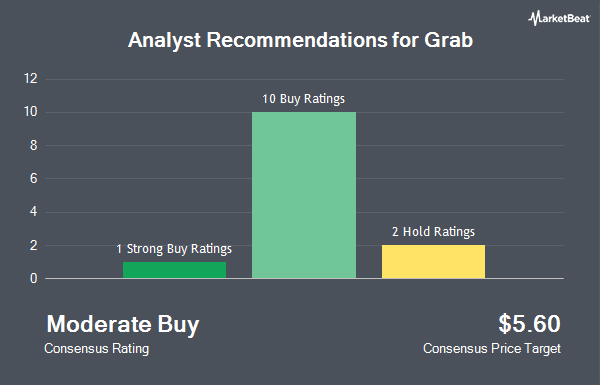

Shares of Grab Holdings Limited (NASDAQ:GRAB - Get Free Report) have earned an average rating of "Buy" from the nine analysts that are currently covering the company, Marketbeat reports. Nine investment analysts have rated the stock with a buy recommendation. The average 1-year price objective among brokers that have issued a report on the stock in the last year is $5.48.

GRAB has been the topic of several research reports. Barclays lifted their target price on Grab from $4.70 to $5.50 and gave the stock an "overweight" rating in a report on Wednesday. JPMorgan Chase & Co. increased their target price on Grab from $5.00 to $5.70 and gave the company an "overweight" rating in a research report on Tuesday. Mizuho boosted their price target on shares of Grab from $5.00 to $6.00 and gave the stock an "outperform" rating in a research report on Wednesday. Benchmark reiterated a "buy" rating and set a $6.00 price objective on shares of Grab in a research report on Tuesday. Finally, Daiwa Capital Markets began coverage on shares of Grab in a report on Wednesday, October 23rd. They issued an "outperform" rating and a $4.60 target price on the stock.

Check Out Our Latest Analysis on Grab

Grab Price Performance

NASDAQ GRAB remained flat at $4.73 during trading hours on Friday. The company had a trading volume of 54,217,902 shares, compared to its average volume of 24,747,713. Grab has a one year low of $2.90 and a one year high of $4.93. The company has a current ratio of 2.70, a quick ratio of 2.97 and a debt-to-equity ratio of 0.04. The business's 50-day moving average is $3.87 and its 200-day moving average is $3.61.

Grab (NASDAQ:GRAB - Get Free Report) last released its earnings results on Monday, November 11th. The company reported $0.01 EPS for the quarter. The firm had revenue of $716.00 million for the quarter, compared to the consensus estimate of $705.40 million. Grab had a negative net margin of 3.57% and a negative return on equity of 1.50%. During the same quarter in the previous year, the firm earned ($0.02) earnings per share. Research analysts predict that Grab will post -0.03 EPS for the current fiscal year.

Institutional Inflows and Outflows

A number of hedge funds have recently made changes to their positions in the stock. Wellington Management Group LLP lifted its holdings in Grab by 13.4% during the 3rd quarter. Wellington Management Group LLP now owns 124,314,286 shares of the company's stock valued at $472,394,000 after buying an additional 14,671,388 shares in the last quarter. Baillie Gifford & Co. purchased a new position in shares of Grab during the second quarter worth approximately $166,587,000. Coronation Fund Managers Ltd. raised its stake in shares of Grab by 29.7% during the second quarter. Coronation Fund Managers Ltd. now owns 45,452,613 shares of the company's stock valued at $161,357,000 after acquiring an additional 10,410,574 shares in the last quarter. State Street Corp boosted its holdings in shares of Grab by 2.3% in the third quarter. State Street Corp now owns 43,570,388 shares of the company's stock valued at $165,567,000 after purchasing an additional 967,233 shares during the period. Finally, Marshall Wace LLP grew its stake in Grab by 39.7% in the second quarter. Marshall Wace LLP now owns 30,405,993 shares of the company's stock worth $107,941,000 after purchasing an additional 8,635,310 shares in the last quarter. 55.52% of the stock is currently owned by institutional investors.

Grab Company Profile

(

Get Free ReportGrab Holdings Limited engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. The company offers its Grab ecosystem, a single platform with superapps for driver- and merchant-partners and consumers, that allows access to mobility, delivery, digital financial services, and enterprise sector offerings.

Featured Articles

Before you consider Grab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grab wasn't on the list.

While Grab currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.