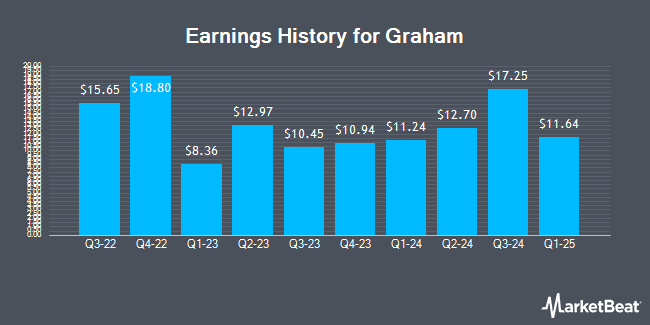

Graham (NYSE:GHC - Get Free Report) issued its earnings results on Wednesday. The company reported $22.58 earnings per share (EPS) for the quarter, beating the consensus estimate of $18.94 by $3.64, Zacks reports. The company had revenue of $1.25 billion during the quarter, compared to analysts' expectations of $1.27 billion. Graham had a return on equity of 5.79% and a net margin of 4.86%.

Graham Trading Up 0.0 %

Shares of NYSE GHC traded up $0.37 during mid-day trading on Friday, reaching $979.67. 20,381 shares of the company's stock were exchanged, compared to its average volume of 16,374. The firm has a market capitalization of $4.25 billion, a price-to-earnings ratio of 19.18 and a beta of 1.13. The company has a debt-to-equity ratio of 0.18, a quick ratio of 1.34 and a current ratio of 1.57. Graham has a 52-week low of $683.00 and a 52-week high of $993.49. The company's 50-day moving average is $914.16 and its 200-day moving average is $864.38.

Graham Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Thursday, May 8th. Stockholders of record on Thursday, April 17th will be issued a dividend of $1.80 per share. This represents a $7.20 dividend on an annualized basis and a dividend yield of 0.73%. The ex-dividend date of this dividend is Thursday, April 17th. Graham's dividend payout ratio is presently 14.10%.

Analyst Ratings Changes

Separately, StockNews.com upgraded Graham from a "hold" rating to a "buy" rating in a report on Monday, November 4th.

Check Out Our Latest Stock Analysis on GHC

Insider Transactions at Graham

In related news, CAO Marcel A. Snyman sold 159 shares of the firm's stock in a transaction dated Monday, January 6th. The stock was sold at an average price of $881.30, for a total transaction of $140,126.70. Following the completion of the transaction, the chief accounting officer now directly owns 442 shares in the company, valued at $389,534.60. This trade represents a 26.46 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Company insiders own 20.50% of the company's stock.

Graham Company Profile

(

Get Free Report)

Graham Holdings Company, through its subsidiaries, operates as a diversified education and media company in the United States and internationally. It provides test preparation services and materials; professional training and exam preparation for professional certifications and licensures; and non-academic operations support services to the Purdue University Global; operations support services for online courses and programs; training and test preparation services for accounting and financial services professionals; English-language training, academic preparation programs, and test preparation for English proficiency exams; and A-level examination preparation services, as well as operates colleges, business school, higher education institution, and an online learning institution.

Featured Stories

Before you consider Graham, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Graham wasn't on the list.

While Graham currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.