Ashton Thomas Private Wealth LLC reduced its position in Glacier Bancorp, Inc. (NASDAQ:GBCI - Free Report) by 7.4% in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 221,469 shares of the bank's stock after selling 17,684 shares during the quarter. Ashton Thomas Private Wealth LLC owned approximately 0.20% of Glacier Bancorp worth $11,122,000 as of its most recent SEC filing.

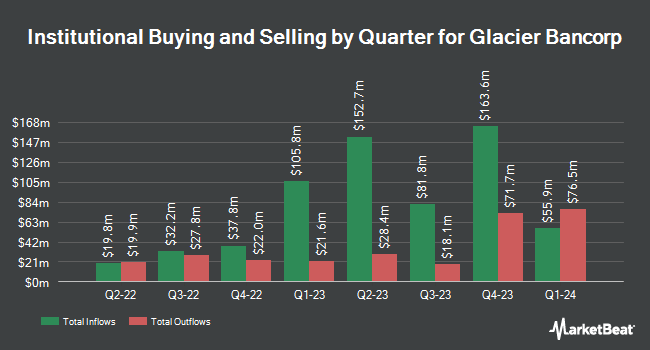

A number of other institutional investors and hedge funds also recently bought and sold shares of GBCI. Geode Capital Management LLC boosted its holdings in Glacier Bancorp by 1.4% in the third quarter. Geode Capital Management LLC now owns 2,902,373 shares of the bank's stock valued at $132,662,000 after purchasing an additional 41,160 shares during the period. Thrivent Financial for Lutherans boosted its stake in shares of Glacier Bancorp by 19.8% in the 3rd quarter. Thrivent Financial for Lutherans now owns 1,694,409 shares of the bank's stock valued at $77,435,000 after buying an additional 280,255 shares during the period. Charles Schwab Investment Management Inc. boosted its stake in shares of Glacier Bancorp by 3.1% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 1,628,055 shares of the bank's stock valued at $74,402,000 after buying an additional 49,006 shares during the period. Victory Capital Management Inc. grew its position in shares of Glacier Bancorp by 0.4% during the third quarter. Victory Capital Management Inc. now owns 1,534,667 shares of the bank's stock worth $70,134,000 after buying an additional 6,394 shares in the last quarter. Finally, Bank of New York Mellon Corp increased its stake in shares of Glacier Bancorp by 4.6% during the fourth quarter. Bank of New York Mellon Corp now owns 1,194,495 shares of the bank's stock worth $59,988,000 after buying an additional 52,566 shares during the period. 80.17% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

A number of research analysts recently issued reports on the stock. Keefe, Bruyette & Woods lifted their price target on shares of Glacier Bancorp from $50.00 to $62.00 and gave the stock a "market perform" rating in a research note on Wednesday, December 4th. Piper Sandler decreased their price target on Glacier Bancorp from $57.00 to $54.00 and set a "neutral" rating for the company in a report on Monday, January 27th. Raymond James reaffirmed an "outperform" rating and set a $55.00 price objective (up from $52.00) on shares of Glacier Bancorp in a research report on Wednesday, January 15th. Finally, Stephens raised shares of Glacier Bancorp from a "hold" rating to a "strong-buy" rating in a report on Monday, March 3rd. One equities research analyst has rated the stock with a sell rating, three have given a hold rating, two have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, Glacier Bancorp presently has a consensus rating of "Hold" and a consensus price target of $51.50.

Read Our Latest Report on Glacier Bancorp

Glacier Bancorp Stock Performance

GBCI stock traded down $1.28 on Tuesday, hitting $44.23. The company's stock had a trading volume of 1,018,887 shares, compared to its average volume of 583,441. The stock has a market cap of $5.02 billion, a price-to-earnings ratio of 26.49 and a beta of 0.77. The firm has a 50 day moving average of $49.40 and a two-hundred day moving average of $49.99. The company has a current ratio of 0.81, a quick ratio of 0.81 and a debt-to-equity ratio of 0.63. Glacier Bancorp, Inc. has a 1 year low of $34.35 and a 1 year high of $60.67.

About Glacier Bancorp

(

Free Report)

Glacier Bancorp, Inc operates as the bank holding company for Glacier Bank that provides commercial banking services to individuals, small to medium-sized businesses, community organizations, and public entities in the United States. The company offers retail banking, business banking, and mortgage origination and loan servicing services.

See Also

Before you consider Glacier Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Glacier Bancorp wasn't on the list.

While Glacier Bancorp currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.