Glenmede Trust Co. NA raised its stake in shares of Akamai Technologies, Inc. (NASDAQ:AKAM - Free Report) by 4.3% in the third quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 206,764 shares of the technology infrastructure company's stock after buying an additional 8,559 shares during the period. Glenmede Trust Co. NA owned about 0.14% of Akamai Technologies worth $20,873,000 as of its most recent SEC filing.

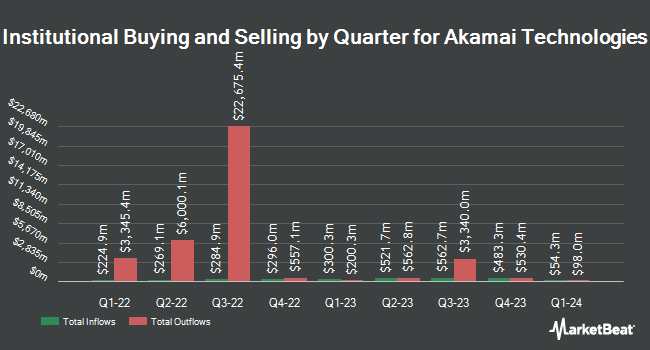

Other institutional investors and hedge funds have also modified their holdings of the company. Janus Henderson Group PLC boosted its position in Akamai Technologies by 19.6% during the first quarter. Janus Henderson Group PLC now owns 41,034 shares of the technology infrastructure company's stock valued at $4,462,000 after purchasing an additional 6,724 shares during the last quarter. Banque Cantonale Vaudoise lifted its holdings in shares of Akamai Technologies by 86.9% during the 3rd quarter. Banque Cantonale Vaudoise now owns 44,390 shares of the technology infrastructure company's stock valued at $4,481,000 after buying an additional 20,633 shares during the last quarter. Principal Financial Group Inc. grew its stake in shares of Akamai Technologies by 3.5% in the 3rd quarter. Principal Financial Group Inc. now owns 200,458 shares of the technology infrastructure company's stock valued at $20,236,000 after buying an additional 6,785 shares in the last quarter. Charles Schwab Investment Management Inc. grew its stake in shares of Akamai Technologies by 1.3% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 892,356 shares of the technology infrastructure company's stock valued at $90,083,000 after buying an additional 11,272 shares in the last quarter. Finally, Sompo Asset Management Co. Ltd. raised its position in Akamai Technologies by 148.4% during the third quarter. Sompo Asset Management Co. Ltd. now owns 19,900 shares of the technology infrastructure company's stock valued at $2,009,000 after acquiring an additional 11,890 shares in the last quarter. 94.28% of the stock is currently owned by hedge funds and other institutional investors.

Akamai Technologies Stock Performance

Shares of NASDAQ:AKAM traded up $0.76 on Thursday, hitting $93.86. 1,540,881 shares of the company were exchanged, compared to its average volume of 1,681,629. The company's 50 day moving average price is $98.83 and its two-hundred day moving average price is $96.25. The firm has a market capitalization of $14.10 billion, a price-to-earnings ratio of 27.77, a PEG ratio of 3.60 and a beta of 0.68. The company has a debt-to-equity ratio of 0.50, a quick ratio of 1.33 and a current ratio of 1.33. Akamai Technologies, Inc. has a one year low of $84.70 and a one year high of $129.17.

Analyst Ratings Changes

Several research firms have commented on AKAM. DA Davidson reissued a "buy" rating and issued a $115.00 target price on shares of Akamai Technologies in a research report on Friday, August 9th. HSBC upgraded shares of Akamai Technologies from a "hold" rating to a "buy" rating and set a $121.00 price objective for the company in a report on Monday, November 11th. Royal Bank of Canada restated a "sector perform" rating and set a $100.00 target price on shares of Akamai Technologies in a report on Thursday, August 15th. Hsbc Global Res upgraded Akamai Technologies from a "hold" rating to a "strong-buy" rating in a research note on Monday, November 11th. Finally, TD Cowen raised their price objective on Akamai Technologies from $129.00 to $131.00 and gave the company a "buy" rating in a research note on Friday, August 9th. One analyst has rated the stock with a sell rating, five have assigned a hold rating, twelve have issued a buy rating and two have issued a strong buy rating to the stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $117.47.

Get Our Latest Report on AKAM

Insider Buying and Selling at Akamai Technologies

In other Akamai Technologies news, Director William Raymond Wagner sold 1,000 shares of Akamai Technologies stock in a transaction on Wednesday, November 27th. The shares were sold at an average price of $93.38, for a total transaction of $93,380.00. Following the sale, the director now owns 15,719 shares in the company, valued at $1,467,840.22. The trade was a 5.98 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, CTO Robert Blumofe sold 2,500 shares of the business's stock in a transaction on Friday, November 15th. The shares were sold at an average price of $88.61, for a total transaction of $221,525.00. Following the completion of the sale, the chief technology officer now directly owns 19,510 shares in the company, valued at $1,728,781.10. This trade represents a 11.36 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 11,500 shares of company stock valued at $1,058,625 in the last quarter. Corporate insiders own 1.80% of the company's stock.

Akamai Technologies Company Profile

(

Free Report)

Akamai Technologies, Inc provides cloud computing, security, and content delivery services in the United States and internationally. The company offers cloud solutions to keep infrastructure, websites, applications, application programming interfaces, and users safe from various cyberattacks and online threats while enhancing performance.

See Also

Before you consider Akamai Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Akamai Technologies wasn't on the list.

While Akamai Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.