Equities researchers at UBS Group initiated coverage on shares of Glaukos (NYSE:GKOS - Get Free Report) in a research note issued on Friday, MarketBeat.com reports. The brokerage set a "buy" rating and a $182.00 price target on the medical instruments supplier's stock. UBS Group's price target suggests a potential upside of 29.74% from the stock's current price.

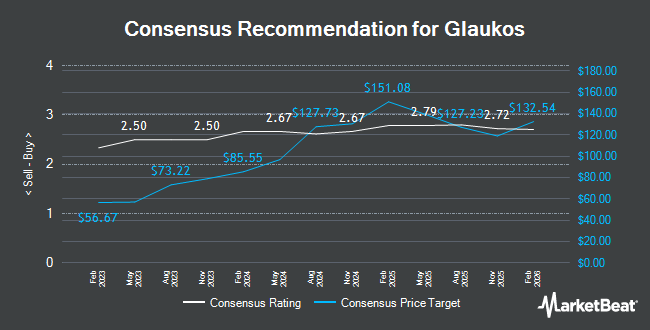

A number of other brokerages also recently commented on GKOS. Morgan Stanley downgraded Glaukos from an "equal weight" rating to an "underweight" rating and set a $120.00 target price for the company. in a report on Monday. Stephens upgraded shares of Glaukos to a "strong-buy" rating in a report on Monday. Wells Fargo & Company lifted their target price on shares of Glaukos from $135.00 to $145.00 and gave the company an "overweight" rating in a research note on Tuesday, November 5th. JPMorgan Chase & Co. increased their price target on shares of Glaukos from $130.00 to $145.00 and gave the stock an "overweight" rating in a research note on Tuesday, November 5th. Finally, Piper Sandler set a $140.00 price objective on Glaukos in a research report on Thursday, October 17th. One analyst has rated the stock with a sell rating, three have assigned a hold rating, nine have given a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, Glaukos currently has a consensus rating of "Moderate Buy" and an average target price of $140.00.

Read Our Latest Stock Report on Glaukos

Glaukos Trading Up 3.4 %

Glaukos stock traded up $4.58 during mid-day trading on Friday, hitting $140.28. The company's stock had a trading volume of 762,124 shares, compared to its average volume of 570,567. The business has a 50 day moving average price of $134.93 and a 200-day moving average price of $125.51. The company has a debt-to-equity ratio of 0.19, a current ratio of 5.54 and a quick ratio of 4.71. Glaukos has a 12 month low of $59.58 and a 12 month high of $146.86. The stock has a market cap of $7.74 billion, a price-to-earnings ratio of -44.93 and a beta of 1.03.

Glaukos (NYSE:GKOS - Get Free Report) last released its earnings results on Monday, November 4th. The medical instruments supplier reported ($0.28) earnings per share for the quarter, beating analysts' consensus estimates of ($0.48) by $0.20. Glaukos had a negative return on equity of 18.99% and a negative net margin of 42.43%. The company had revenue of $96.70 million during the quarter, compared to analyst estimates of $91.50 million. During the same quarter in the previous year, the company posted ($0.50) EPS. Glaukos's revenue for the quarter was up 23.9% on a year-over-year basis. As a group, analysts forecast that Glaukos will post -1.91 EPS for the current year.

Insider Buying and Selling at Glaukos

In other news, COO Joseph E. Gilliam sold 2,275 shares of the firm's stock in a transaction dated Wednesday, October 30th. The shares were sold at an average price of $138.97, for a total transaction of $316,156.75. Following the sale, the chief operating officer now owns 102,169 shares of the company's stock, valued at $14,198,425.93. This trade represents a 2.18 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, Director Gilbert H. Kliman sold 3,000 shares of the business's stock in a transaction that occurred on Monday, September 9th. The shares were sold at an average price of $130.67, for a total transaction of $392,010.00. Following the transaction, the director now directly owns 32,336 shares of the company's stock, valued at $4,225,345.12. The trade was a 8.49 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 6.40% of the stock is owned by company insiders.

Institutional Investors Weigh In On Glaukos

A number of large investors have recently added to or reduced their stakes in the stock. Wellington Management Group LLP increased its position in shares of Glaukos by 294.5% during the 3rd quarter. Wellington Management Group LLP now owns 2,183,766 shares of the medical instruments supplier's stock valued at $284,501,000 after purchasing an additional 1,630,270 shares during the last quarter. State Street Corp grew its position in Glaukos by 5.3% during the third quarter. State Street Corp now owns 1,954,449 shares of the medical instruments supplier's stock valued at $254,626,000 after buying an additional 98,109 shares during the period. Fred Alger Management LLC increased its holdings in Glaukos by 3.8% during the second quarter. Fred Alger Management LLC now owns 1,278,723 shares of the medical instruments supplier's stock valued at $151,337,000 after buying an additional 47,308 shares during the last quarter. Primecap Management Co. CA raised its position in Glaukos by 2.0% in the third quarter. Primecap Management Co. CA now owns 1,245,185 shares of the medical instruments supplier's stock worth $162,223,000 after acquiring an additional 24,370 shares during the period. Finally, Geode Capital Management LLC boosted its stake in shares of Glaukos by 6.0% during the 3rd quarter. Geode Capital Management LLC now owns 1,172,016 shares of the medical instruments supplier's stock worth $152,722,000 after acquiring an additional 66,134 shares during the last quarter. Institutional investors own 99.04% of the company's stock.

Glaukos Company Profile

(

Get Free Report)

Glaukos Corporation, an ophthalmic pharmaceutical and medical technology company, focuses on the development of novel therapies for the treatment of glaucoma, corneal disorders, and retinal diseases. It offers iStent and iStent inject W micro-bypass stents that enhance aqueous humor outflow inserted in cataract surgery to treat mild-to-moderate open-angle glaucoma.

See Also

Before you consider Glaukos, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Glaukos wasn't on the list.

While Glaukos currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.