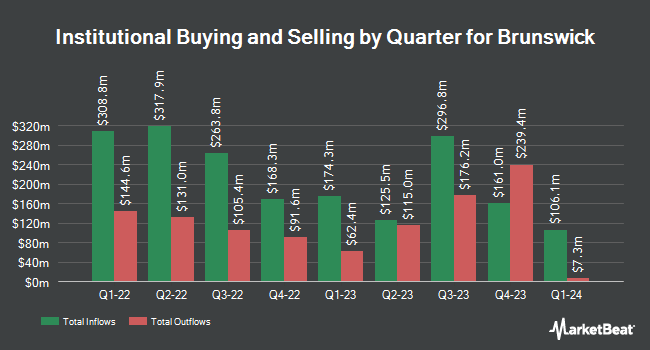

Global Alpha Capital Management Ltd. raised its stake in Brunswick Co. (NYSE:BC - Free Report) by 47.5% during the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 240,128 shares of the company's stock after purchasing an additional 77,340 shares during the period. Global Alpha Capital Management Ltd. owned 0.36% of Brunswick worth $20,128,000 as of its most recent SEC filing.

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in the stock. Vanguard Group Inc. boosted its position in Brunswick by 2.3% during the first quarter. Vanguard Group Inc. now owns 7,266,170 shares of the company's stock worth $701,331,000 after purchasing an additional 160,531 shares in the last quarter. Massachusetts Financial Services Co. MA grew its position in Brunswick by 2.3% during the second quarter. Massachusetts Financial Services Co. MA now owns 2,637,962 shares of the company's stock valued at $191,964,000 after acquiring an additional 58,583 shares during the period. Baillie Gifford & Co. raised its holdings in Brunswick by 88.0% in the second quarter. Baillie Gifford & Co. now owns 2,430,983 shares of the company's stock valued at $176,903,000 after buying an additional 1,137,568 shares during the period. Dimensional Fund Advisors LP increased its holdings in Brunswick by 7.4% in the 2nd quarter. Dimensional Fund Advisors LP now owns 2,096,808 shares of the company's stock valued at $152,577,000 after purchasing an additional 144,416 shares in the last quarter. Finally, American Century Companies Inc. grew its stake in shares of Brunswick by 4.1% in the second quarter. American Century Companies Inc. now owns 1,461,268 shares of the company's stock valued at $106,337,000 after buying an additional 57,605 shares in the last quarter. 99.34% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several equities analysts have recently commented on the company. Jefferies Financial Group reiterated a "hold" rating and set a $70.00 target price (down from $115.00) on shares of Brunswick in a research note on Friday, July 26th. Robert W. Baird decreased their target price on shares of Brunswick from $95.00 to $93.00 and set an "outperform" rating for the company in a research report on Friday, July 26th. Roth Mkm restated a "buy" rating and set a $94.00 price target on shares of Brunswick in a research report on Thursday, July 25th. Northcoast Research upgraded shares of Brunswick from a "neutral" rating to a "buy" rating and set a $100.00 price target on the stock in a research report on Monday, July 29th. Finally, Citigroup boosted their target price on Brunswick from $92.00 to $101.00 and gave the stock a "buy" rating in a research report on Friday, September 27th. Six research analysts have rated the stock with a hold rating and eight have given a buy rating to the company. According to MarketBeat, Brunswick has a consensus rating of "Moderate Buy" and an average target price of $89.23.

Get Our Latest Analysis on BC

Brunswick Price Performance

Shares of BC traded down $1.08 during trading hours on Wednesday, reaching $78.45. The stock had a trading volume of 574,701 shares, compared to its average volume of 699,009. The stock has a market capitalization of $5.18 billion, a PE ratio of 19.79 and a beta of 1.51. The company's 50-day moving average is $81.59 and its two-hundred day moving average is $78.79. The company has a debt-to-equity ratio of 1.17, a quick ratio of 0.74 and a current ratio of 1.97. Brunswick Co. has a 12 month low of $69.05 and a 12 month high of $99.68.

Brunswick Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, December 13th. Stockholders of record on Wednesday, November 20th will be issued a $0.42 dividend. The ex-dividend date of this dividend is Wednesday, November 20th. This represents a $1.68 annualized dividend and a dividend yield of 2.14%. Brunswick's dividend payout ratio is currently 41.79%.

Insider Transactions at Brunswick

In other news, CEO David M. Foulkes sold 23,829 shares of the firm's stock in a transaction dated Thursday, October 31st. The shares were sold at an average price of $80.22, for a total value of $1,911,562.38. Following the completion of the sale, the chief executive officer now directly owns 251,094 shares of the company's stock, valued at approximately $20,142,760.68. This trade represents a 8.67 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, Director Joseph W. Mcclanathan sold 4,745 shares of Brunswick stock in a transaction dated Friday, October 25th. The shares were sold at an average price of $80.14, for a total transaction of $380,264.30. Following the transaction, the director now directly owns 19,218 shares of the company's stock, valued at approximately $1,540,130.52. This trade represents a 19.80 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 28,940 shares of company stock worth $2,321,176 in the last quarter. Insiders own 0.81% of the company's stock.

Brunswick Company Profile

(

Free Report)

Brunswick Corporation designs, manufactures, and markets recreation products in the United States, Europe, the Asia-Pacific, Canada, and internationally. It operates through four segments: Propulsion, Engine P&A, Navico Group, and Boat. The Propulsion segment provides outboard, sterndrive, inboard engines, propulsion-related controls, rigging, and propellers for boat builders through marine retail dealers under the Mercury, Mercury MerCruiser, Mariner, Mercury Racing, Mercury Diesel, Avator, and Fliteboard brands.

Featured Articles

Before you consider Brunswick, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brunswick wasn't on the list.

While Brunswick currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.