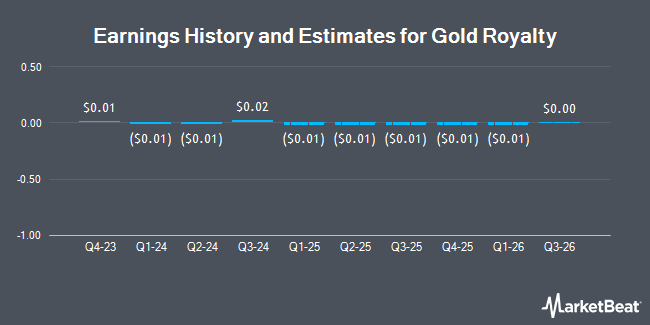

Gold Royalty Corp. (NYSE:GROY - Free Report) - Equities research analysts at National Bank Financial raised their FY2024 earnings estimates for shares of Gold Royalty in a note issued to investors on Tuesday, November 5th. National Bank Financial analyst S. Nagle now expects that the company will post earnings of $0.00 per share for the year, up from their previous forecast of ($0.04). The consensus estimate for Gold Royalty's current full-year earnings is ($0.03) per share. National Bank Financial also issued estimates for Gold Royalty's FY2025 earnings at ($0.01) EPS and FY2026 earnings at $0.00 EPS.

Gold Royalty (NYSE:GROY - Get Free Report) last released its earnings results on Monday, November 4th. The company reported $0.02 EPS for the quarter, topping analysts' consensus estimates of ($0.01) by $0.03. The firm had revenue of $2.06 million during the quarter. Gold Royalty had a negative net margin of 381.76% and a negative return on equity of 0.53%.

Separately, HC Wainwright reduced their target price on Gold Royalty from $5.75 to $5.50 and set a "buy" rating on the stock in a report on Tuesday.

View Our Latest Stock Analysis on Gold Royalty

Gold Royalty Stock Up 0.7 %

Shares of Gold Royalty stock traded up $0.01 during trading on Friday, reaching $1.42. 940,917 shares of the company were exchanged, compared to its average volume of 912,947. The business's 50-day simple moving average is $1.37. The stock has a market cap of $240.08 million, a price-to-earnings ratio of -10.92 and a beta of 0.94. The company has a quick ratio of 1.69, a current ratio of 1.69 and a debt-to-equity ratio of 0.09. Gold Royalty has a twelve month low of $1.17 and a twelve month high of $2.21.

Institutional Trading of Gold Royalty

Several hedge funds have recently added to or reduced their stakes in GROY. Oxbow Advisors LLC bought a new stake in Gold Royalty in the 3rd quarter valued at approximately $49,000. Bayshore Asset Management LLC acquired a new stake in shares of Gold Royalty in the third quarter valued at approximately $61,000. AlphaQ Advisors LLC lifted its position in shares of Gold Royalty by 62.2% in the second quarter. AlphaQ Advisors LLC now owns 84,260 shares of the company's stock worth $119,000 after purchasing an additional 32,315 shares in the last quarter. Regal Partners Ltd boosted its holdings in Gold Royalty by 101.9% during the second quarter. Regal Partners Ltd now owns 83,017 shares of the company's stock worth $120,000 after purchasing an additional 41,899 shares during the last quarter. Finally, DiNuzzo Private Wealth Inc. bought a new position in Gold Royalty in the third quarter valued at $132,000. Institutional investors and hedge funds own 33.75% of the company's stock.

About Gold Royalty

(

Get Free Report)

Gold Royalty Corp., a precious metals-focused royalty company, provides financing solutions to the metals and mining industry. It focuses on acquiring royalties, streams, and similar interests at varying stages of the mine life cycle to build a portfolio offering near, medium, and longer-term returns for its investors.

Further Reading

Before you consider Gold Royalty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gold Royalty wasn't on the list.

While Gold Royalty currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.