Intech Investment Management LLC raised its position in shares of Getty Realty Corp. (NYSE:GTY - Free Report) by 155.6% during the 4th quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 49,497 shares of the real estate investment trust's stock after purchasing an additional 30,134 shares during the quarter. Intech Investment Management LLC owned 0.09% of Getty Realty worth $1,491,000 at the end of the most recent quarter.

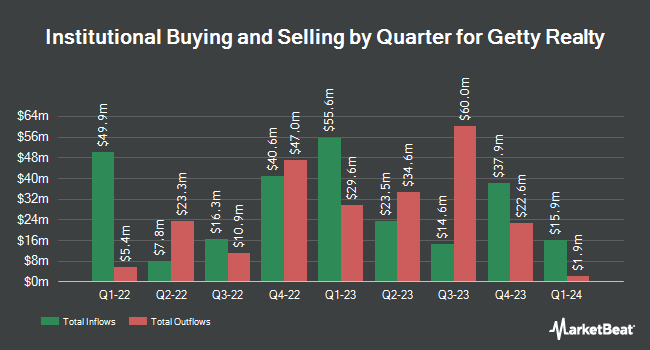

A number of other hedge funds also recently modified their holdings of GTY. HighTower Advisors LLC grew its holdings in shares of Getty Realty by 0.6% during the fourth quarter. HighTower Advisors LLC now owns 63,200 shares of the real estate investment trust's stock valued at $1,904,000 after buying an additional 391 shares in the last quarter. Louisiana State Employees Retirement System grew its stake in Getty Realty by 1.7% during the 4th quarter. Louisiana State Employees Retirement System now owns 24,500 shares of the real estate investment trust's stock valued at $738,000 after acquiring an additional 400 shares in the last quarter. GAMMA Investing LLC grew its stake in Getty Realty by 66.2% during the 4th quarter. GAMMA Investing LLC now owns 1,486 shares of the real estate investment trust's stock valued at $45,000 after acquiring an additional 592 shares in the last quarter. KBC Group NV increased its holdings in shares of Getty Realty by 45.8% in the 3rd quarter. KBC Group NV now owns 2,175 shares of the real estate investment trust's stock valued at $69,000 after purchasing an additional 683 shares during the period. Finally, State of Alaska Department of Revenue lifted its position in shares of Getty Realty by 1.9% in the fourth quarter. State of Alaska Department of Revenue now owns 52,913 shares of the real estate investment trust's stock worth $1,593,000 after purchasing an additional 1,009 shares in the last quarter. Hedge funds and other institutional investors own 85.11% of the company's stock.

Getty Realty Stock Up 1.0 %

GTY traded up $0.30 during midday trading on Wednesday, hitting $30.79. 288,328 shares of the company's stock traded hands, compared to its average volume of 276,487. The company has a debt-to-equity ratio of 0.94, a current ratio of 2.28 and a quick ratio of 2.28. The company has a market cap of $1.69 billion, a PE ratio of 24.44 and a beta of 0.91. The stock's fifty day simple moving average is $30.81 and its 200-day simple moving average is $31.29. Getty Realty Corp. has a one year low of $25.70 and a one year high of $33.85.

Getty Realty (NYSE:GTY - Get Free Report) last released its quarterly earnings results on Wednesday, February 12th. The real estate investment trust reported $0.60 earnings per share for the quarter, beating analysts' consensus estimates of $0.31 by $0.29. Getty Realty had a net margin of 34.94% and a return on equity of 7.43%. As a group, equities analysts anticipate that Getty Realty Corp. will post 2.29 earnings per share for the current fiscal year.

Getty Realty Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Thursday, April 10th. Stockholders of record on Thursday, March 27th will be paid a dividend of $0.47 per share. The ex-dividend date of this dividend is Thursday, March 27th. This represents a $1.88 annualized dividend and a dividend yield of 6.11%. Getty Realty's dividend payout ratio (DPR) is presently 149.21%.

Wall Street Analysts Forecast Growth

Several research analysts have weighed in on the stock. KeyCorp upgraded shares of Getty Realty from a "sector weight" rating to an "overweight" rating and set a $35.00 price objective on the stock in a research note on Tuesday, December 17th. JMP Securities reaffirmed a "market outperform" rating and issued a $34.00 price target on shares of Getty Realty in a research note on Friday, January 10th. Two analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to data from MarketBeat, Getty Realty presently has an average rating of "Moderate Buy" and an average price target of $34.00.

Check Out Our Latest Research Report on Getty Realty

Getty Realty Company Profile

(

Free Report)

Further Reading

Before you consider Getty Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Getty Realty wasn't on the list.

While Getty Realty currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.