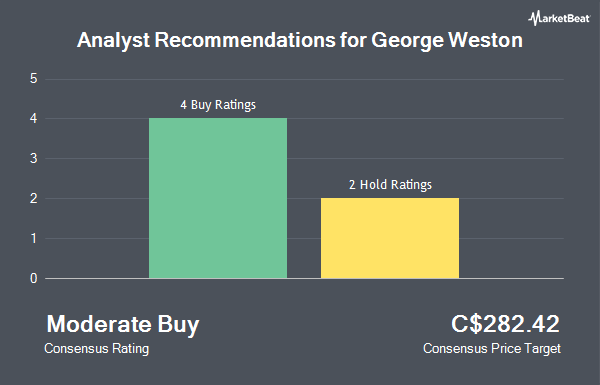

George Weston Limited (TSE:WN - Get Free Report) has received a consensus recommendation of "Moderate Buy" from the six ratings firms that are covering the company, Marketbeat.com reports. Two equities research analysts have rated the stock with a hold rating and four have issued a buy rating on the company. The average twelve-month price objective among analysts that have covered the stock in the last year is C$251.42.

Several research firms recently weighed in on WN. Royal Bank of Canada cut their price target on shares of George Weston from C$266.00 to C$264.00 and set an "outperform" rating on the stock in a report on Thursday, February 27th. Scotiabank lowered George Weston from an "outperform" rating to a "sector perform" rating and upped their target price for the company from C$240.00 to C$241.00 in a report on Thursday, February 27th. CIBC dropped their price target on George Weston from C$269.00 to C$268.00 and set an "outperform" rating on the stock in a report on Thursday, February 27th. Finally, Desjardins cut their price objective on George Weston from C$255.00 to C$251.00 and set a "buy" rating on the stock in a research report on Thursday, February 27th.

View Our Latest Stock Analysis on WN

Insider Buying and Selling at George Weston

In other George Weston news, Senior Officer Rashid Wasti sold 250 shares of George Weston stock in a transaction dated Friday, February 28th. The stock was sold at an average price of C$231.30, for a total transaction of C$57,825.00. Also, Director Willard Galen Garfield Weston sold 57,463 shares of the stock in a transaction dated Wednesday, March 5th. The stock was sold at an average price of C$231.03, for a total transaction of C$13,275,441.29. Over the last ninety days, insiders bought 4,000 shares of company stock valued at $90,780 and sold 77,461 shares valued at $17,949,441. 59.41% of the stock is owned by corporate insiders.

George Weston Stock Up 0.1 %

WN traded up C$0.23 during midday trading on Monday, reaching C$238.80. 87,890 shares of the company were exchanged, compared to its average volume of 136,157. The company has a market cap of C$31.00 billion, a price-to-earnings ratio of 47.80, a price-to-earnings-growth ratio of 5.03 and a beta of 0.42. George Weston has a one year low of C$174.30 and a one year high of C$241.48. The company's fifty day moving average price is C$227.24 and its 200 day moving average price is C$225.64. The company has a debt-to-equity ratio of 372.50, a quick ratio of 0.73 and a current ratio of 1.32.

George Weston Company Profile

(

Get Free ReportGeorge Weston is a holding company that operates through two subsidiaries encompassing retail and real estate. The first is Loblaw, the largest grocer in Canada, in which it has a 53% controlling stake. The second is Choice Properties, an open-ended real estate investment trust, where George Weston's ownership sits close to 62%.

Further Reading

Before you consider George Weston, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and George Weston wasn't on the list.

While George Weston currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.