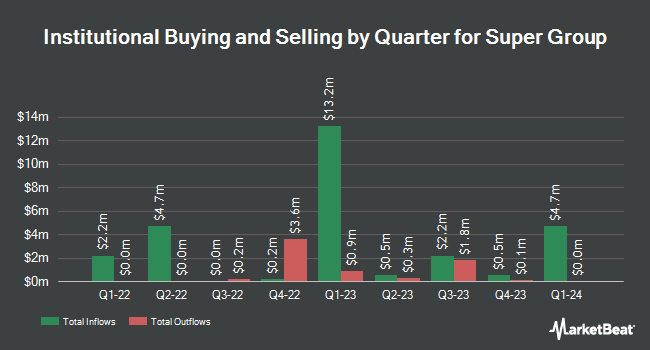

Globeflex Capital L P acquired a new position in Super Group Limited (NYSE:SGHC - Free Report) in the fourth quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor acquired 92,508 shares of the company's stock, valued at approximately $576,000.

Several other institutional investors and hedge funds have also recently modified their holdings of SGHC. Helikon Investments Ltd boosted its holdings in Super Group by 82.5% in the 4th quarter. Helikon Investments Ltd now owns 3,234,022 shares of the company's stock worth $20,148,000 after buying an additional 1,462,418 shares during the period. State Street Corp grew its position in shares of Super Group by 8.5% during the third quarter. State Street Corp now owns 2,490,833 shares of the company's stock worth $9,042,000 after purchasing an additional 194,460 shares in the last quarter. Geode Capital Management LLC raised its stake in Super Group by 0.8% during the 3rd quarter. Geode Capital Management LLC now owns 1,742,924 shares of the company's stock valued at $6,327,000 after purchasing an additional 14,507 shares during the period. Charles Schwab Investment Management Inc. lifted its holdings in Super Group by 2.3% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 362,798 shares of the company's stock worth $2,260,000 after purchasing an additional 8,232 shares in the last quarter. Finally, Barclays PLC boosted its stake in Super Group by 141.1% in the 3rd quarter. Barclays PLC now owns 269,435 shares of the company's stock worth $978,000 after purchasing an additional 157,693 shares during the period. 5.09% of the stock is currently owned by institutional investors.

Super Group Stock Up 2.4 %

Super Group stock traded up $0.17 during mid-day trading on Wednesday, reaching $6.95. 1,137,945 shares of the company's stock traded hands, compared to its average volume of 543,786. Super Group Limited has a 12-month low of $2.90 and a 12-month high of $8.51. The stock has a 50 day moving average of $7.30 and a two-hundred day moving average of $5.81. The company has a market cap of $3.46 billion, a price-to-earnings ratio of 115.77 and a beta of 1.00.

Super Group Announces Dividend

The firm also recently declared a semi-annual dividend, which will be paid on Friday, March 28th. Investors of record on Monday, March 10th will be issued a $0.04 dividend. This represents a dividend yield of 3.6%. The ex-dividend date of this dividend is Monday, March 10th. Super Group's payout ratio is 266.67%.

Analyst Upgrades and Downgrades

SGHC has been the topic of several research analyst reports. Oppenheimer boosted their target price on shares of Super Group from $9.00 to $11.00 and gave the stock an "outperform" rating in a report on Wednesday, January 29th. Canaccord Genuity Group boosted their price target on shares of Super Group from $10.00 to $11.00 and gave the stock a "buy" rating in a research note on Wednesday, February 26th. Benchmark restated a "buy" rating and set a $10.00 price objective on shares of Super Group in a research report on Monday, January 27th. Finally, Needham & Company LLC boosted their target price on Super Group from $9.00 to $10.00 and gave the stock a "buy" rating in a research report on Wednesday, February 26th.

View Our Latest Stock Analysis on Super Group

Super Group Company Profile

(

Free Report)

Super Group (SGHC) Limited operates as an online sports betting and gaming operator. It offers Betway, an online sports betting brand; and Spin, a multi-brand online casino offering. Super Group (SGHC) Limited is based in Saint Peter Port, Guernsey.

Further Reading

Before you consider Super Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Super Group wasn't on the list.

While Super Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.