Glenmede Trust Co. NA grew its holdings in Cencora, Inc. (NYSE:COR - Free Report) by 254.6% in the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 195,871 shares of the company's stock after acquiring an additional 140,641 shares during the period. Glenmede Trust Co. NA owned 0.10% of Cencora worth $44,087,000 as of its most recent SEC filing.

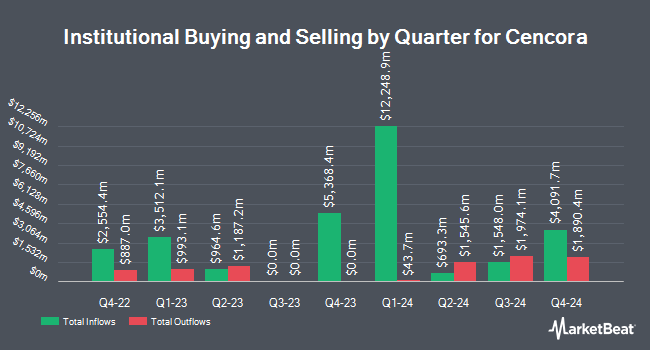

Other hedge funds also recently modified their holdings of the company. Quantbot Technologies LP boosted its holdings in Cencora by 61.3% in the third quarter. Quantbot Technologies LP now owns 131,557 shares of the company's stock worth $29,611,000 after purchasing an additional 49,997 shares in the last quarter. The Manufacturers Life Insurance Company boosted its stake in shares of Cencora by 2.9% during the 3rd quarter. The Manufacturers Life Insurance Company now owns 503,317 shares of the company's stock worth $113,287,000 after acquiring an additional 14,079 shares in the last quarter. Truvestments Capital LLC acquired a new position in shares of Cencora during the 3rd quarter valued at about $86,000. Dynamic Technology Lab Private Ltd bought a new position in shares of Cencora in the 3rd quarter valued at approximately $974,000. Finally, Daiwa Securities Group Inc. lifted its holdings in Cencora by 3.1% in the 3rd quarter. Daiwa Securities Group Inc. now owns 22,935 shares of the company's stock worth $5,162,000 after purchasing an additional 691 shares during the last quarter. Institutional investors and hedge funds own 97.52% of the company's stock.

Insider Buying and Selling at Cencora

In related news, Chairman Steven H. Collis sold 50,000 shares of the firm's stock in a transaction that occurred on Monday, November 25th. The stock was sold at an average price of $243.97, for a total transaction of $12,198,500.00. Following the completion of the transaction, the chairman now owns 326,557 shares in the company, valued at $79,670,111.29. This trade represents a 13.28 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Over the last ninety days, insiders have sold 93,018 shares of company stock valued at $22,478,942. 15.80% of the stock is currently owned by corporate insiders.

Cencora Trading Up 1.7 %

Shares of COR stock opened at $248.40 on Wednesday. The firm has a fifty day moving average of $233.56 and a 200-day moving average of $232.01. The stock has a market cap of $48.95 billion, a price-to-earnings ratio of 33.08, a P/E/G ratio of 1.63 and a beta of 0.44. Cencora, Inc. has a 52-week low of $195.83 and a 52-week high of $251.56. The company has a debt-to-equity ratio of 4.84, a quick ratio of 0.53 and a current ratio of 0.88.

Cencora Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, November 29th. Shareholders of record on Friday, November 15th will be paid a dividend of $0.55 per share. This is a boost from Cencora's previous quarterly dividend of $0.51. The ex-dividend date of this dividend is Friday, November 15th. This represents a $2.20 dividend on an annualized basis and a yield of 0.89%. Cencora's dividend payout ratio (DPR) is currently 29.29%.

Analysts Set New Price Targets

A number of research firms have recently commented on COR. Evercore ISI lifted their price target on shares of Cencora from $250.00 to $285.00 and gave the company an "outperform" rating in a research report on Thursday, November 7th. Barclays lifted their target price on shares of Cencora from $263.00 to $290.00 and gave the stock an "overweight" rating in a report on Thursday, November 7th. Bank of America reaffirmed a "neutral" rating and issued a $245.00 price target (down from $275.00) on shares of Cencora in a research report on Wednesday, September 18th. Robert W. Baird boosted their price objective on Cencora from $287.00 to $292.00 and gave the stock an "outperform" rating in a research report on Thursday, November 7th. Finally, Leerink Partners cut their price target on Cencora from $277.00 to $275.00 and set an "outperform" rating for the company in a report on Monday, October 7th. Three research analysts have rated the stock with a hold rating and nine have assigned a buy rating to the stock. According to data from MarketBeat.com, Cencora currently has an average rating of "Moderate Buy" and an average target price of $271.20.

View Our Latest Report on Cencora

Cencora Profile

(

Free Report)

Cencora, Inc sources and distributes pharmaceutical products. The company's U.S. Healthcare Solutions segment distributes pharmaceuticals, over-the-counter healthcare products, home healthcare supplies and equipment, and related services to acute care hospitals and health systems, independent and chain retail pharmacies, mail order pharmacies, medical clinics, long-term care and alternate site pharmacies, and other customers; provides pharmacy management, staffing, and other consulting services; supply management software to retail and institutional healthcare providers; packaging solutions to various institutional and retail healthcare providers; clinical trial support, product post-approval, and commercialization support services; data analytics, outcomes research, and additional services for biotechnology and pharmaceutical manufacturers; pharmaceuticals, vaccines, parasiticides, diagnostics, micro feed ingredients, and other products to the companion animal and production animal markets; and sales force services to manufacturers.

Recommended Stories

Want to see what other hedge funds are holding COR? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Cencora, Inc. (NYSE:COR - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cencora, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cencora wasn't on the list.

While Cencora currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.