Golub Capital BDC (NASDAQ:GBDC - Free Report) had its price target trimmed by Wells Fargo & Company from $15.50 to $15.00 in a report released on Thursday,Benzinga reports. The brokerage currently has an equal weight rating on the investment management company's stock.

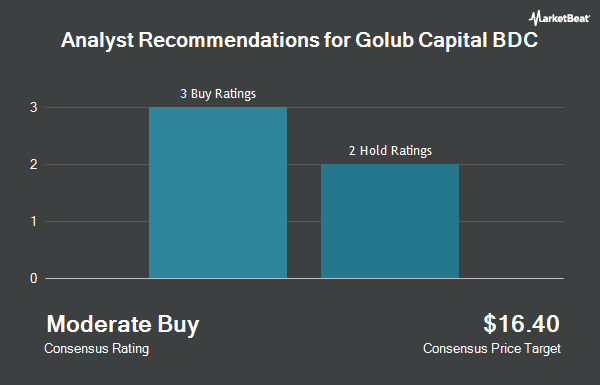

Other analysts also recently issued reports about the company. Oppenheimer reaffirmed an "outperform" rating and issued a $17.00 target price on shares of Golub Capital BDC in a research note on Wednesday, August 7th. Keefe, Bruyette & Woods cut their price objective on Golub Capital BDC from $17.50 to $16.50 and set an "outperform" rating for the company in a research report on Wednesday, August 7th. Finally, StockNews.com raised Golub Capital BDC from a "sell" rating to a "hold" rating in a research report on Thursday, October 10th. Three research analysts have rated the stock with a hold rating and three have given a buy rating to the company's stock. According to data from MarketBeat.com, Golub Capital BDC presently has an average rating of "Moderate Buy" and a consensus target price of $16.40.

Check Out Our Latest Research Report on GBDC

Golub Capital BDC Stock Down 0.5 %

Shares of GBDC traded down $0.07 during mid-day trading on Thursday, hitting $15.15. 1,805,923 shares of the company traded hands, compared to its average volume of 1,169,160. Golub Capital BDC has a 1-year low of $14.05 and a 1-year high of $17.72. The company has a quick ratio of 5.01, a current ratio of 5.01 and a debt-to-equity ratio of 1.06. The company has a market capitalization of $2.60 billion, a PE ratio of 10.79 and a beta of 0.54. The business has a 50 day moving average of $15.19 and a 200 day moving average of $15.44.

Golub Capital BDC Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, December 27th. Stockholders of record on Monday, December 9th will be paid a $0.39 dividend. This represents a $1.56 annualized dividend and a dividend yield of 10.30%. The ex-dividend date of this dividend is Monday, December 9th. Golub Capital BDC's payout ratio is presently 110.64%.

Insider Buying and Selling

In other Golub Capital BDC news, Chairman Lawrence E. Golub bought 20,000 shares of the firm's stock in a transaction dated Thursday, September 5th. The stock was acquired at an average price of $14.91 per share, for a total transaction of $298,200.00. Following the completion of the purchase, the chairman now owns 1,998,880 shares of the company's stock, valued at approximately $29,803,300.80. This represents a 1.01 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Insiders acquired a total of 80,000 shares of company stock worth $1,197,400 over the last 90 days. 2.70% of the stock is owned by insiders.

Institutional Inflows and Outflows

Large investors have recently bought and sold shares of the business. Hexagon Capital Partners LLC lifted its holdings in shares of Golub Capital BDC by 171.5% during the 3rd quarter. Hexagon Capital Partners LLC now owns 2,145 shares of the investment management company's stock worth $32,000 after acquiring an additional 1,355 shares during the period. Allworth Financial LP boosted its stake in shares of Golub Capital BDC by 135.6% in the third quarter. Allworth Financial LP now owns 2,340 shares of the investment management company's stock valued at $35,000 after purchasing an additional 1,347 shares during the period. Cove Street Capital LLC acquired a new stake in shares of Golub Capital BDC during the second quarter valued at about $39,000. Quarry LP acquired a new stake in Golub Capital BDC during the 2nd quarter valued at approximately $61,000. Finally, Brown Brothers Harriman & Co. acquired a new stake in shares of Golub Capital BDC during the second quarter worth approximately $71,000. Hedge funds and other institutional investors own 42.38% of the company's stock.

About Golub Capital BDC

(

Get Free Report)

Golub Capital BDC, Inc (GBDC) is a business development company and operates as an externally managed closed-end non-diversified management investment company. It invests in debt and minority equity investments in middle-market companies that are, in most cases, sponsored by private equity investors.

See Also

Before you consider Golub Capital BDC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Golub Capital BDC wasn't on the list.

While Golub Capital BDC currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.