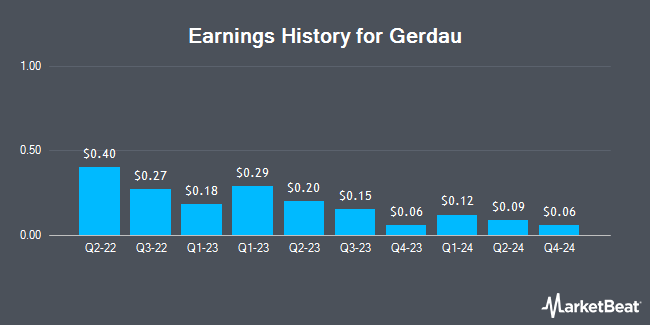

Gerdau (NYSE:GGB - Get Free Report) will likely be issuing its Q1 2025 quarterly earnings data before the market opens on Friday, May 2nd. Analysts expect the company to announce earnings of $0.11 per share and revenue of $2.97 billion for the quarter.

Gerdau (NYSE:GGB - Get Free Report) last announced its quarterly earnings results on Wednesday, February 19th. The basic materials company reported $0.06 earnings per share (EPS) for the quarter, meeting the consensus estimate of $0.06. The company had revenue of $2.88 billion for the quarter, compared to the consensus estimate of $2.66 billion. Gerdau had a net margin of 7.03% and a return on equity of 7.74%. On average, analysts expect Gerdau to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Gerdau Trading Up 2.7 %

GGB stock opened at $2.66 on Friday. The business has a fifty day simple moving average of $2.78 and a 200-day simple moving average of $3.02. Gerdau has a 52 week low of $2.27 and a 52 week high of $4.04. The company has a quick ratio of 1.53, a current ratio of 2.98 and a debt-to-equity ratio of 0.21. The company has a market cap of $5.53 billion, a price-to-earnings ratio of 6.19 and a beta of 1.37.

Gerdau Cuts Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, March 21st. Investors of record on Friday, March 7th were issued a dividend of $0.0175 per share. The ex-dividend date was Friday, March 7th. This represents a $0.07 annualized dividend and a dividend yield of 2.64%. Gerdau's payout ratio is 13.95%.

Wall Street Analyst Weigh In

Several equities research analysts recently issued reports on GGB shares. UBS Group initiated coverage on shares of Gerdau in a research note on Wednesday, March 12th. They set a "neutral" rating on the stock. Bank of America reiterated a "neutral" rating on shares of Gerdau in a research note on Monday, April 7th.

Read Our Latest Stock Report on GGB

About Gerdau

(

Get Free Report)

Gerdau SA, together with its subsidiaries, operates as a steel producer company. The company operates through Brazil Business, North America Business, South America Business, and Special Steel Business segments. It also provides semi-finished products, including billets, blooms, and slabs; common long rolled products, such as rebars, wire rods, merchant bars, light shapes, and profiles to the construction and manufacturing industries; drawn products comprising barbed and barbless fence wires, galvanized wires, fences, concrete reinforcing wire mesh, nails, and clamps for manufacturing, construction, and agricultural industries; and special steel products used in auto parts, light and heavy vehicles, and agricultural machinery, as well as in the oil and gas, wind energy, machinery and equipment, mining and rail, and other markets.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Gerdau, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gerdau wasn't on the list.

While Gerdau currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.