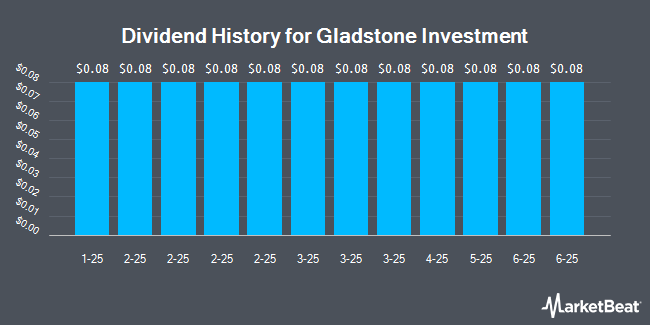

Gladstone Investment Co. (NASDAQ:GAIN - Get Free Report) announced a monthly dividend on Wednesday, April 9th, Wall Street Journal reports. Shareholders of record on Friday, June 20th will be given a dividend of 0.08 per share by the investment management company on Monday, June 30th. This represents a $0.96 annualized dividend and a yield of 7.13%. The ex-dividend date of this dividend is Friday, June 20th.

Gladstone Investment has a payout ratio of 91.4% meaning its dividend is currently covered by earnings, but may not be in the future if the company's earnings tumble. Equities analysts expect Gladstone Investment to earn $0.94 per share next year, which means the company may not be able to cover its $0.96 annual dividend with an expected future payout ratio of 102.1%.

Gladstone Investment Stock Up 1.6 %

Shares of GAIN stock traded up $0.21 during trading hours on Monday, hitting $13.46. 144,819 shares of the company were exchanged, compared to its average volume of 131,998. Gladstone Investment has a 1 year low of $11.42 and a 1 year high of $14.85. The firm has a fifty day moving average of $13.37 and a 200 day moving average of $13.48. The firm has a market cap of $495.83 million, a PE ratio of 7.01 and a beta of 1.12.

Gladstone Investment (NASDAQ:GAIN - Get Free Report) last posted its quarterly earnings results on Wednesday, February 12th. The investment management company reported $0.23 earnings per share for the quarter, missing analysts' consensus estimates of $0.24 by ($0.01). Gladstone Investment had a return on equity of 7.17% and a net margin of 78.02%. Analysts expect that Gladstone Investment will post 0.96 earnings per share for the current year.

Gladstone Investment Company Profile

(

Get Free Report)

Gladstone Investment Corporation is business development company, specializes in lower middle market, mature stage, buyouts; refinancing existing debt; senior debt securities such as senior loans, senior term loans, lines of credit, and senior notes; senior subordinated debt securities such as senior subordinated loans and senior subordinated notes; junior subordinated debt securities such as subordinated notes and mezzanine loans; limited liability company interests, and warrants or options.

Recommended Stories

Before you consider Gladstone Investment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gladstone Investment wasn't on the list.

While Gladstone Investment currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.