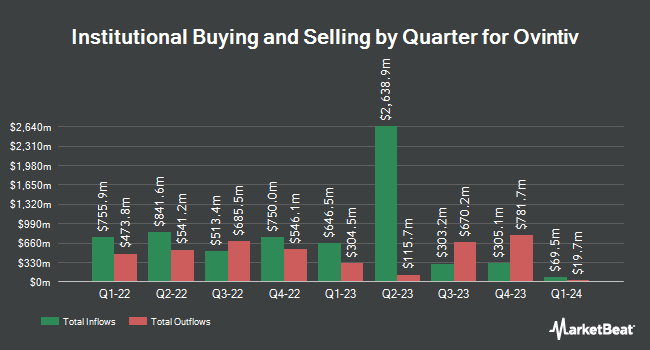

Geode Capital Management LLC grew its position in Ovintiv Inc. (NYSE:OVV - Free Report) by 4.7% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 4,533,633 shares of the company's stock after purchasing an additional 205,409 shares during the quarter. Geode Capital Management LLC owned about 1.74% of Ovintiv worth $173,296,000 at the end of the most recent reporting period.

Other large investors have also made changes to their positions in the company. Raymond James & Associates grew its stake in Ovintiv by 1.2% during the 3rd quarter. Raymond James & Associates now owns 196,518 shares of the company's stock worth $7,529,000 after buying an additional 2,275 shares during the last quarter. Quarry LP grew its stake in shares of Ovintiv by 89.1% during the second quarter. Quarry LP now owns 40,902 shares of the company's stock worth $1,917,000 after acquiring an additional 19,272 shares during the last quarter. Smead Capital Management Inc. increased its holdings in shares of Ovintiv by 3.5% during the third quarter. Smead Capital Management Inc. now owns 6,303,203 shares of the company's stock valued at $241,476,000 after acquiring an additional 212,535 shares in the last quarter. Entropy Technologies LP raised its position in shares of Ovintiv by 319.9% in the 3rd quarter. Entropy Technologies LP now owns 149,457 shares of the company's stock valued at $5,726,000 after purchasing an additional 113,866 shares during the last quarter. Finally, KBC Group NV boosted its stake in Ovintiv by 8.9% in the 3rd quarter. KBC Group NV now owns 333,207 shares of the company's stock worth $12,765,000 after purchasing an additional 27,338 shares in the last quarter. 83.81% of the stock is owned by institutional investors and hedge funds.

Ovintiv Price Performance

OVV stock traded down $0.74 during mid-day trading on Monday, reaching $39.77. 3,261,691 shares of the company's stock were exchanged, compared to its average volume of 3,070,333. The company has a debt-to-equity ratio of 0.46, a current ratio of 0.52 and a quick ratio of 0.52. Ovintiv Inc. has a 12-month low of $36.90 and a 12-month high of $55.95. The stock's 50 day moving average is $42.32 and its 200 day moving average is $43.55. The company has a market cap of $10.35 billion, a price-to-earnings ratio of 5.37 and a beta of 2.63.

Ovintiv Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Stockholders of record on Friday, December 13th will be given a dividend of $0.30 per share. The ex-dividend date is Friday, December 13th. This represents a $1.20 dividend on an annualized basis and a dividend yield of 3.02%. Ovintiv's dividend payout ratio (DPR) is 15.92%.

Wall Street Analysts Forecast Growth

OVV has been the topic of a number of recent analyst reports. Barclays upped their price target on shares of Ovintiv from $53.00 to $57.00 and gave the company an "overweight" rating in a research note on Friday, November 15th. Evercore ISI cut their target price on Ovintiv from $60.00 to $54.00 and set an "outperform" rating on the stock in a research report on Monday, September 30th. JPMorgan Chase & Co. lowered their price target on Ovintiv from $60.00 to $51.00 and set an "overweight" rating for the company in a research report on Thursday, September 12th. Mizuho dropped their price target on Ovintiv from $63.00 to $60.00 and set an "outperform" rating on the stock in a research note on Monday. Finally, Siebert Williams Shank upgraded Ovintiv to a "strong-buy" rating in a research note on Tuesday, October 15th. Five equities research analysts have rated the stock with a hold rating, twelve have assigned a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $56.59.

Check Out Our Latest Analysis on Ovintiv

Ovintiv Company Profile

(

Free Report)

Ovintiv Inc, together with its subsidiaries, explores, develops, produces, and markets natural gas, oil, and natural gas liquids in the United States and Canada. The company operates through USA Operations, Canadian Operations, and Market Optimization segments. Its principal assets include Permian in west Texas and Anadarko in west-central Oklahoma; and Montney in northeast British Columbia and northwest Alberta.

See Also

Before you consider Ovintiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ovintiv wasn't on the list.

While Ovintiv currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.