Globus Medical (NYSE:GMED - Free Report) had its price objective lifted by Piper Sandler from $80.00 to $100.00 in a report released on Wednesday morning, Benzinga reports. They currently have an overweight rating on the medical device company's stock.

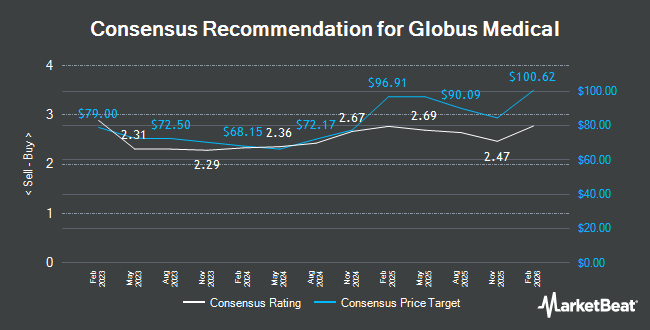

Other equities research analysts have also recently issued research reports about the stock. Truist Financial upped their price target on shares of Globus Medical from $78.00 to $79.00 and gave the company a "hold" rating in a report on Wednesday, August 7th. Wells Fargo & Company upgraded shares of Globus Medical from an "equal weight" rating to an "overweight" rating and increased their price target for the stock from $60.00 to $78.00 in a research note on Wednesday, August 7th. BTIG Research increased their price objective on shares of Globus Medical from $77.00 to $78.00 and gave the company a "buy" rating in a research report on Monday, October 14th. Needham & Company LLC reissued a "hold" rating on shares of Globus Medical in a research report on Wednesday. Finally, Morgan Stanley raised their price target on shares of Globus Medical from $67.00 to $71.00 and gave the company an "equal weight" rating in a report on Monday, July 15th. One analyst has rated the stock with a sell rating, three have issued a hold rating and eight have given a buy rating to the stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $87.09.

Read Our Latest Analysis on GMED

Globus Medical Trading Up 9.4 %

Shares of NYSE GMED traded up $7.13 during midday trading on Wednesday, hitting $82.71. The company's stock had a trading volume of 3,865,151 shares, compared to its average volume of 998,129. The stock has a fifty day moving average price of $71.69 and a 200 day moving average price of $68.06. The firm has a market capitalization of $11.20 billion, a price-to-earnings ratio of 270.17, a P/E/G ratio of 2.07 and a beta of 1.17. Globus Medical has a one year low of $43.38 and a one year high of $84.87.

Globus Medical (NYSE:GMED - Get Free Report) last issued its quarterly earnings data on Tuesday, November 5th. The medical device company reported $0.83 EPS for the quarter, beating the consensus estimate of $0.65 by $0.18. The company had revenue of $625.71 million during the quarter, compared to analysts' expectations of $604.69 million. Globus Medical had a net margin of 1.82% and a return on equity of 8.70%. Globus Medical's revenue for the quarter was up 63.1% on a year-over-year basis. During the same quarter in the previous year, the company earned $0.57 earnings per share. On average, equities research analysts predict that Globus Medical will post 2.84 earnings per share for the current fiscal year.

Insider Activity at Globus Medical

In other Globus Medical news, Director David D. Davidar sold 30,000 shares of the business's stock in a transaction dated Wednesday, October 16th. The shares were sold at an average price of $75.04, for a total value of $2,251,200.00. Following the completion of the transaction, the director now directly owns 536,275 shares in the company, valued at approximately $40,242,076. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. In other news, Director Ann D. Rhoads sold 15,000 shares of the business's stock in a transaction dated Friday, September 13th. The stock was sold at an average price of $70.36, for a total transaction of $1,055,400.00. Following the sale, the director now owns 42,884 shares in the company, valued at approximately $3,017,318.24. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, Director David D. Davidar sold 30,000 shares of the company's stock in a transaction that occurred on Wednesday, October 16th. The shares were sold at an average price of $75.04, for a total value of $2,251,200.00. Following the completion of the sale, the director now owns 536,275 shares in the company, valued at approximately $40,242,076. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 18.54% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Several large investors have recently made changes to their positions in GMED. Sheaff Brock Investment Advisors LLC increased its stake in shares of Globus Medical by 0.8% in the 3rd quarter. Sheaff Brock Investment Advisors LLC now owns 39,024 shares of the medical device company's stock worth $2,792,000 after acquiring an additional 321 shares during the last quarter. KBC Group NV grew its holdings in shares of Globus Medical by 0.5% during the 3rd quarter. KBC Group NV now owns 45,505 shares of the medical device company's stock worth $3,255,000 after purchasing an additional 237 shares during the period. Geneva Capital Management LLC grew its holdings in shares of Globus Medical by 1.1% during the 3rd quarter. Geneva Capital Management LLC now owns 1,598,130 shares of the medical device company's stock worth $114,330,000 after purchasing an additional 18,117 shares during the period. Lisanti Capital Growth LLC grew its holdings in shares of Globus Medical by 68.4% during the 3rd quarter. Lisanti Capital Growth LLC now owns 24,915 shares of the medical device company's stock worth $1,782,000 after purchasing an additional 10,120 shares during the period. Finally, River Global Investors LLP boosted its holdings in Globus Medical by 0.7% during the 3rd quarter. River Global Investors LLP now owns 47,067 shares of the medical device company's stock valued at $3,366,000 after acquiring an additional 331 shares during the period. 95.16% of the stock is owned by institutional investors and hedge funds.

About Globus Medical

(

Get Free Report)

Globus Medical, Inc, a medical device company, develops and commercializes healthcare solutions for patients with musculoskeletal disorders in the United States and internationally. The company offers spine products, such as traditional fusion implants comprising pedicle screw and rod systems, plating systems, intervertebral spacers, and corpectomy devices for treating degenerative and congenital conditions, deformity, tumors, and trauma injuries; treatment options for motion preservation technologies that consist of dynamic stabilization, total disc replacement, and interspinous distraction devices; interventional solutions to treat vertebral compression fractures; and regenerative biologic products comprising of allografts and synthetic alternatives.

Featured Stories

Before you consider Globus Medical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Globus Medical wasn't on the list.

While Globus Medical currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.