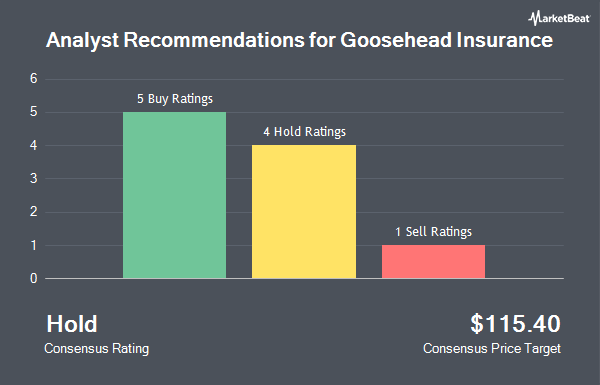

Shares of Goosehead Insurance, Inc (NASDAQ:GSHD - Get Free Report) have been given a consensus recommendation of "Hold" by the ten ratings firms that are presently covering the firm, MarketBeat.com reports. One analyst has rated the stock with a sell recommendation, four have assigned a hold recommendation and five have assigned a buy recommendation to the company. The average 12 month price target among analysts that have updated their coverage on the stock in the last year is $110.10.

Several analysts have weighed in on GSHD shares. UBS Group boosted their price target on shares of Goosehead Insurance from $120.00 to $145.00 and gave the stock a "buy" rating in a research note on Friday, March 7th. Bank of America boosted their target price on Goosehead Insurance from $39.00 to $43.00 and gave the company an "underperform" rating in a research note on Tuesday, February 25th. Piper Sandler reduced their price target on Goosehead Insurance from $132.00 to $122.00 and set an "overweight" rating on the stock in a research report on Wednesday, April 9th. Truist Financial reaffirmed a "hold" rating and issued a $90.00 price target (up from $80.00) on shares of Goosehead Insurance in a research note on Tuesday, February 25th. Finally, Keefe, Bruyette & Woods increased their price objective on Goosehead Insurance from $110.00 to $127.00 and gave the company an "outperform" rating in a research note on Wednesday, February 26th.

Check Out Our Latest Research Report on GSHD

Goosehead Insurance Trading Up 4.8 %

GSHD stock opened at $103.22 on Wednesday. Goosehead Insurance has a one year low of $50.47 and a one year high of $130.39. The company has a market capitalization of $3.85 billion, a PE ratio of 143.36, a price-to-earnings-growth ratio of 5.17 and a beta of 1.48. The company's 50 day moving average price is $114.42 and its two-hundred day moving average price is $111.13. The company has a debt-to-equity ratio of 37.70, a quick ratio of 1.55 and a current ratio of 1.55.

Insider Buying and Selling

In other Goosehead Insurance news, major shareholder & Robyn Jones Descendants Mark sold 19,600 shares of Goosehead Insurance stock in a transaction that occurred on Wednesday, March 5th. The stock was sold at an average price of $123.09, for a total transaction of $2,412,564.00. Following the sale, the insider now directly owns 132,349 shares of the company's stock, valued at approximately $16,290,838.41. The trade was a 12.90 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, Director Thomas Mcconnon sold 205,000 shares of the stock in a transaction that occurred on Friday, February 28th. The stock was sold at an average price of $121.35, for a total value of $24,876,750.00. Following the completion of the transaction, the director now directly owns 339,008 shares of the company's stock, valued at $41,138,620.80. This represents a 37.68 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 308,812 shares of company stock valued at $37,392,258 over the last quarter. 48.35% of the stock is owned by company insiders.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of the business. Vanguard Group Inc. grew its holdings in Goosehead Insurance by 0.8% in the fourth quarter. Vanguard Group Inc. now owns 2,499,479 shares of the company's stock worth $267,994,000 after purchasing an additional 19,980 shares during the period. American Century Companies Inc. grew its stake in shares of Goosehead Insurance by 51.4% in the 4th quarter. American Century Companies Inc. now owns 649,104 shares of the company's stock worth $69,597,000 after buying an additional 220,267 shares during the last quarter. Whitebark Investors LP bought a new position in Goosehead Insurance during the 4th quarter valued at approximately $55,326,000. Northern Trust Corp raised its stake in Goosehead Insurance by 10.4% during the fourth quarter. Northern Trust Corp now owns 266,466 shares of the company's stock valued at $28,570,000 after buying an additional 25,173 shares during the last quarter. Finally, Charles Schwab Investment Management Inc. grew its stake in shares of Goosehead Insurance by 2.6% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 215,680 shares of the company's stock worth $23,125,000 after acquiring an additional 5,459 shares during the last quarter.

Goosehead Insurance Company Profile

(

Get Free ReportGoosehead Insurance, Inc operates as a holding company for Goosehead Financial, LLC that engages in the provision of personal lines insurance agency services in the United States. The company offers homeowner's, automotive, dwelling property, flood, wind, earthquake, excess liability or umbrella, motorcycle, recreational vehicle, general liability, property, and life insurance products and services.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Goosehead Insurance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Goosehead Insurance wasn't on the list.

While Goosehead Insurance currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.