Glazer Capital LLC acquired a new stake in ALLETE, Inc. (NYSE:ALE - Free Report) during the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm acquired 89,822 shares of the utilities provider's stock, valued at approximately $5,766,000. Glazer Capital LLC owned approximately 0.16% of ALLETE as of its most recent SEC filing.

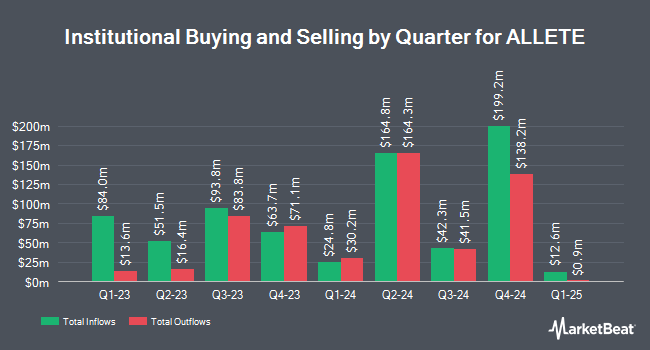

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Longfellow Investment Management Co. LLC acquired a new position in shares of ALLETE during the third quarter worth $38,000. UMB Bank n.a. increased its holdings in ALLETE by 261.0% in the 3rd quarter. UMB Bank n.a. now owns 1,083 shares of the utilities provider's stock worth $70,000 after purchasing an additional 783 shares in the last quarter. Lazard Asset Management LLC increased its holdings in ALLETE by 4,157.1% in the 1st quarter. Lazard Asset Management LLC now owns 1,192 shares of the utilities provider's stock worth $71,000 after purchasing an additional 1,164 shares in the last quarter. Point72 Asia Singapore Pte. Ltd. bought a new position in ALLETE in the second quarter valued at about $74,000. Finally, Hantz Financial Services Inc. acquired a new stake in shares of ALLETE during the second quarter valued at about $75,000. Institutional investors own 76.55% of the company's stock.

ALLETE Stock Performance

Shares of ALE remained flat at $64.88 during mid-day trading on Friday. The stock had a trading volume of 138,769 shares, compared to its average volume of 261,413. The stock has a 50 day simple moving average of $64.42 and a 200 day simple moving average of $63.73. The company has a debt-to-equity ratio of 0.51, a current ratio of 1.45 and a quick ratio of 0.95. The company has a market capitalization of $3.75 billion, a PE ratio of 20.79 and a beta of 0.80. ALLETE, Inc. has a 52 week low of $54.90 and a 52 week high of $65.86.

ALLETE (NYSE:ALE - Get Free Report) last released its quarterly earnings results on Wednesday, October 30th. The utilities provider reported $0.78 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.99 by ($0.21). ALLETE had a return on equity of 5.99% and a net margin of 11.49%. The firm had revenue of $407.20 million for the quarter. During the same period last year, the firm posted $1.49 EPS. The business's revenue was up 7.5% on a year-over-year basis.

ALLETE Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Sunday, December 1st. Shareholders of record on Friday, November 15th will be given a dividend of $0.705 per share. The ex-dividend date is Friday, November 15th. This represents a $2.82 dividend on an annualized basis and a yield of 4.35%. This is a boost from ALLETE's previous quarterly dividend of $0.70. ALLETE's dividend payout ratio is 90.38%.

Wall Street Analysts Forecast Growth

Several research analysts have recently issued reports on ALE shares. Sidoti raised ALLETE from a "hold" rating to a "strong-buy" rating in a research note on Monday, September 30th. StockNews.com started coverage on shares of ALLETE in a research report on Sunday. They issued a "hold" rating for the company. Four research analysts have rated the stock with a hold rating and one has given a strong buy rating to the stock. According to MarketBeat, ALLETE currently has a consensus rating of "Hold" and an average price target of $62.00.

Check Out Our Latest Stock Analysis on ALE

About ALLETE

(

Free Report)

ALLETE, Inc operates as an energy company. The company operates through Regulated Operations, ALLETE Clean Energy, and Corporate and Other segments. It generates electricity from coal-fired, biomass co-fired / natural gas, hydroelectric, wind, and solar. In addition, the company provides regulated utility electric services in northwestern Wisconsin to approximately 15,000 electric customers, 13,000 natural gas customers, and 10,000 water customers, as well as regulated utility electric services in northeastern Minnesota to approximately 150,000 retail customers and 14 non-affiliated municipal customers.

Read More

Before you consider ALLETE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ALLETE wasn't on the list.

While ALLETE currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.