Glenmede Trust Co. NA raised its holdings in Charter Communications, Inc. (NASDAQ:CHTR - Free Report) by 13.2% during the third quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 15,356 shares of the company's stock after buying an additional 1,791 shares during the quarter. Glenmede Trust Co. NA's holdings in Charter Communications were worth $4,977,000 at the end of the most recent quarter.

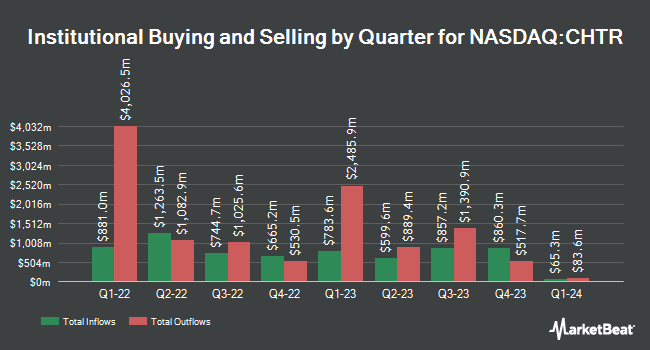

Several other hedge funds have also recently made changes to their positions in the business. Fernbridge Capital Management LP purchased a new position in shares of Charter Communications during the third quarter valued at about $48,200,000. Townsquare Capital LLC boosted its position in Charter Communications by 16.8% during the 3rd quarter. Townsquare Capital LLC now owns 1,721 shares of the company's stock valued at $558,000 after acquiring an additional 248 shares in the last quarter. Avestar Capital LLC grew its holdings in shares of Charter Communications by 9.9% during the 3rd quarter. Avestar Capital LLC now owns 830 shares of the company's stock worth $269,000 after acquiring an additional 75 shares during the period. Brooklyn Investment Group purchased a new position in shares of Charter Communications in the 3rd quarter valued at approximately $205,000. Finally, Quantbot Technologies LP boosted its position in shares of Charter Communications by 144.2% during the third quarter. Quantbot Technologies LP now owns 15,763 shares of the company's stock valued at $5,108,000 after purchasing an additional 9,307 shares in the last quarter. 81.76% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

CHTR has been the subject of a number of research reports. Deutsche Bank Aktiengesellschaft increased their price objective on Charter Communications from $340.00 to $365.00 and gave the stock a "hold" rating in a report on Monday, November 4th. Morgan Stanley boosted their price objective on shares of Charter Communications from $360.00 to $415.00 and gave the stock an "equal weight" rating in a research note on Monday, November 4th. BNP Paribas raised shares of Charter Communications from an "underperform" rating to a "neutral" rating and set a $360.00 target price for the company in a research note on Tuesday, November 26th. Bank of America raised Charter Communications from a "neutral" rating to a "buy" rating and boosted their price target for the stock from $385.00 to $450.00 in a research report on Monday, November 4th. Finally, Wells Fargo & Company raised their price objective on Charter Communications from $350.00 to $400.00 and gave the company an "equal weight" rating in a research report on Monday, November 4th. Four analysts have rated the stock with a sell rating, ten have issued a hold rating and five have issued a buy rating to the company. According to data from MarketBeat.com, the company has an average rating of "Hold" and an average price target of $378.00.

Check Out Our Latest Research Report on Charter Communications

Charter Communications Stock Performance

CHTR traded up $7.15 during midday trading on Friday, hitting $396.96. 553,485 shares of the company traded hands, compared to its average volume of 1,478,226. The company's 50-day moving average is $353.45 and its 200 day moving average is $329.56. The company has a quick ratio of 0.34, a current ratio of 0.34 and a debt-to-equity ratio of 5.24. The firm has a market capitalization of $56.45 billion, a PE ratio of 12.43, a price-to-earnings-growth ratio of 0.63 and a beta of 1.03. Charter Communications, Inc. has a 52 week low of $236.08 and a 52 week high of $415.27.

Charter Communications (NASDAQ:CHTR - Get Free Report) last issued its quarterly earnings data on Friday, November 1st. The company reported $8.82 earnings per share for the quarter, beating analysts' consensus estimates of $8.55 by $0.27. Charter Communications had a net margin of 8.52% and a return on equity of 28.73%. The company had revenue of $13.80 billion for the quarter, compared to the consensus estimate of $13.66 billion. During the same quarter in the prior year, the firm earned $8.25 earnings per share. The firm's revenue for the quarter was up 1.6% compared to the same quarter last year. On average, research analysts expect that Charter Communications, Inc. will post 32.87 EPS for the current year.

Charter Communications Profile

(

Free Report)

Charter Communications, Inc operates as a broadband connectivity and cable operator company serving residential and commercial customers in the United States. The company offers subscription-based internet, video, and mobile and voice services; a suite of broadband connectivity services, including fixed internet, WiFi, and mobile; Advanced WiFi services; Spectrum Security Shield; in-home WiFi, which provides customers with high performance wireless routers and managed WiFi services to enhance their fixed wireless internet experience; out-of-home WiFi; and Spectrum WiFi services.

Read More

Before you consider Charter Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Charter Communications wasn't on the list.

While Charter Communications currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.