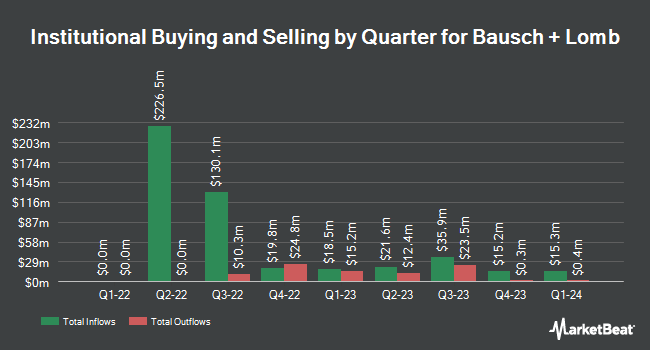

Goldentree Asset Management LP trimmed its position in shares of Bausch + Lomb Co. (NYSE:BLCO - Free Report) by 34.2% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 3,355,437 shares of the company's stock after selling 1,745,693 shares during the period. Bausch + Lomb comprises 5.2% of Goldentree Asset Management LP's portfolio, making the stock its 5th largest position. Goldentree Asset Management LP owned 0.95% of Bausch + Lomb worth $64,600,000 at the end of the most recent quarter.

A number of other institutional investors also recently modified their holdings of BLCO. River Road Asset Management LLC lifted its stake in Bausch + Lomb by 4.4% in the third quarter. River Road Asset Management LLC now owns 2,020,414 shares of the company's stock worth $38,974,000 after acquiring an additional 85,987 shares during the period. Whitebox Advisors LLC raised its holdings in Bausch + Lomb by 28.2% in the 2nd quarter. Whitebox Advisors LLC now owns 1,545,946 shares of the company's stock worth $22,447,000 after purchasing an additional 339,643 shares in the last quarter. Clearline Capital LP lifted its position in shares of Bausch + Lomb by 136.8% in the 2nd quarter. Clearline Capital LP now owns 712,055 shares of the company's stock worth $10,339,000 after purchasing an additional 411,404 shares during the period. Point72 Europe London LLP boosted its stake in shares of Bausch + Lomb by 28.9% during the 2nd quarter. Point72 Europe London LLP now owns 653,492 shares of the company's stock valued at $9,489,000 after purchasing an additional 146,583 shares in the last quarter. Finally, Point72 Asset Management L.P. boosted its stake in shares of Bausch + Lomb by 31.0% during the 2nd quarter. Point72 Asset Management L.P. now owns 647,156 shares of the company's stock valued at $9,397,000 after purchasing an additional 153,000 shares in the last quarter. 11.07% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

BLCO has been the subject of a number of research reports. Needham & Company LLC reissued a "hold" rating on shares of Bausch + Lomb in a research note on Thursday, October 31st. Citigroup increased their target price on Bausch + Lomb from $20.00 to $24.00 and gave the stock a "buy" rating in a research report on Thursday, October 31st. Wells Fargo & Company raised their target price on Bausch + Lomb from $23.00 to $26.00 and gave the company an "overweight" rating in a research note on Thursday, October 31st. HC Wainwright upped their price target on Bausch + Lomb from $22.00 to $23.00 and gave the stock a "buy" rating in a research note on Thursday, October 31st. Finally, Royal Bank of Canada raised their price objective on Bausch + Lomb from $20.00 to $23.00 and gave the company an "outperform" rating in a research report on Tuesday, October 22nd. Five equities research analysts have rated the stock with a hold rating and seven have given a buy rating to the company. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average target price of $20.91.

Check Out Our Latest Report on BLCO

Bausch + Lomb Stock Down 0.8 %

Shares of NYSE:BLCO traded down $0.15 on Friday, hitting $19.82. 149,096 shares of the company traded hands, compared to its average volume of 554,680. The company has a market cap of $6.98 billion, a PE ratio of -18.88, a PEG ratio of 1.92 and a beta of 0.46. The stock has a 50 day simple moving average of $19.79 and a 200-day simple moving average of $17.19. Bausch + Lomb Co. has a 52 week low of $13.16 and a 52 week high of $21.69. The company has a quick ratio of 0.95, a current ratio of 1.57 and a debt-to-equity ratio of 0.69.

Bausch + Lomb (NYSE:BLCO - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The company reported $0.17 earnings per share for the quarter, beating analysts' consensus estimates of $0.16 by $0.01. The business had revenue of $1.20 billion during the quarter, compared to analyst estimates of $1.17 billion. Bausch + Lomb had a negative net margin of 7.86% and a positive return on equity of 3.17%. Bausch + Lomb's revenue was up 18.8% compared to the same quarter last year. During the same period last year, the business earned $0.22 EPS. As a group, research analysts expect that Bausch + Lomb Co. will post 0.6 earnings per share for the current year.

Bausch + Lomb Profile

(

Free Report)

Bausch + Lomb Corporation operates as an eye health company in the United States, Puerto Rico, China, France, Japan, Germany, the United Kingdom, Canada, Russia, Spain, Italy, Mexico, Poland, South Korea, and internationally. It operates in three segments: Vision Care, Pharmaceuticals, and Surgical. The Vision Care segment provides contact lens that covers the spectrum of wearing modalities, including daily disposable and frequently replaced contact lenses; and contact lens care products comprising over-the-counter eye drops, eye vitamins, and mineral supplements that address various conditions, such as eye allergies, conjunctivitis, dry eye, and redness relief.

Featured Articles

Before you consider Bausch + Lomb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bausch + Lomb wasn't on the list.

While Bausch + Lomb currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.