Glaxis Capital Management LLC acquired a new position in AerCap Holdings (NYSE:AER - Free Report) during the 4th quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund acquired 15,400 shares of the financial services provider's stock, valued at approximately $1,474,000. AerCap accounts for about 4.0% of Glaxis Capital Management LLC's portfolio, making the stock its 9th largest position.

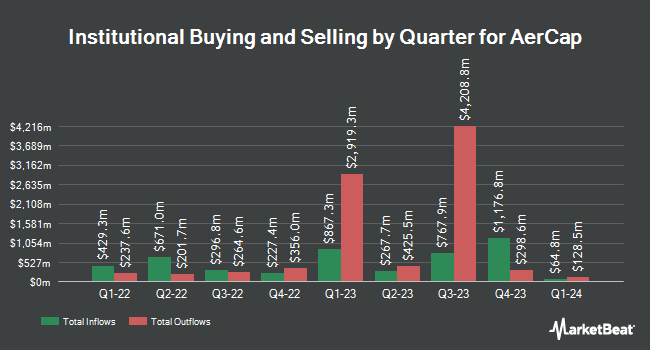

Several other hedge funds have also added to or reduced their stakes in AER. B. Riley Wealth Advisors Inc. raised its position in shares of AerCap by 59.3% in the third quarter. B. Riley Wealth Advisors Inc. now owns 17,875 shares of the financial services provider's stock valued at $1,686,000 after purchasing an additional 6,654 shares during the period. Connor Clark & Lunn Investment Management Ltd. raised its position in shares of AerCap by 66.8% in the third quarter. Connor Clark & Lunn Investment Management Ltd. now owns 279,803 shares of the financial services provider's stock valued at $26,503,000 after purchasing an additional 112,084 shares during the period. KBC Group NV raised its position in shares of AerCap by 18.7% in the third quarter. KBC Group NV now owns 350,888 shares of the financial services provider's stock valued at $33,236,000 after purchasing an additional 55,213 shares during the period. Bank of New York Mellon Corp raised its position in shares of AerCap by 1.0% in the fourth quarter. Bank of New York Mellon Corp now owns 446,303 shares of the financial services provider's stock valued at $42,711,000 after purchasing an additional 4,222 shares during the period. Finally, Franklin Resources Inc. raised its position in shares of AerCap by 5.3% in the third quarter. Franklin Resources Inc. now owns 5,601,208 shares of the financial services provider's stock valued at $545,726,000 after purchasing an additional 282,980 shares during the period. Institutional investors own 96.42% of the company's stock.

Wall Street Analyst Weigh In

AER has been the subject of several recent analyst reports. Susquehanna boosted their price objective on shares of AerCap from $108.00 to $120.00 and gave the company a "positive" rating in a research note on Thursday, February 27th. UBS Group cut shares of AerCap to an "underperform" rating in a research note on Friday. Barclays reaffirmed an "overweight" rating and set a $115.00 price objective (up previously from $113.00) on shares of AerCap in a research note on Thursday, February 27th. Bank of America boosted their price objective on shares of AerCap from $105.00 to $125.00 and gave the company a "buy" rating in a research note on Friday, March 7th. Finally, The Goldman Sachs Group reaffirmed a "buy" rating and set a $119.00 price objective on shares of AerCap in a research note on Thursday, November 21st. One investment analyst has rated the stock with a sell rating, one has given a hold rating and six have given a buy rating to the company's stock. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $117.43.

Check Out Our Latest Research Report on AerCap

AerCap Price Performance

AER stock opened at $97.54 on Wednesday. The company has a debt-to-equity ratio of 2.89, a current ratio of 0.67 and a quick ratio of 0.67. AerCap Holdings has a one year low of $81.69 and a one year high of $107.36. The stock has a market cap of $18.22 billion, a PE ratio of 7.73, a P/E/G ratio of 2.22 and a beta of 1.83. The firm has a 50 day simple moving average of $97.87 and a two-hundred day simple moving average of $96.34.

AerCap (NYSE:AER - Get Free Report) last released its quarterly earnings results on Wednesday, February 26th. The financial services provider reported $3.31 EPS for the quarter, topping analysts' consensus estimates of $2.56 by $0.75. AerCap had a net margin of 32.38% and a return on equity of 13.98%. The business had revenue of $2.07 billion during the quarter, compared to analysts' expectations of $1.97 billion. On average, analysts predict that AerCap Holdings will post 11.29 EPS for the current fiscal year.

AerCap announced that its Board of Directors has initiated a share buyback plan on Wednesday, February 26th that allows the company to repurchase $1.00 billion in shares. This repurchase authorization allows the financial services provider to reacquire up to 4.9% of its shares through open market purchases. Shares repurchase plans are generally a sign that the company's board believes its shares are undervalued.

AerCap Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, April 3rd. Stockholders of record on Wednesday, March 12th will be paid a $0.27 dividend. This is a boost from AerCap's previous quarterly dividend of $0.25. The ex-dividend date is Wednesday, March 12th. This represents a $1.08 dividend on an annualized basis and a dividend yield of 1.11%. AerCap's dividend payout ratio is 9.99%.

AerCap Company Profile

(

Free Report)

AerCap Holdings N.V. engages in the lease, financing, sale, and management of commercial flight equipment in China, Hong Kong, Macau, the United States, Ireland, and internationally. The company offers aircraft asset management services, such as remarketing aircraft and engines; collecting rental and maintenance rent payments, monitoring aircraft maintenance, monitoring and enforcing contract compliance, and accepting delivery and redelivery of aircraft and engines; and conducting ongoing lessee financial performance reviews.

Further Reading

Want to see what other hedge funds are holding AER? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for AerCap Holdings (NYSE:AER - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider AerCap, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AerCap wasn't on the list.

While AerCap currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.