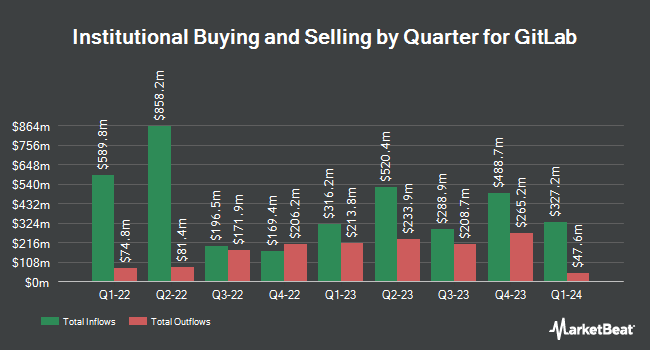

Geode Capital Management LLC lifted its stake in GitLab Inc. (NASDAQ:GTLB - Free Report) by 7.0% during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 2,026,567 shares of the company's stock after buying an additional 132,548 shares during the quarter. Geode Capital Management LLC owned approximately 1.26% of GitLab worth $104,476,000 as of its most recent SEC filing.

Several other institutional investors also recently bought and sold shares of GTLB. Sumitomo Mitsui Trust Holdings Inc. acquired a new stake in GitLab during the second quarter worth $214,000. Summit Global Investments acquired a new position in GitLab during the second quarter worth $293,000. Bank of New York Mellon Corp boosted its position in shares of GitLab by 30.1% during the second quarter. Bank of New York Mellon Corp now owns 676,579 shares of the company's stock worth $33,640,000 after buying an additional 156,582 shares during the period. Allspring Global Investments Holdings LLC lifted its stake in GitLab by 549.1% during the 2nd quarter. Allspring Global Investments Holdings LLC now owns 3,726 shares of the company's stock worth $185,000 after acquiring an additional 3,152 shares in the last quarter. Finally, Zurcher Kantonalbank Zurich Cantonalbank boosted its holdings in GitLab by 48.3% during the 2nd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 24,524 shares of the company's stock valued at $1,219,000 after acquiring an additional 7,987 shares during the period. 95.04% of the stock is currently owned by hedge funds and other institutional investors.

GitLab Stock Down 2.8 %

GTLB traded down $1.58 during trading on Thursday, reaching $55.66. 3,104,351 shares of the company's stock were exchanged, compared to its average volume of 2,450,360. GitLab Inc. has a fifty-two week low of $40.72 and a fifty-two week high of $78.53. The company has a market capitalization of $9.03 billion, a P/E ratio of -173.94 and a beta of 0.54. The business has a 50 day moving average price of $59.52 and a 200 day moving average price of $52.64.

Analyst Ratings Changes

Several brokerages recently weighed in on GTLB. TD Cowen raised their target price on shares of GitLab from $63.00 to $70.00 and gave the company a "buy" rating in a report on Thursday, November 21st. The Goldman Sachs Group upped their price objective on shares of GitLab from $80.00 to $88.00 and gave the stock a "buy" rating in a research report on Friday, December 6th. JPMorgan Chase & Co. raised their target price on GitLab from $60.00 to $65.00 and gave the company a "neutral" rating in a report on Friday, December 6th. Mizuho raised their price objective on GitLab from $67.00 to $80.00 and gave the company an "outperform" rating in a research note on Monday, December 9th. Finally, BTIG Research increased their price objective on GitLab from $58.00 to $63.00 and gave the company a "buy" rating in a research note on Wednesday, September 4th. Three research analysts have rated the stock with a hold rating, twenty-three have issued a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $76.42.

View Our Latest Stock Report on GitLab

Insider Buying and Selling

In related news, insider Robin Schulman sold 2,990 shares of the stock in a transaction dated Thursday, October 10th. The stock was sold at an average price of $55.00, for a total transaction of $164,450.00. Following the completion of the transaction, the insider now directly owns 136,076 shares in the company, valued at approximately $7,484,180. This trade represents a 2.15 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CFO Brian G. Robins sold 10,000 shares of GitLab stock in a transaction on Monday, December 9th. The shares were sold at an average price of $67.59, for a total transaction of $675,900.00. Following the completion of the sale, the chief financial officer now owns 242,803 shares in the company, valued at $16,411,054.77. The trade was a 3.96 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 180,182 shares of company stock worth $10,466,739 over the last three months. 21.36% of the stock is currently owned by company insiders.

GitLab Company Profile

(

Free Report)

GitLab Inc, through its subsidiaries, develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific. It offers GitLab, a DevOps platform, which is a single application that leads to faster cycle time and allows visibility throughout and control over various stages of the DevOps lifecycle.

Featured Articles

Before you consider GitLab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GitLab wasn't on the list.

While GitLab currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.