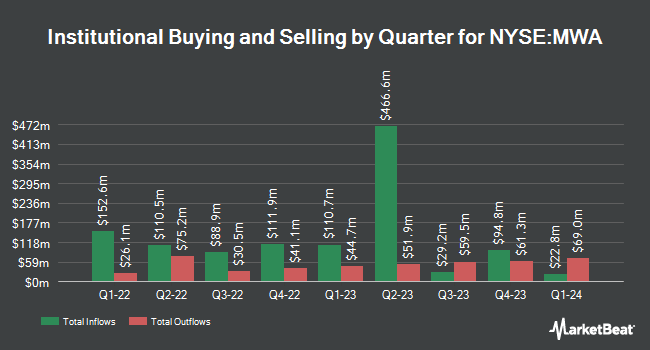

Geode Capital Management LLC raised its stake in shares of Mueller Water Products, Inc. (NYSE:MWA - Free Report) by 2.1% in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 3,538,901 shares of the industrial products company's stock after buying an additional 73,069 shares during the period. Geode Capital Management LLC owned about 2.27% of Mueller Water Products worth $76,809,000 as of its most recent SEC filing.

Other institutional investors and hedge funds have also modified their holdings of the company. Victory Capital Management Inc. boosted its position in Mueller Water Products by 399.0% during the second quarter. Victory Capital Management Inc. now owns 2,962,757 shares of the industrial products company's stock valued at $53,093,000 after purchasing an additional 2,369,055 shares during the last quarter. Mesirow Institutional Investment Management Inc. acquired a new stake in shares of Mueller Water Products during the 2nd quarter valued at about $14,040,000. Driehaus Capital Management LLC bought a new stake in shares of Mueller Water Products in the 2nd quarter valued at approximately $13,031,000. Robeco Schweiz AG acquired a new position in Mueller Water Products in the second quarter worth approximately $9,154,000. Finally, Cubist Systematic Strategies LLC raised its position in Mueller Water Products by 281.7% during the second quarter. Cubist Systematic Strategies LLC now owns 663,792 shares of the industrial products company's stock valued at $11,895,000 after acquiring an additional 489,902 shares in the last quarter. 91.68% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several analysts have commented on the stock. Oppenheimer reissued an "outperform" rating and issued a $27.00 target price (up from $26.00) on shares of Mueller Water Products in a research report on Friday, November 8th. StockNews.com cut shares of Mueller Water Products from a "strong-buy" rating to a "buy" rating in a report on Wednesday, October 30th. Five research analysts have rated the stock with a hold rating and two have assigned a buy rating to the company's stock. Based on data from MarketBeat, Mueller Water Products presently has a consensus rating of "Hold" and an average price target of $22.20.

Check Out Our Latest Stock Report on MWA

Insiders Place Their Bets

In other news, Director Lydia W. Thomas sold 10,791 shares of the company's stock in a transaction dated Monday, November 18th. The shares were sold at an average price of $24.40, for a total transaction of $263,300.40. Following the completion of the transaction, the director now owns 136,405 shares of the company's stock, valued at approximately $3,328,282. This represents a 7.33 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CAO Suzanne G. Smith sold 26,138 shares of Mueller Water Products stock in a transaction dated Monday, December 9th. The stock was sold at an average price of $24.99, for a total value of $653,188.62. Following the sale, the chief accounting officer now directly owns 9,378 shares in the company, valued at approximately $234,356.22. This trade represents a 73.59 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 98,433 shares of company stock valued at $2,494,144 in the last three months. Company insiders own 1.40% of the company's stock.

Mueller Water Products Stock Performance

Shares of NYSE:MWA traded up $0.07 during trading on Friday, reaching $22.94. The stock had a trading volume of 1,972,939 shares, compared to its average volume of 1,245,178. The stock has a fifty day simple moving average of $23.87 and a two-hundred day simple moving average of $21.23. The company has a quick ratio of 2.16, a current ratio of 3.33 and a debt-to-equity ratio of 0.55. Mueller Water Products, Inc. has a 52 week low of $13.49 and a 52 week high of $26.28. The firm has a market capitalization of $3.58 billion, a price-to-earnings ratio of 31.42, a P/E/G ratio of 1.38 and a beta of 1.37.

Mueller Water Products (NYSE:MWA - Get Free Report) last announced its earnings results on Wednesday, November 6th. The industrial products company reported $0.22 EPS for the quarter, hitting the consensus estimate of $0.22. The firm had revenue of $348.20 million for the quarter, compared to the consensus estimate of $324.80 million. Mueller Water Products had a net margin of 8.82% and a return on equity of 19.38%. The business's quarterly revenue was up 15.5% on a year-over-year basis. During the same quarter last year, the firm posted $0.19 EPS. As a group, analysts anticipate that Mueller Water Products, Inc. will post 1.17 earnings per share for the current fiscal year.

Mueller Water Products Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Wednesday, November 20th. Investors of record on Friday, November 8th were paid a dividend of $0.067 per share. This is an increase from Mueller Water Products's previous quarterly dividend of $0.06. The ex-dividend date was Friday, November 8th. This represents a $0.27 annualized dividend and a yield of 1.17%. Mueller Water Products's dividend payout ratio is presently 36.99%.

Mueller Water Products Company Profile

(

Free Report)

Mueller Water Products, Inc manufactures and markets products and services for the transmission, distribution, and measurement of water used by municipalities, and the residential and non-residential construction industries in the United States, Israel, and internationally. It operates in two segments, Water Flow Solutions and Water Management Solutions.

Read More

Before you consider Mueller Water Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mueller Water Products wasn't on the list.

While Mueller Water Products currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report