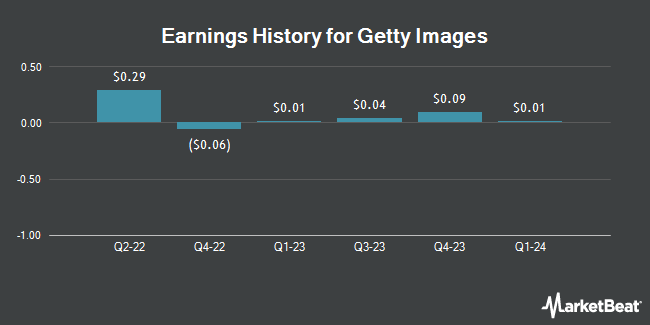

Getty Images (NYSE:GETY - Get Free Report) will likely be releasing its earnings data after the market closes on Monday, March 17th. Analysts expect Getty Images to post earnings of $0.04 per share and revenue of $245.50 million for the quarter. Individual interested in listening to the company's earnings conference call can do so using this link.

Getty Images Price Performance

GETY traded down $0.03 during midday trading on Thursday, hitting $2.03. 671,949 shares of the company traded hands, compared to its average volume of 3,360,462. The business has a 50 day simple moving average of $2.48 and a two-hundred day simple moving average of $3.04. Getty Images has a 52-week low of $1.90 and a 52-week high of $5.70. The company has a market capitalization of $832.43 million, a price-to-earnings ratio of 16.88 and a beta of 1.97. The company has a current ratio of 0.79, a quick ratio of 0.79 and a debt-to-equity ratio of 1.84.

Wall Street Analyst Weigh In

Several equities analysts have recently weighed in on GETY shares. Wedbush restated an "outperform" rating and issued a $7.70 target price on shares of Getty Images in a research report on Tuesday, January 7th. Macquarie restated a "neutral" rating and issued a $3.75 price objective on shares of Getty Images in a report on Wednesday, January 8th. Benchmark reaffirmed a "buy" rating and set a $6.00 target price on shares of Getty Images in a report on Friday, January 10th. Finally, JPMorgan Chase & Co. reiterated an "underweight" rating on shares of Getty Images in a research report on Wednesday, December 18th. One investment analyst has rated the stock with a sell rating, one has assigned a hold rating and three have assigned a buy rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus price target of $5.61.

Read Our Latest Stock Analysis on GETY

Insider Activity

In related news, CEO Craig Warren Peters sold 32,753 shares of the business's stock in a transaction on Tuesday, December 24th. The stock was sold at an average price of $2.20, for a total value of $72,056.60. Following the sale, the chief executive officer now owns 1,212,648 shares in the company, valued at approximately $2,667,825.60. The trade was a 2.63 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CFO Jennifer Leyden sold 12,342 shares of the business's stock in a transaction dated Tuesday, December 24th. The stock was sold at an average price of $2.20, for a total transaction of $27,152.40. Following the sale, the chief financial officer now owns 261,034 shares in the company, valued at $574,274.80. This trade represents a 4.51 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 70,521 shares of company stock valued at $155,146 in the last 90 days. Company insiders own 12.30% of the company's stock.

Getty Images Company Profile

(

Get Free Report)

Getty Images Holdings, Inc offers creative and editorial visual content solutions in the Americas, Europe, the Middle East, Africa, and Asia-Pacific. Its products include Getty Images that offers creative and editorial content including stills, music and video which focuses on corporate, agency, and media customers; iStock.com, an e-commerce offering where customers have access to creative stills and video; Unsplash.com, a platform offering free stock photo downloads and paid subscriptions targeted to the high-growth prosumer and semi-professional creator segments; and Unsplash+ that provides access to unique model released content with expanded legal protections.

Recommended Stories

Before you consider Getty Images, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Getty Images wasn't on the list.

While Getty Images currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.