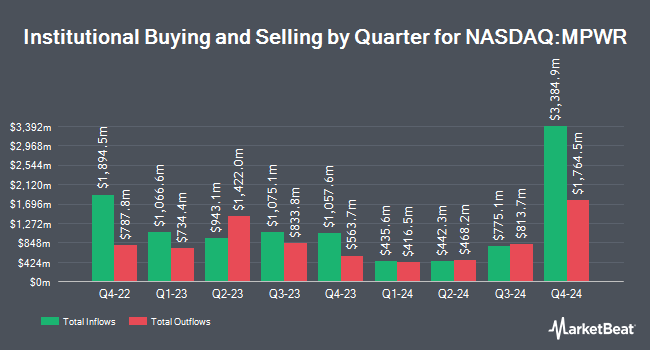

Geode Capital Management LLC raised its holdings in Monolithic Power Systems, Inc. (NASDAQ:MPWR - Free Report) by 11.2% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 1,334,164 shares of the semiconductor company's stock after acquiring an additional 133,838 shares during the period. Geode Capital Management LLC owned about 2.74% of Monolithic Power Systems worth $1,230,626,000 at the end of the most recent quarter.

Several other institutional investors have also recently bought and sold shares of MPWR. Executive Wealth Management LLC acquired a new position in Monolithic Power Systems during the 3rd quarter worth approximately $370,000. Barclays PLC grew its stake in shares of Monolithic Power Systems by 5.0% during the third quarter. Barclays PLC now owns 322,115 shares of the semiconductor company's stock worth $297,799,000 after buying an additional 15,350 shares during the last quarter. EWA LLC increased its holdings in shares of Monolithic Power Systems by 7.3% during the third quarter. EWA LLC now owns 366 shares of the semiconductor company's stock worth $338,000 after buying an additional 25 shares in the last quarter. Groupama Asset Managment lifted its stake in shares of Monolithic Power Systems by 29.8% in the 3rd quarter. Groupama Asset Managment now owns 4,024 shares of the semiconductor company's stock valued at $3,720,000 after acquiring an additional 924 shares during the last quarter. Finally, Nomura Asset Management Co. Ltd. boosted its holdings in shares of Monolithic Power Systems by 3.2% during the 3rd quarter. Nomura Asset Management Co. Ltd. now owns 19,287 shares of the semiconductor company's stock valued at $17,831,000 after acquiring an additional 601 shares in the last quarter. Institutional investors and hedge funds own 93.46% of the company's stock.

Monolithic Power Systems Trading Up 4.8 %

NASDAQ MPWR traded up $28.50 during trading hours on Wednesday, hitting $623.82. 948,107 shares of the company's stock were exchanged, compared to its average volume of 621,562. The firm has a market cap of $30.43 billion, a price-to-earnings ratio of 70.33, a PEG ratio of 2.81 and a beta of 1.05. The stock has a 50-day simple moving average of $743.45 and a 200 day simple moving average of $809.31. Monolithic Power Systems, Inc. has a 1-year low of $546.71 and a 1-year high of $959.64.

Monolithic Power Systems (NASDAQ:MPWR - Get Free Report) last released its earnings results on Wednesday, October 30th. The semiconductor company reported $2.99 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $3.04 by ($0.05). The company had revenue of $620.12 million for the quarter, compared to analyst estimates of $600.10 million. Monolithic Power Systems had a net margin of 21.29% and a return on equity of 20.44%. On average, sell-side analysts anticipate that Monolithic Power Systems, Inc. will post 10.46 earnings per share for the current fiscal year.

Monolithic Power Systems Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Tuesday, October 15th. Investors of record on Monday, September 30th were paid a dividend of $1.25 per share. This represents a $5.00 dividend on an annualized basis and a yield of 0.80%. The ex-dividend date was Monday, September 30th. Monolithic Power Systems's dividend payout ratio (DPR) is currently 56.37%.

Insider Buying and Selling

In other Monolithic Power Systems news, CFO Theodore Blegen sold 2,500 shares of Monolithic Power Systems stock in a transaction dated Monday, December 9th. The stock was sold at an average price of $600.00, for a total transaction of $1,500,000.00. Following the completion of the transaction, the chief financial officer now owns 53,444 shares in the company, valued at approximately $32,066,400. The trade was a 4.47 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, EVP Maurice Sciammas sold 11,000 shares of the stock in a transaction that occurred on Monday, October 7th. The stock was sold at an average price of $929.59, for a total value of $10,225,490.00. Following the completion of the sale, the executive vice president now directly owns 103,829 shares of the company's stock, valued at approximately $96,518,400.11. This trade represents a 9.58 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 20,100 shares of company stock worth $17,153,021 in the last ninety days. Corporate insiders own 3.70% of the company's stock.

Analysts Set New Price Targets

MPWR has been the subject of several research reports. Truist Financial reiterated a "buy" rating and issued a $994.00 target price (up from $918.00) on shares of Monolithic Power Systems in a research report on Wednesday, October 2nd. KeyCorp cut their target price on shares of Monolithic Power Systems from $1,075.00 to $700.00 and set an "overweight" rating on the stock in a research report on Monday, November 18th. Rosenblatt Securities cut shares of Monolithic Power Systems from a "strong-buy" rating to a "hold" rating in a research report on Thursday, October 31st. Needham & Company LLC cut their price target on shares of Monolithic Power Systems from $950.00 to $600.00 and set a "buy" rating on the stock in a report on Friday, November 22nd. Finally, Stifel Nicolaus boosted their price objective on shares of Monolithic Power Systems from $1,000.00 to $1,100.00 and gave the stock a "buy" rating in a research note on Friday, September 27th. Two equities research analysts have rated the stock with a hold rating and ten have assigned a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $828.67.

View Our Latest Analysis on Monolithic Power Systems

About Monolithic Power Systems

(

Free Report)

Monolithic Power Systems, Inc engages in the design, development, marketing, and sale of semiconductor-based power electronics solutions for the storage and computing, automotive, enterprise data, consumer, communications, and industrial markets. The company provides direct current (DC) to DC integrated circuits (ICs) that are used to convert and control voltages of various electronic systems, such as cloud-based CPU servers, server artificial intelligence applications, storage applications, commercial notebooks, digital cockpit, power sources, home appliances, 4G and 5G infrastructure, and satellite communications applications.

Featured Articles

Before you consider Monolithic Power Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Monolithic Power Systems wasn't on the list.

While Monolithic Power Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report