GFL Environmental (NYSE:GFL - Free Report) had its price objective upped by Truist Financial from $46.00 to $54.00 in a research note released on Friday,Benzinga reports. The brokerage currently has a buy rating on the stock.

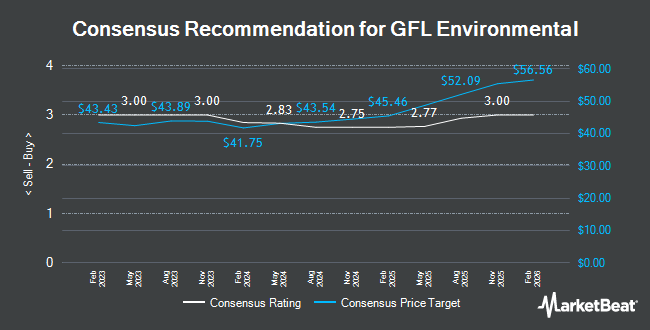

A number of other research analysts also recently weighed in on GFL. Scotiabank raised their price target on shares of GFL Environmental from $50.00 to $51.00 and gave the company a "sector outperform" rating in a report on Friday. Royal Bank of Canada raised their target price on GFL Environmental from $46.00 to $48.00 and gave the company an "outperform" rating in a report on Friday, August 2nd. Raymond James upped their price target on GFL Environmental from $43.00 to $45.00 and gave the stock an "outperform" rating in a research note on Monday, July 22nd. Finally, UBS Group raised their price objective on GFL Environmental from $47.00 to $50.00 and gave the company a "buy" rating in a research note on Thursday. Three analysts have rated the stock with a hold rating and seven have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $45.80.

Get Our Latest Stock Report on GFL Environmental

GFL Environmental Stock Down 0.8 %

NYSE GFL traded down $0.37 on Friday, reaching $45.13. The stock had a trading volume of 1,954,631 shares, compared to its average volume of 1,227,953. The company has a current ratio of 0.89, a quick ratio of 0.89 and a debt-to-equity ratio of 1.45. GFL Environmental has a 1 year low of $26.87 and a 1 year high of $46.48. The business has a 50 day moving average price of $40.79 and a 200 day moving average price of $38.27. The company has a market capitalization of $16.99 billion, a price-to-earnings ratio of -30.10 and a beta of 1.15.

GFL Environmental (NYSE:GFL - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The company reported $0.24 EPS for the quarter, beating the consensus estimate of $0.23 by $0.01. GFL Environmental had a positive return on equity of 3.32% and a negative net margin of 8.78%. The business had revenue of $1.48 billion during the quarter, compared to analysts' expectations of $1.49 billion. On average, analysts forecast that GFL Environmental will post 0.61 EPS for the current fiscal year.

GFL Environmental Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Thursday, October 31st. Stockholders of record on Wednesday, October 16th were issued a dividend of $0.014 per share. The ex-dividend date was Wednesday, October 16th. This represents a $0.06 dividend on an annualized basis and a dividend yield of 0.12%. GFL Environmental's dividend payout ratio (DPR) is presently -4.00%.

Institutional Investors Weigh In On GFL Environmental

Hedge funds and other institutional investors have recently modified their holdings of the stock. Janney Montgomery Scott LLC grew its position in GFL Environmental by 143.9% during the first quarter. Janney Montgomery Scott LLC now owns 17,628 shares of the company's stock worth $608,000 after buying an additional 10,400 shares in the last quarter. Envestnet Portfolio Solutions Inc. increased its position in shares of GFL Environmental by 13.0% during the first quarter. Envestnet Portfolio Solutions Inc. now owns 6,795 shares of the company's stock valued at $234,000 after purchasing an additional 780 shares during the period. Oppenheimer Asset Management Inc. acquired a new position in shares of GFL Environmental in the first quarter valued at $459,000. Headlands Technologies LLC bought a new position in GFL Environmental in the first quarter worth $39,000. Finally, Element Capital Management LLC bought a new position in GFL Environmental in the first quarter worth $2,516,000. Institutional investors and hedge funds own 64.70% of the company's stock.

About GFL Environmental

(

Get Free Report)

GFL Environmental Inc offers non-hazardous solid waste management and environmental services in Canada and the United States. It offers solid waste management, liquid waste management, and soil remediation services, including collection, transportation, transfer, recycling, and disposal services for municipal, residential, and commercial, and industrial customers.

Featured Stories

Before you consider GFL Environmental, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GFL Environmental wasn't on the list.

While GFL Environmental currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.