,405 shares of the transportation company's stock worth $302,761,000 after acquiring an additional 64,351 shares in the last quarter. Westfield Capital Management Co. LP grew its stake in shares of Saia by 11.8% in the third quarter. Westfield Capital Management Co. LP now owns 303,582 shares of the transportation company's stock worth $132,744,000 after acquiring an additional 31,991 shares during the last quarter. Finally, Allspring Global Investments Holdings LLC increased its holdings in shares of Saia by 64.6% during the third quarter. Allspring Global Investments Holdings LLC now owns 250,626 shares of the transportation company's stock valued at $109,589,000 after acquiring an additional 98,383 shares in the last quarter.

Insider Transactions at Saia

In other news, EVP Rohit Lal sold 1,120 shares of the stock in a transaction on Thursday, November 21st. The shares were sold at an average price of $560.00, for a total value of $627,200.00. Following the completion of the sale, the executive vice president now directly owns 8,270 shares of the company's stock, valued at $4,631,200. This represents a 11.93 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Corporate insiders own 0.30% of the company's stock.

Saia Stock Performance

Shares of SAIA traded up $7.66 on Monday, reaching $536.31. The company's stock had a trading volume of 308,451 shares, compared to its average volume of 383,173. The stock's 50 day simple moving average is $503.01 and its two-hundred day simple moving average is $455.57. The company has a debt-to-equity ratio of 0.08, a current ratio of 1.26 and a quick ratio of 1.26. The stock has a market capitalization of $14.26 billion, a P/E ratio of 37.79, a PEG ratio of 2.96 and a beta of 1.74. Saia, Inc. has a 12-month low of $358.90 and a 12-month high of $628.34.

Saia (NASDAQ:SAIA - Get Free Report) last issued its quarterly earnings results on Friday, October 25th. The transportation company reported $3.46 earnings per share for the quarter, missing the consensus estimate of $3.53 by ($0.07). Saia had a return on equity of 18.00% and a net margin of 11.83%. The business had revenue of $842.10 million for the quarter, compared to analysts' expectations of $839.82 million. During the same quarter in the prior year, the business earned $3.67 EPS. The company's revenue was up 8.6% compared to the same quarter last year. Research analysts forecast that Saia, Inc. will post 13.51 earnings per share for the current fiscal year.

Analysts Set New Price Targets

SAIA has been the topic of several recent analyst reports. TD Cowen increased their price objective on shares of Saia from $416.00 to $418.00 and gave the company a "hold" rating in a research report on Thursday, September 5th. Bank of America raised their price target on shares of Saia from $443.00 to $460.00 and gave the company a "buy" rating in a research report on Thursday, September 5th. Susquehanna boosted their price objective on shares of Saia from $550.00 to $585.00 and gave the stock a "positive" rating in a report on Wednesday, September 18th. Citigroup reduced their target price on Saia from $651.00 to $644.00 and set a "buy" rating for the company in a report on Wednesday, December 4th. Finally, Wells Fargo & Company upped their price target on Saia from $400.00 to $410.00 and gave the company an "equal weight" rating in a report on Thursday, September 5th. One analyst has rated the stock with a sell rating, five have assigned a hold rating and twelve have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and an average price target of $514.88.

Check Out Our Latest Report on SAIA

About Saia

(

Free Report)

Saia, Inc, together with its subsidiaries, operates as a transportation company in North America. The company provides less-than-truckload services for shipments between 100 and 10,000 pounds; and other value-added services, including non-asset truckload, expedited, and logistics services. It also offers other value-added services, including non-asset truckload, expedited, and logistics services.

Featured Stories

Before you consider Saia, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Saia wasn't on the list.

While Saia currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.