King Luther Capital Management Corp decreased its stake in shares of Global Industrial (NYSE:GIC - Free Report) by 23.1% in the 4th quarter, according to its most recent Form 13F filing with the SEC. The fund owned 241,593 shares of the company's stock after selling 72,675 shares during the period. King Luther Capital Management Corp owned 0.63% of Global Industrial worth $5,989,000 at the end of the most recent reporting period.

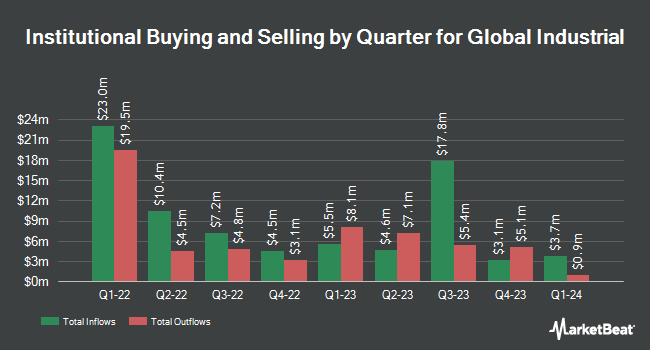

Several other institutional investors and hedge funds have also recently bought and sold shares of the stock. Barclays PLC grew its stake in shares of Global Industrial by 221.5% during the 3rd quarter. Barclays PLC now owns 30,622 shares of the company's stock valued at $1,041,000 after buying an additional 21,097 shares during the period. JPMorgan Chase & Co. boosted its holdings in Global Industrial by 39.8% in the third quarter. JPMorgan Chase & Co. now owns 46,005 shares of the company's stock valued at $1,563,000 after acquiring an additional 13,105 shares during the last quarter. New York State Common Retirement Fund grew its position in Global Industrial by 34.6% during the fourth quarter. New York State Common Retirement Fund now owns 37,772 shares of the company's stock valued at $936,000 after acquiring an additional 9,700 shares during the period. FMR LLC increased its stake in Global Industrial by 14.7% during the third quarter. FMR LLC now owns 2,534,156 shares of the company's stock worth $86,085,000 after acquiring an additional 325,555 shares during the last quarter. Finally, State Street Corp raised its holdings in shares of Global Industrial by 2.6% in the 3rd quarter. State Street Corp now owns 315,779 shares of the company's stock worth $10,727,000 after purchasing an additional 8,136 shares during the period. Institutional investors and hedge funds own 31.19% of the company's stock.

Global Industrial Stock Performance

Shares of NYSE:GIC opened at $23.00 on Wednesday. The stock has a 50-day simple moving average of $24.29 and a 200-day simple moving average of $28.11. The stock has a market capitalization of $881.08 million, a P/E ratio of 13.53, a PEG ratio of 0.93 and a beta of 0.85. Global Industrial has a 1 year low of $22.62 and a 1 year high of $46.97.

Global Industrial (NYSE:GIC - Get Free Report) last released its quarterly earnings data on Tuesday, February 25th. The company reported $0.27 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.30 by ($0.03). The business had revenue of $302.30 million during the quarter, compared to analyst estimates of $306.07 million. Global Industrial had a return on equity of 24.53% and a net margin of 4.92%. Analysts predict that Global Industrial will post 1.59 earnings per share for the current year.

Global Industrial Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, March 17th. Shareholders of record on Monday, March 10th will be given a $0.26 dividend. The ex-dividend date is Monday, March 10th. This is a positive change from Global Industrial's previous quarterly dividend of $0.25. This represents a $1.04 annualized dividend and a yield of 4.52%. Global Industrial's dividend payout ratio (DPR) is 66.24%.

About Global Industrial

(

Free Report)

Global Industrial Company operates as an industrial distributor of various industrial and maintenance, repair, and operation (MRO) products in North America. It offers storage and shelving, safety and security, carts and trucks, HVAC and fans, furniture and decor, material handling, janitorial and facility maintenance, workbenches and shop desks, tools and instruments, plumbing and pumps, office and school supplies, packaging and shipping, lighting and electrical, foodservice and retail, medical and laboratory, motors and power transmission, building supplies, machining, fasteners and hardware, vehicle maintenance, and raw materials.

Read More

Want to see what other hedge funds are holding GIC? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Global Industrial (NYSE:GIC - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Global Industrial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Global Industrial wasn't on the list.

While Global Industrial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.