Globus Medical (NYSE:GMED - Get Free Report) issued an update on its FY 2024 earnings guidance on Tuesday morning. The company provided earnings per share (EPS) guidance of 2.900-3.000 for the period, compared to the consensus estimate of 2.850. The company issued revenue guidance of $2.5 billion-$2.5 billion, compared to the consensus revenue estimate of $2.5 billion. Globus Medical also updated its FY24 guidance to $2.90-3.00 EPS.

Globus Medical Price Performance

NYSE GMED traded up $0.86 on Tuesday, reaching $75.58. The company had a trading volume of 1,273,301 shares, compared to its average volume of 984,722. Globus Medical has a 1 year low of $43.38 and a 1 year high of $76.13. The firm has a 50-day moving average of $71.61 and a 200-day moving average of $67.88. The firm has a market capitalization of $10.23 billion, a PE ratio of 251.00, a P/E/G ratio of 2.07 and a beta of 1.17.

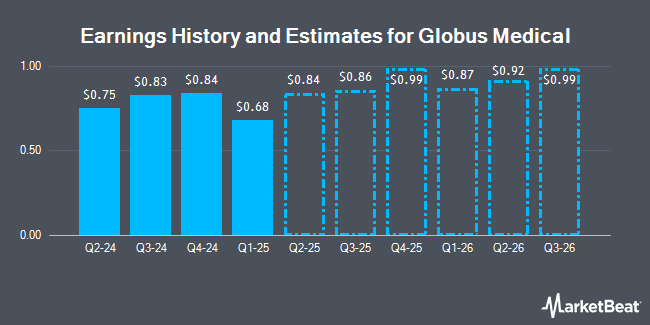

Globus Medical (NYSE:GMED - Get Free Report) last announced its quarterly earnings results on Tuesday, August 6th. The medical device company reported $0.75 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.68 by $0.07. The business had revenue of $629.69 million for the quarter, compared to the consensus estimate of $615.33 million. Globus Medical had a return on equity of 8.70% and a net margin of 1.82%. The business's revenue was up 115.9% on a year-over-year basis. During the same quarter last year, the business posted $0.63 EPS. As a group, sell-side analysts expect that Globus Medical will post 2.84 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

A number of equities research analysts recently weighed in on GMED shares. BTIG Research lifted their price objective on shares of Globus Medical from $77.00 to $78.00 and gave the company a "buy" rating in a research note on Monday, October 14th. Morgan Stanley boosted their price objective on shares of Globus Medical from $67.00 to $71.00 and gave the company an "equal weight" rating in a research report on Monday, July 15th. Barclays boosted their target price on Globus Medical from $85.00 to $93.00 and gave the company an "overweight" rating in a research note on Thursday, August 8th. Wells Fargo & Company upgraded shares of Globus Medical from an "equal weight" rating to an "overweight" rating and increased their price target for the stock from $60.00 to $78.00 in a research note on Wednesday, August 7th. Finally, Royal Bank of Canada boosted their target price on Globus Medical from $78.00 to $80.00 and gave the stock an "outperform" rating in a report on Tuesday, October 8th. Three investment analysts have rated the stock with a hold rating and seven have assigned a buy rating to the stock. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $77.78.

View Our Latest Stock Analysis on Globus Medical

Insiders Place Their Bets

In other news, Director Ann D. Rhoads sold 15,000 shares of the business's stock in a transaction on Friday, September 13th. The stock was sold at an average price of $70.36, for a total transaction of $1,055,400.00. Following the completion of the sale, the director now owns 42,884 shares in the company, valued at $3,017,318.24. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this link. In other news, Director Ann D. Rhoads sold 15,000 shares of the stock in a transaction on Friday, September 13th. The stock was sold at an average price of $70.36, for a total value of $1,055,400.00. Following the transaction, the director now owns 42,884 shares of the company's stock, valued at $3,017,318.24. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, Director David D. Davidar sold 30,000 shares of the business's stock in a transaction dated Wednesday, October 16th. The stock was sold at an average price of $75.04, for a total value of $2,251,200.00. Following the transaction, the director now owns 536,275 shares of the company's stock, valued at $40,242,076. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 18.54% of the company's stock.

Globus Medical Company Profile

(

Get Free Report)

Globus Medical, Inc, a medical device company, develops and commercializes healthcare solutions for patients with musculoskeletal disorders in the United States and internationally. The company offers spine products, such as traditional fusion implants comprising pedicle screw and rod systems, plating systems, intervertebral spacers, and corpectomy devices for treating degenerative and congenital conditions, deformity, tumors, and trauma injuries; treatment options for motion preservation technologies that consist of dynamic stabilization, total disc replacement, and interspinous distraction devices; interventional solutions to treat vertebral compression fractures; and regenerative biologic products comprising of allografts and synthetic alternatives.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Globus Medical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Globus Medical wasn't on the list.

While Globus Medical currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.