Grantham Mayo Van Otterloo & Co. LLC increased its holdings in shares of Mueller Industries, Inc. (NYSE:MLI - Free Report) by 22.6% during the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 50,780 shares of the industrial products company's stock after buying an additional 9,346 shares during the quarter. Grantham Mayo Van Otterloo & Co. LLC's holdings in Mueller Industries were worth $4,030,000 as of its most recent filing with the Securities and Exchange Commission.

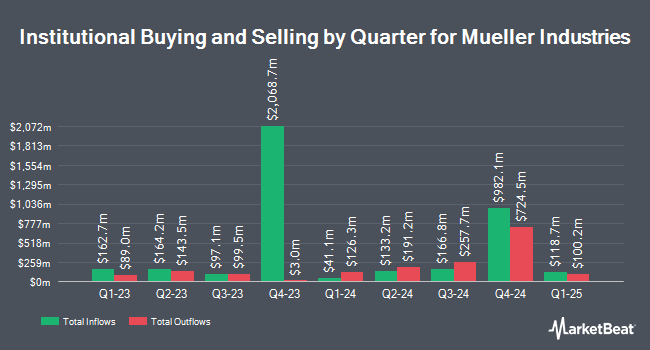

Other hedge funds have also recently bought and sold shares of the company. New Age Alpha Advisors LLC purchased a new position in shares of Mueller Industries during the 4th quarter valued at $32,000. Westside Investment Management Inc. acquired a new stake in shares of Mueller Industries during the 3rd quarter valued at about $41,000. SBI Securities Co. Ltd. bought a new stake in shares of Mueller Industries in the 4th quarter valued at approximately $47,000. Mirae Asset Global Investments Co. Ltd. acquired a new position in Mueller Industries in the fourth quarter worth approximately $53,000. Finally, City State Bank acquired a new stake in Mueller Industries in the fourth quarter valued at approximately $58,000. 94.50% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling at Mueller Industries

In related news, Director Scott Jay Goldman sold 10,000 shares of the stock in a transaction that occurred on Thursday, February 13th. The stock was sold at an average price of $79.81, for a total transaction of $798,100.00. Following the completion of the sale, the director now owns 56,098 shares in the company, valued at $4,477,181.38. This represents a 15.13 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Corporate insiders own 2.80% of the company's stock.

Mueller Industries Stock Up 2.2 %

Shares of MLI traded up $1.63 during mid-day trading on Friday, hitting $74.24. 704,260 shares of the company's stock were exchanged, compared to its average volume of 916,412. Mueller Industries, Inc. has a twelve month low of $50.85 and a twelve month high of $96.81. The firm has a fifty day moving average of $78.36 and a two-hundred day moving average of $79.94. The stock has a market cap of $8.22 billion, a price-to-earnings ratio of 13.98 and a beta of 0.96.

Mueller Industries (NYSE:MLI - Get Free Report) last announced its quarterly earnings results on Tuesday, February 4th. The industrial products company reported $1.21 earnings per share for the quarter, topping analysts' consensus estimates of $1.12 by $0.09. Mueller Industries had a return on equity of 22.97% and a net margin of 16.05%.

Mueller Industries Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, March 28th. Investors of record on Friday, March 14th were issued a dividend of $0.25 per share. This is an increase from Mueller Industries's previous quarterly dividend of $0.20. This represents a $1.00 annualized dividend and a dividend yield of 1.35%. The ex-dividend date of this dividend was Friday, March 14th. Mueller Industries's dividend payout ratio is currently 18.83%.

About Mueller Industries

(

Free Report)

Mueller Industries, Inc manufactures and sells copper, brass, aluminum, and plastic products in the United States, the United Kingdom, Canada, South Korea, the Middle East, China, and Mexico. It operates through three segments: Piping Systems, Industrial Metals, and Climate. The Piping Systems segment offers copper tubes, fittings, line sets, and pipe nipples.

Further Reading

Before you consider Mueller Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mueller Industries wasn't on the list.

While Mueller Industries currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.