Geode Capital Management LLC raised its holdings in shares of Rigetti Computing, Inc. (NASDAQ:RGTI - Free Report) by 6.3% in the fourth quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 3,850,220 shares of the company's stock after purchasing an additional 228,391 shares during the period. Geode Capital Management LLC owned 2.00% of Rigetti Computing worth $58,767,000 as of its most recent SEC filing.

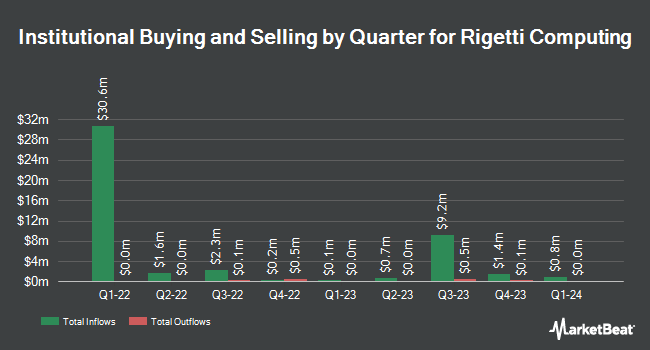

Several other large investors have also recently made changes to their positions in the business. Signaturefd LLC bought a new stake in Rigetti Computing during the 4th quarter valued at about $25,000. EverSource Wealth Advisors LLC bought a new stake in shares of Rigetti Computing in the 4th quarter worth $28,000. Tucker Asset Management LLC purchased a new position in shares of Rigetti Computing in the fourth quarter worth $32,000. Spire Wealth Management bought a new position in shares of Rigetti Computing during the fourth quarter valued at $46,000. Finally, Jones Financial Companies Lllp purchased a new stake in shares of Rigetti Computing during the fourth quarter valued at $50,000. 35.38% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several research firms have issued reports on RGTI. Benchmark restated a "buy" rating and set a $14.00 target price on shares of Rigetti Computing in a research note on Thursday, March 6th. B. Riley raised their target price on shares of Rigetti Computing from $8.50 to $15.00 and gave the stock a "buy" rating in a report on Friday, February 14th. Alliance Global Partners reiterated a "buy" rating on shares of Rigetti Computing in a research note on Thursday, March 6th. Craig Hallum began coverage on Rigetti Computing in a report on Friday, December 20th. They issued a "buy" rating and a $12.00 price objective for the company. Finally, Needham & Company LLC reissued a "buy" rating and issued a $17.00 target price on shares of Rigetti Computing in a report on Thursday, March 6th. Five research analysts have rated the stock with a buy rating, According to data from MarketBeat, Rigetti Computing has an average rating of "Buy" and an average price target of $14.50.

Read Our Latest Research Report on Rigetti Computing

Rigetti Computing Stock Performance

RGTI traded down $0.24 during midday trading on Monday, reaching $8.86. The company had a trading volume of 23,153,761 shares, compared to its average volume of 48,711,084. Rigetti Computing, Inc. has a 1 year low of $0.66 and a 1 year high of $21.42. The company has a quick ratio of 4.84, a current ratio of 4.84 and a debt-to-equity ratio of 0.02. The company has a market cap of $2.53 billion, a P/E ratio of -23.32 and a beta of 1.41. The business has a 50-day moving average of $9.64 and a two-hundred day moving average of $7.41.

Rigetti Computing (NASDAQ:RGTI - Get Free Report) last posted its quarterly earnings results on Wednesday, March 5th. The company reported ($0.08) earnings per share for the quarter, hitting analysts' consensus estimates of ($0.08). The business had revenue of $2.27 million during the quarter, compared to analyst estimates of $2.40 million. Rigetti Computing had a negative net margin of 509.58% and a negative return on equity of 51.56%. During the same period in the prior year, the business posted ($0.04) earnings per share. As a group, equities research analysts predict that Rigetti Computing, Inc. will post -0.34 earnings per share for the current fiscal year.

Insider Activity at Rigetti Computing

In other Rigetti Computing news, CTO David Rivas sold 351,785 shares of the company's stock in a transaction that occurred on Tuesday, March 11th. The stock was sold at an average price of $7.76, for a total transaction of $2,729,851.60. Following the sale, the chief technology officer now directly owns 1,094,738 shares in the company, valued at $8,495,166.88. This represents a 24.32 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this link. 2.81% of the stock is currently owned by insiders.

Rigetti Computing Profile

(

Free Report)

Rigetti Computing, Inc, through its subsidiaries, builds quantum computers and the superconducting quantum processors. The company offers cloud in a form of quantum processing unit, such as 9-qubit chip and Ankaa-2 system under the Novera brand name; and sells access to its quantum computers through quantum computing as a service.

Further Reading

Before you consider Rigetti Computing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rigetti Computing wasn't on the list.

While Rigetti Computing currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.