GitLab (NASDAQ:GTLB - Get Free Report) had its price target increased by investment analysts at Royal Bank of Canada from $73.00 to $80.00 in a research note issued to investors on Friday,Benzinga reports. The firm currently has an "outperform" rating on the stock. Royal Bank of Canada's target price would indicate a potential upside of 19.07% from the company's previous close.

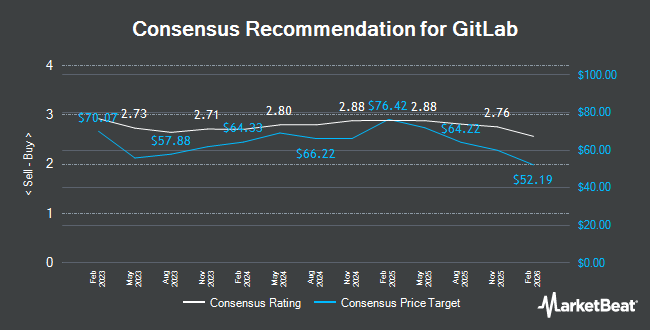

Several other analysts also recently commented on GTLB. Morgan Stanley assumed coverage on GitLab in a research note on Wednesday, October 9th. They issued an "overweight" rating and a $70.00 price objective for the company. Barclays increased their price objective on GitLab from $50.00 to $55.00 and gave the stock an "equal weight" rating in a research note on Thursday, September 5th. DA Davidson reissued a "neutral" rating and issued a $50.00 price objective on shares of GitLab in a research note on Monday, October 14th. JPMorgan Chase & Co. upped their target price on GitLab from $60.00 to $65.00 and gave the company a "neutral" rating in a report on Friday. Finally, Piper Sandler upped their target price on GitLab from $75.00 to $85.00 and gave the company an "overweight" rating in a report on Friday. Three research analysts have rated the stock with a hold rating, twenty-two have issued a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, GitLab has an average rating of "Moderate Buy" and a consensus price target of $74.56.

View Our Latest Report on GTLB

GitLab Trading Up 1.7 %

GTLB stock traded up $1.15 during trading on Friday, reaching $67.19. 12,913,277 shares of the stock were exchanged, compared to its average volume of 1,952,928. The firm's 50 day moving average is $57.91 and its 200 day moving average is $52.24. GitLab has a twelve month low of $40.72 and a twelve month high of $78.53. The firm has a market cap of $10.78 billion, a P/E ratio of -209.97 and a beta of 0.54.

GitLab (NASDAQ:GTLB - Get Free Report) last posted its quarterly earnings results on Tuesday, September 3rd. The company reported $0.15 earnings per share for the quarter, topping analysts' consensus estimates of $0.10 by $0.05. GitLab had a negative return on equity of 15.40% and a negative net margin of 54.62%. The business had revenue of $182.58 million for the quarter, compared to the consensus estimate of $176.86 million. During the same period in the prior year, the business earned ($0.29) EPS. The firm's revenue for the quarter was up 30.8% on a year-over-year basis. As a group, analysts predict that GitLab will post -0.41 earnings per share for the current fiscal year.

Insider Activity

In other news, CEO Sytse Sijbrandij sold 84,776 shares of the firm's stock in a transaction on Monday, November 18th. The shares were sold at an average price of $59.64, for a total transaction of $5,056,040.64. The transaction was disclosed in a legal filing with the SEC, which is available at the SEC website. Also, insider Robin Schulman sold 2,990 shares of the firm's stock in a transaction on Thursday, October 10th. The shares were sold at an average price of $55.00, for a total transaction of $164,450.00. Following the sale, the insider now owns 136,076 shares in the company, valued at approximately $7,484,180. This trade represents a 2.15 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 185,033 shares of company stock worth $10,569,356. 21.36% of the stock is owned by company insiders.

Institutional Trading of GitLab

Several institutional investors and hedge funds have recently made changes to their positions in the stock. Renaissance Technologies LLC grew its holdings in shares of GitLab by 168.8% during the 2nd quarter. Renaissance Technologies LLC now owns 1,190,582 shares of the company's stock valued at $59,196,000 after purchasing an additional 747,712 shares during the last quarter. Primecap Management Co. CA grew its holdings in shares of GitLab by 269.5% during the 2nd quarter. Primecap Management Co. CA now owns 827,040 shares of the company's stock valued at $41,120,000 after purchasing an additional 603,200 shares during the last quarter. Los Angeles Capital Management LLC bought a new position in shares of GitLab during the 3rd quarter valued at $30,827,000. Atreides Management LP bought a new position in shares of GitLab during the 3rd quarter valued at $25,605,000. Finally, William Blair Investment Management LLC bought a new stake in GitLab in the 2nd quarter worth $16,071,000. Hedge funds and other institutional investors own 91.72% of the company's stock.

GitLab Company Profile

(

Get Free Report)

GitLab Inc, through its subsidiaries, develops software for the software development lifecycle in the United States, Europe, and the Asia Pacific. It offers GitLab, a DevOps platform, which is a single application that leads to faster cycle time and allows visibility throughout and control over various stages of the DevOps lifecycle.

See Also

Before you consider GitLab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GitLab wasn't on the list.

While GitLab currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.