Grab (NASDAQ:GRAB - Free Report) had its price target hoisted by JPMorgan Chase & Co. from $5.00 to $5.70 in a research note issued to investors on Tuesday morning,Benzinga reports. JPMorgan Chase & Co. currently has an overweight rating on the stock.

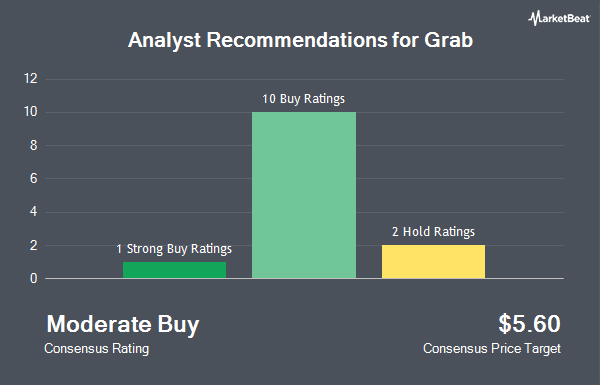

Several other brokerages have also issued reports on GRAB. Benchmark reaffirmed a "buy" rating and set a $6.00 target price on shares of Grab in a research report on Tuesday. Daiwa Capital Markets began coverage on Grab in a report on Wednesday, October 23rd. They set an "outperform" rating and a $4.60 price objective for the company. Evercore ISI boosted their target price on Grab from $7.00 to $8.00 and gave the company an "outperform" rating in a research note on Tuesday. Finally, Jefferies Financial Group decreased their price objective on Grab from $5.00 to $4.70 and set a "buy" rating for the company in a report on Wednesday, July 17th. Nine analysts have rated the stock with a buy rating, According to MarketBeat, the company presently has a consensus rating of "Buy" and a consensus price target of $5.28.

Check Out Our Latest Research Report on Grab

Grab Stock Up 11.6 %

NASDAQ GRAB traded up $0.51 on Tuesday, reaching $4.89. The company had a trading volume of 148,522,912 shares, compared to its average volume of 24,245,191. The company has a quick ratio of 2.97, a current ratio of 3.00 and a debt-to-equity ratio of 0.03. The company's fifty day moving average is $3.78 and its 200 day moving average is $3.58. Grab has a 52-week low of $2.90 and a 52-week high of $4.93. The stock has a market capitalization of $19.18 billion, a P/E ratio of -96.00 and a beta of 0.81.

Grab (NASDAQ:GRAB - Get Free Report) last released its quarterly earnings results on Thursday, August 15th. The company reported ($0.01) earnings per share for the quarter, meeting analysts' consensus estimates of ($0.01). The company had revenue of $664.00 million for the quarter, compared to analyst estimates of $674.17 million. Grab had a negative net margin of 8.24% and a negative return on equity of 3.35%. The firm's revenue was up 17.1% on a year-over-year basis. During the same period last year, the firm earned ($0.03) earnings per share. Sell-side analysts anticipate that Grab will post -0.04 earnings per share for the current fiscal year.

Institutional Trading of Grab

A number of large investors have recently modified their holdings of the business. Sequoia Financial Advisors LLC raised its holdings in shares of Grab by 8.1% during the 2nd quarter. Sequoia Financial Advisors LLC now owns 40,185 shares of the company's stock valued at $143,000 after buying an additional 3,020 shares in the last quarter. Empowered Funds LLC grew its holdings in shares of Grab by 7.7% during the 3rd quarter. Empowered Funds LLC now owns 43,788 shares of the company's stock valued at $166,000 after purchasing an additional 3,147 shares during the last quarter. Blue Trust Inc. raised its position in Grab by 53.6% in the 3rd quarter. Blue Trust Inc. now owns 9,767 shares of the company's stock worth $35,000 after purchasing an additional 3,408 shares during the period. Dorsey & Whitney Trust CO LLC boosted its position in Grab by 37.0% during the second quarter. Dorsey & Whitney Trust CO LLC now owns 14,061 shares of the company's stock valued at $50,000 after buying an additional 3,795 shares during the period. Finally, Asset Management One Co. Ltd. grew its stake in shares of Grab by 0.5% during the third quarter. Asset Management One Co. Ltd. now owns 776,458 shares of the company's stock valued at $2,951,000 after buying an additional 3,941 shares during the last quarter. Institutional investors own 55.52% of the company's stock.

Grab Company Profile

(

Get Free Report)

Grab Holdings Limited engages in the provision of superapps in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. The company offers its Grab ecosystem, a single platform with superapps for driver- and merchant-partners and consumers, that allows access to mobility, delivery, digital financial services, and enterprise sector offerings.

Further Reading

Before you consider Grab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grab wasn't on the list.

While Grab currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.