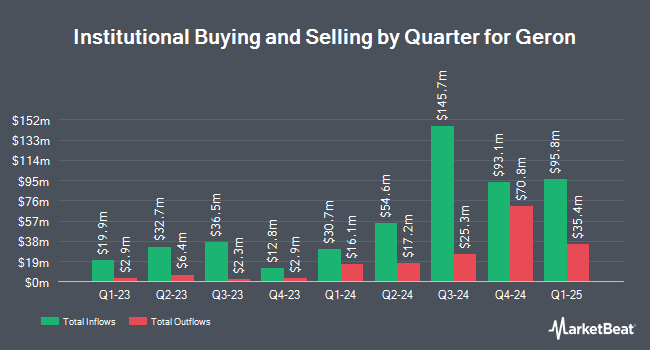

MML Investors Services LLC trimmed its holdings in Geron Co. (NASDAQ:GERN - Free Report) by 35.3% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 551,168 shares of the biopharmaceutical company's stock after selling 300,060 shares during the quarter. MML Investors Services LLC owned about 0.09% of Geron worth $2,502,000 as of its most recent SEC filing.

Several other institutional investors and hedge funds have also made changes to their positions in the stock. Darwin Global Management Ltd. purchased a new stake in shares of Geron in the second quarter valued at about $106,185,000. Renaissance Technologies LLC acquired a new position in Geron in the 2nd quarter valued at about $3,315,000. RTW Investments LP purchased a new stake in shares of Geron in the 3rd quarter valued at approximately $200,268,000. Algert Global LLC acquired a new stake in shares of Geron during the 2nd quarter worth approximately $539,000. Finally, Farallon Capital Management LLC raised its position in shares of Geron by 124.6% during the 2nd quarter. Farallon Capital Management LLC now owns 16,837,000 shares of the biopharmaceutical company's stock valued at $71,389,000 after buying an additional 9,342,000 shares during the period. 73.71% of the stock is currently owned by institutional investors and hedge funds.

Geron Stock Down 1.3 %

Shares of GERN stock traded down $0.05 during trading on Monday, reaching $3.81. The company's stock had a trading volume of 10,751,748 shares, compared to its average volume of 10,174,543. The company has a market capitalization of $2.30 billion, a price-to-earnings ratio of -11.91 and a beta of 0.51. Geron Co. has a 1-year low of $1.64 and a 1-year high of $5.34. The company has a debt-to-equity ratio of 0.04, a current ratio of 2.89 and a quick ratio of 2.74. The stock's 50-day moving average price is $4.06 and its 200 day moving average price is $4.36.

Geron (NASDAQ:GERN - Get Free Report) last posted its quarterly earnings data on Thursday, November 7th. The biopharmaceutical company reported ($0.04) earnings per share for the quarter, topping analysts' consensus estimates of ($0.09) by $0.05. The business had revenue of $28.27 million for the quarter, compared to analyst estimates of $18.97 million. Geron had a negative return on equity of 67.53% and a negative net margin of 682.48%. The company's revenue was up 17138.4% on a year-over-year basis. During the same quarter in the prior year, the company earned ($0.08) earnings per share. On average, research analysts anticipate that Geron Co. will post -0.25 EPS for the current year.

Wall Street Analysts Forecast Growth

GERN has been the subject of several analyst reports. Leerink Partnrs upgraded Geron to a "strong-buy" rating in a research report on Monday, September 9th. Barclays upgraded Geron to a "strong-buy" rating in a report on Friday, November 29th. HC Wainwright restated a "buy" rating and issued a $9.00 price objective on shares of Geron in a report on Tuesday, December 10th. Scotiabank initiated coverage on shares of Geron in a research note on Wednesday, October 16th. They set a "sector outperform" rating and a $6.00 target price for the company. Finally, Needham & Company LLC reissued a "buy" rating and issued a $6.00 price target on shares of Geron in a research note on Friday. One equities research analyst has rated the stock with a sell rating, one has given a hold rating, eight have issued a buy rating and two have assigned a strong buy rating to the stock. Based on data from MarketBeat.com, Geron presently has an average rating of "Moderate Buy" and a consensus target price of $7.15.

Get Our Latest Stock Report on GERN

About Geron

(

Free Report)

Geron Corporation, a late-stage clinical biopharmaceutical company, focuses on the development and commercialization of therapeutics for myeloid hematologic malignancies. It develops imetelstat, a telomerase inhibitor that is in Phase 3 clinical trials, which inhibits the uncontrolled proliferation of malignant stem and progenitor cells in myeloid hematologic malignancies for the treatment of low or intermediate-1 risk myelodysplastic syndromes and intermediate-2 or high-risk myelofibrosis.

Featured Articles

Before you consider Geron, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Geron wasn't on the list.

While Geron currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.