StockNews.com upgraded shares of Golub Capital BDC (NASDAQ:GBDC - Free Report) from a sell rating to a hold rating in a report published on Friday.

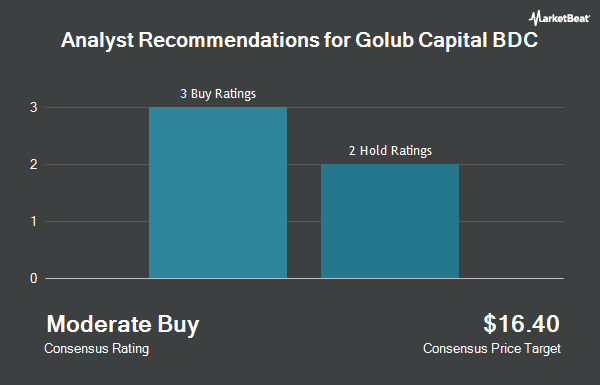

Other equities analysts have also recently issued research reports about the stock. Wells Fargo & Company dropped their target price on shares of Golub Capital BDC from $15.50 to $15.00 and set an "equal weight" rating on the stock in a research report on Thursday, November 21st. Keefe, Bruyette & Woods decreased their price target on shares of Golub Capital BDC from $17.50 to $16.50 and set an "outperform" rating for the company in a research note on Wednesday, August 7th. Finally, Oppenheimer restated an "outperform" rating and set a $17.00 price target on shares of Golub Capital BDC in a research note on Wednesday, August 7th. Three research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average price target of $16.40.

Get Our Latest Stock Analysis on Golub Capital BDC

Golub Capital BDC Stock Up 1.8 %

NASDAQ GBDC traded up $0.27 during trading hours on Friday, hitting $15.67. The company's stock had a trading volume of 930,260 shares, compared to its average volume of 1,173,339. Golub Capital BDC has a 52 week low of $14.05 and a 52 week high of $17.72. The company's 50-day simple moving average is $15.24 and its two-hundred day simple moving average is $15.39. The company has a current ratio of 4.73, a quick ratio of 4.73 and a debt-to-equity ratio of 1.15. The company has a market capitalization of $4.14 billion, a PE ratio of 10.99 and a beta of 0.54.

Golub Capital BDC Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, December 27th. Investors of record on Monday, December 9th will be paid a $0.39 dividend. The ex-dividend date of this dividend is Monday, December 9th. This represents a $1.56 dividend on an annualized basis and a yield of 9.96%. Golub Capital BDC's dividend payout ratio is 110.64%.

Insider Activity at Golub Capital BDC

In other Golub Capital BDC news, Chairman Lawrence E. Golub acquired 20,000 shares of Golub Capital BDC stock in a transaction that occurred on Thursday, September 5th. The stock was acquired at an average cost of $14.91 per share, for a total transaction of $298,200.00. Following the purchase, the chairman now owns 1,998,880 shares of the company's stock, valued at approximately $29,803,300.80. This represents a 1.01 % increase in their ownership of the stock. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. 2.70% of the stock is owned by company insiders.

Institutional Inflows and Outflows

A number of hedge funds have recently made changes to their positions in the company. Franklin Resources Inc. grew its position in shares of Golub Capital BDC by 32.2% during the 3rd quarter. Franklin Resources Inc. now owns 404,865 shares of the investment management company's stock valued at $6,134,000 after purchasing an additional 98,685 shares in the last quarter. Tidal Investments LLC grew its position in shares of Golub Capital BDC by 4.1% during the 3rd quarter. Tidal Investments LLC now owns 76,160 shares of the investment management company's stock valued at $1,151,000 after purchasing an additional 2,991 shares in the last quarter. Wilmington Savings Fund Society FSB purchased a new position in shares of Golub Capital BDC during the 3rd quarter valued at $1,533,000. Sanctuary Advisors LLC grew its position in shares of Golub Capital BDC by 1.1% during the 3rd quarter. Sanctuary Advisors LLC now owns 71,988 shares of the investment management company's stock valued at $1,101,000 after purchasing an additional 769 shares in the last quarter. Finally, Anchor Investment Management LLC grew its position in shares of Golub Capital BDC by 195.0% during the 3rd quarter. Anchor Investment Management LLC now owns 274,115 shares of the investment management company's stock valued at $4,142,000 after purchasing an additional 181,210 shares in the last quarter. 42.38% of the stock is currently owned by hedge funds and other institutional investors.

About Golub Capital BDC

(

Get Free Report)

Golub Capital BDC, Inc (GBDC) is a business development company and operates as an externally managed closed-end non-diversified management investment company. It invests in debt and minority equity investments in middle-market companies that are, in most cases, sponsored by private equity investors.

Further Reading

Before you consider Golub Capital BDC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Golub Capital BDC wasn't on the list.

While Golub Capital BDC currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.