Geode Capital Management LLC reduced its position in shares of Phillips Edison & Company, Inc. (NASDAQ:PECO - Free Report) by 0.3% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 3,181,904 shares of the company's stock after selling 8,932 shares during the period. Geode Capital Management LLC owned approximately 2.60% of Phillips Edison & Company, Inc. worth $119,218,000 at the end of the most recent reporting period.

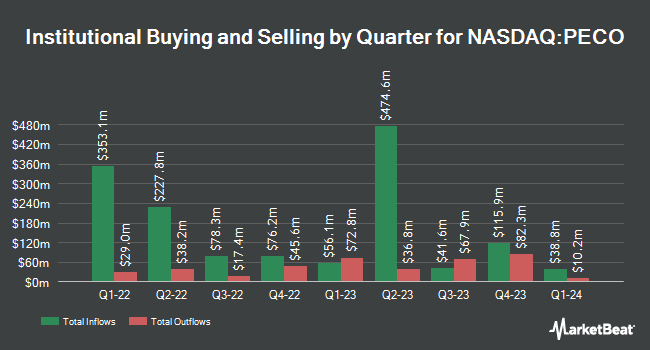

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in PECO. Verition Fund Management LLC lifted its position in shares of Phillips Edison & Company, Inc. by 191.3% during the 3rd quarter. Verition Fund Management LLC now owns 22,802 shares of the company's stock worth $860,000 after buying an additional 14,975 shares during the last quarter. Centiva Capital LP bought a new position in shares of Phillips Edison & Company, Inc. in the third quarter worth about $318,000. HighTower Advisors LLC boosted its stake in shares of Phillips Edison & Company, Inc. by 26.9% in the 3rd quarter. HighTower Advisors LLC now owns 31,411 shares of the company's stock valued at $1,191,000 after purchasing an additional 6,666 shares in the last quarter. Point72 Asset Management L.P. acquired a new position in Phillips Edison & Company, Inc. during the 3rd quarter worth approximately $588,000. Finally, State Street Corp lifted its stake in Phillips Edison & Company, Inc. by 0.3% in the 3rd quarter. State Street Corp now owns 7,068,684 shares of the company's stock valued at $267,289,000 after purchasing an additional 18,429 shares during the last quarter. 80.70% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

PECO has been the subject of several research analyst reports. Mizuho lowered their price target on shares of Phillips Edison & Company, Inc. from $41.00 to $38.00 and set an "outperform" rating for the company in a report on Tuesday, February 25th. Wells Fargo & Company dropped their price objective on shares of Phillips Edison & Company, Inc. from $37.00 to $36.00 and set an "equal weight" rating for the company in a report on Wednesday, March 26th. Finally, JPMorgan Chase & Co. cut their price target on shares of Phillips Edison & Company, Inc. from $41.00 to $40.00 and set a "neutral" rating on the stock in a report on Tuesday, January 7th. Three equities research analysts have rated the stock with a hold rating and three have given a buy rating to the stock. According to MarketBeat, Phillips Edison & Company, Inc. presently has an average rating of "Moderate Buy" and an average target price of $38.83.

Read Our Latest Analysis on PECO

Phillips Edison & Company, Inc. Price Performance

Shares of PECO traded up $0.25 during trading hours on Monday, hitting $35.30. The stock had a trading volume of 52,034 shares, compared to its average volume of 694,314. Phillips Edison & Company, Inc. has a 1-year low of $30.62 and a 1-year high of $40.12. The firm has a 50 day simple moving average of $35.81 and a 200-day simple moving average of $37.00. The firm has a market capitalization of $4.42 billion, a P/E ratio of 70.60, a price-to-earnings-growth ratio of 1.70 and a beta of 0.57.

Phillips Edison & Company, Inc. (NASDAQ:PECO - Get Free Report) last posted its quarterly earnings data on Thursday, February 6th. The company reported $0.62 EPS for the quarter, beating the consensus estimate of $0.12 by $0.50. Phillips Edison & Company, Inc. had a net margin of 9.48% and a return on equity of 2.40%. Equities analysts predict that Phillips Edison & Company, Inc. will post 2.55 EPS for the current fiscal year.

Phillips Edison & Company, Inc. Announces Dividend

The company also recently announced a monthly dividend, which will be paid on Thursday, May 1st. Shareholders of record on Tuesday, April 15th will be paid a $0.1025 dividend. The ex-dividend date is Tuesday, April 15th. This represents a $1.23 annualized dividend and a dividend yield of 3.48%. Phillips Edison & Company, Inc.'s payout ratio is presently 246.00%.

Phillips Edison & Company, Inc. Profile

(

Free Report)

Phillips Edison & Co, Inc is a real estate investment trust, which engages in the ownership and operation of shopping centers. It also offers an investment management business providing property management and advisory services. Its portfolio consists of well-occupied, grocery-anchored neighborhood and community shopping centers having a mix of national, regional, and local retailers offering necessity-based goods and services.

Read More

Before you consider Phillips Edison & Company, Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Phillips Edison & Company, Inc. wasn't on the list.

While Phillips Edison & Company, Inc. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.