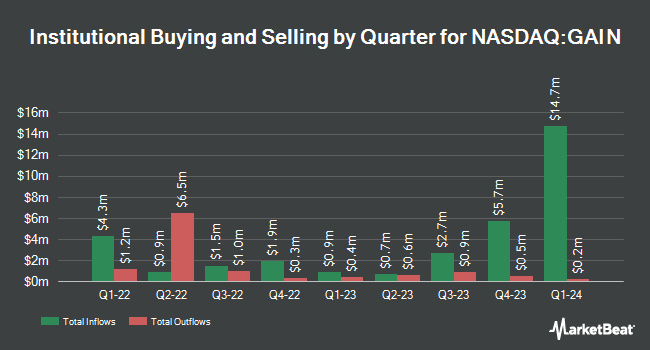

Melia Wealth LLC increased its holdings in Gladstone Investment Co. (NASDAQ:GAIN - Free Report) by 3.6% during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,044,421 shares of the investment management company's stock after acquiring an additional 36,298 shares during the period. Gladstone Investment comprises 7.2% of Melia Wealth LLC's investment portfolio, making the stock its 7th biggest holding. Melia Wealth LLC owned 2.85% of Gladstone Investment worth $13,839,000 as of its most recent SEC filing.

Several other large investors have also added to or reduced their stakes in GAIN. Kentucky Trust Co bought a new position in shares of Gladstone Investment during the fourth quarter valued at about $26,000. Cornerstone Wealth Management LLC purchased a new position in shares of Gladstone Investment in the 4th quarter worth approximately $136,000. Centiva Capital LP bought a new position in shares of Gladstone Investment in the third quarter valued at approximately $192,000. Union Bancaire Privee UBP SA purchased a new stake in shares of Gladstone Investment during the fourth quarter valued at approximately $250,000. Finally, Jane Street Group LLC bought a new stake in Gladstone Investment during the third quarter worth $253,000. Institutional investors own 11.85% of the company's stock.

Gladstone Investment Stock Performance

NASDAQ:GAIN traded up $0.22 during trading on Thursday, reaching $13.91. The company's stock had a trading volume of 103,793 shares, compared to its average volume of 132,247. Gladstone Investment Co. has a 12 month low of $11.42 and a 12 month high of $14.85. The firm has a market cap of $512.29 million, a price-to-earnings ratio of 7.26 and a beta of 1.12. The firm has a 50 day moving average of $13.37 and a 200-day moving average of $13.48.

Gladstone Investment (NASDAQ:GAIN - Get Free Report) last released its earnings results on Wednesday, February 12th. The investment management company reported $0.23 earnings per share for the quarter, missing analysts' consensus estimates of $0.24 by ($0.01). Gladstone Investment had a net margin of 78.02% and a return on equity of 7.17%. Equities research analysts forecast that Gladstone Investment Co. will post 0.96 earnings per share for the current fiscal year.

Gladstone Investment Announces Dividend

The company also recently disclosed a monthly dividend, which will be paid on Wednesday, April 30th. Investors of record on Monday, April 21st will be paid a $0.08 dividend. This represents a $0.96 dividend on an annualized basis and a yield of 6.90%. The ex-dividend date of this dividend is Monday, April 21st. Gladstone Investment's dividend payout ratio is currently 50.00%.

Gladstone Investment Profile

(

Free Report)

Gladstone Investment Corporation is business development company, specializes in lower middle market, mature stage, buyouts; refinancing existing debt; senior debt securities such as senior loans, senior term loans, lines of credit, and senior notes; senior subordinated debt securities such as senior subordinated loans and senior subordinated notes; junior subordinated debt securities such as subordinated notes and mezzanine loans; limited liability company interests, and warrants or options.

Read More

Before you consider Gladstone Investment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gladstone Investment wasn't on the list.

While Gladstone Investment currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.