Glenview Trust co trimmed its position in shares of Waters Co. (NYSE:WAT - Free Report) by 13.0% during the 4th quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 7,337 shares of the medical instruments supplier's stock after selling 1,100 shares during the quarter. Glenview Trust co's holdings in Waters were worth $2,722,000 at the end of the most recent quarter.

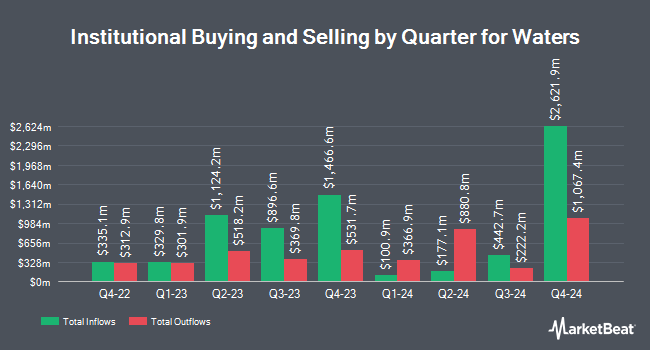

Several other large investors have also bought and sold shares of WAT. Assetmark Inc. boosted its position in Waters by 16.5% during the 3rd quarter. Assetmark Inc. now owns 1,200 shares of the medical instruments supplier's stock valued at $432,000 after acquiring an additional 170 shares in the last quarter. Atria Investments Inc boosted its position in Waters by 10.3% during the 3rd quarter. Atria Investments Inc now owns 3,141 shares of the medical instruments supplier's stock valued at $1,130,000 after acquiring an additional 294 shares in the last quarter. Huntington National Bank boosted its position in Waters by 3.6% during the 3rd quarter. Huntington National Bank now owns 1,377 shares of the medical instruments supplier's stock valued at $496,000 after acquiring an additional 48 shares in the last quarter. OneDigital Investment Advisors LLC boosted its position in Waters by 3.8% during the 3rd quarter. OneDigital Investment Advisors LLC now owns 851 shares of the medical instruments supplier's stock valued at $306,000 after acquiring an additional 31 shares in the last quarter. Finally, CIBC Asset Management Inc lifted its holdings in shares of Waters by 8.2% during the third quarter. CIBC Asset Management Inc now owns 8,780 shares of the medical instruments supplier's stock valued at $3,160,000 after purchasing an additional 662 shares during the last quarter. 94.01% of the stock is owned by institutional investors.

Waters Stock Performance

NYSE:WAT traded down $4.69 during trading hours on Wednesday, reaching $377.46. The company had a trading volume of 42,339 shares, compared to its average volume of 435,703. The company has a current ratio of 0.94, a quick ratio of 0.65 and a debt-to-equity ratio of 1.14. Waters Co. has a 52 week low of $279.24 and a 52 week high of $423.56. The firm has a market cap of $22.43 billion, a price-to-earnings ratio of 35.25, a PEG ratio of 3.79 and a beta of 1.00. The firm's 50 day moving average price is $391.36 and its 200-day moving average price is $370.97.

Waters (NYSE:WAT - Get Free Report) last posted its earnings results on Wednesday, February 12th. The medical instruments supplier reported $4.10 EPS for the quarter, topping analysts' consensus estimates of $4.02 by $0.08. Waters had a net margin of 21.56% and a return on equity of 46.31%. On average, analysts forecast that Waters Co. will post 12.86 EPS for the current year.

Analysts Set New Price Targets

Several equities analysts have recently issued reports on WAT shares. Bank of America lowered their target price on shares of Waters from $430.00 to $410.00 and set a "neutral" rating for the company in a report on Thursday, February 13th. StockNews.com lowered shares of Waters from a "buy" rating to a "hold" rating in a report on Tuesday, February 25th. Wells Fargo & Company lifted their target price on shares of Waters from $415.00 to $420.00 and gave the company an "overweight" rating in a report on Thursday, February 13th. Scotiabank upgraded shares of Waters from a "sector perform" rating to a "sector outperform" rating and lifted their target price for the company from $430.00 to $450.00 in a report on Thursday, February 13th. Finally, Sanford C. Bernstein upgraded shares of Waters from a "market perform" rating to an "outperform" rating and set a $430.00 target price for the company in a report on Friday, January 10th. Eleven investment analysts have rated the stock with a hold rating, five have issued a buy rating and one has given a strong buy rating to the company. According to MarketBeat, the stock has a consensus rating of "Hold" and a consensus target price of $391.07.

View Our Latest Analysis on Waters

About Waters

(

Free Report)

Waters Corporation provides analytical workflow solutions in Asia, the Americas, and Europe. It operates through two segments: Waters and TA. The company designs, manufactures, sells, and services high and ultra-performance liquid chromatography, as well as mass spectrometry (MS) technology systems and support products, including chromatography columns, other consumable products, and post-warranty service plans.

See Also

Before you consider Waters, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Waters wasn't on the list.

While Waters currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.