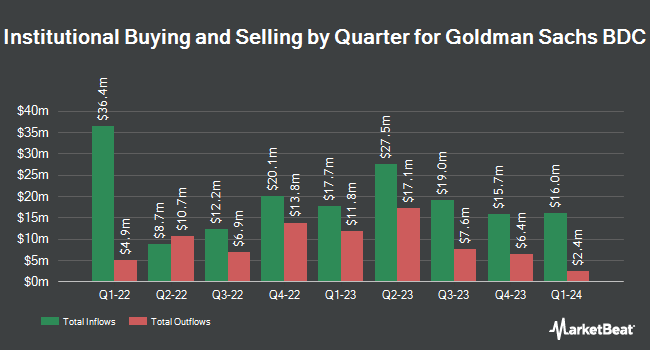

Wells Fargo & Company MN lifted its holdings in shares of Goldman Sachs BDC, Inc. (NYSE:GSBD - Free Report) by 18.4% during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 327,622 shares of the financial services provider's stock after buying an additional 51,014 shares during the period. Wells Fargo & Company MN owned approximately 0.28% of Goldman Sachs BDC worth $3,964,000 at the end of the most recent reporting period.

A number of other hedge funds have also bought and sold shares of the business. Van ECK Associates Corp grew its stake in shares of Goldman Sachs BDC by 1.0% during the 4th quarter. Van ECK Associates Corp now owns 2,732,785 shares of the financial services provider's stock valued at $33,066,000 after purchasing an additional 25,888 shares during the period. Generali Asset Management SPA SGR purchased a new position in shares of Goldman Sachs BDC during the 4th quarter worth $12,879,000. Raymond James Financial Inc. bought a new stake in shares of Goldman Sachs BDC during the 4th quarter valued at $8,114,000. Shikiar Asset Management Inc. raised its holdings in Goldman Sachs BDC by 6.7% in the 4th quarter. Shikiar Asset Management Inc. now owns 450,090 shares of the financial services provider's stock worth $5,446,000 after purchasing an additional 28,100 shares during the period. Finally, Arcus Capital Partners LLC lifted its position in Goldman Sachs BDC by 0.7% during the fourth quarter. Arcus Capital Partners LLC now owns 401,369 shares of the financial services provider's stock valued at $4,857,000 after purchasing an additional 2,958 shares in the last quarter. Hedge funds and other institutional investors own 28.72% of the company's stock.

Analyst Upgrades and Downgrades

Separately, StockNews.com raised Goldman Sachs BDC from a "sell" rating to a "hold" rating in a research report on Sunday, March 23rd.

Read Our Latest Stock Report on GSBD

Goldman Sachs BDC Price Performance

Shares of NYSE:GSBD traded up $0.16 during trading on Friday, hitting $10.92. 467,668 shares of the company's stock were exchanged, compared to its average volume of 795,581. The business's 50-day simple moving average is $11.72 and its 200 day simple moving average is $12.47. The company has a debt-to-equity ratio of 1.19, a current ratio of 1.26 and a quick ratio of 1.26. Goldman Sachs BDC, Inc. has a 52-week low of $9.51 and a 52-week high of $15.94. The company has a market cap of $1.28 billion, a price-to-earnings ratio of 15.58 and a beta of 0.87.

Goldman Sachs BDC Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, April 28th. Investors of record on Monday, March 31st will be given a dividend of $0.16 per share. This is a positive change from Goldman Sachs BDC's previous quarterly dividend of $0.05. The ex-dividend date is Monday, March 31st. This represents a $0.64 dividend on an annualized basis and a dividend yield of 5.86%. Goldman Sachs BDC's dividend payout ratio is currently 224.56%.

About Goldman Sachs BDC

(

Free Report)

Goldman Sachs BDC, Inc is a business development company specializing in middle market and mezzanine investment in private companies. It seeks to make capital appreciation through direct originations of secured debt, senior secured debt, junior secured debt, including first lien, first lien/last-out unitranche and second lien debt, unsecured debt, including mezzanine debt and, to a lesser extent, investments in equities.

Featured Articles

Before you consider Goldman Sachs BDC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Goldman Sachs BDC wasn't on the list.

While Goldman Sachs BDC currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.