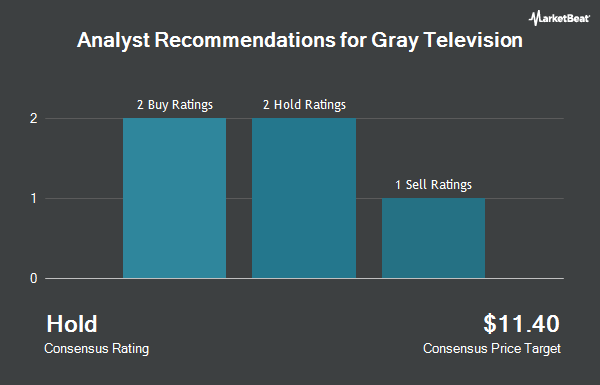

Gray Television, Inc. (NYSE:GTN - Get Free Report) has earned an average recommendation of "Moderate Buy" from the five ratings firms that are presently covering the stock, MarketBeat Ratings reports. One analyst has rated the stock with a sell rating, one has given a hold rating, two have given a buy rating and one has given a strong buy rating to the company. The average 12-month target price among brokerages that have updated their coverage on the stock in the last year is $6.67.

A number of equities analysts have commented on GTN shares. Benchmark decreased their price objective on shares of Gray Television from $11.00 to $8.00 and set a "buy" rating for the company in a report on Monday, November 11th. StockNews.com raised shares of Gray Television from a "sell" rating to a "hold" rating in a report on Monday, November 11th. Guggenheim lowered their price objective on shares of Gray Television from $10.00 to $8.00 and set a "buy" rating for the company in a research report on Tuesday, November 12th. Finally, Barrington Research raised shares of Gray Television to a "hold" rating in a report on Thursday, November 14th.

Check Out Our Latest Stock Report on GTN

Gray Television Stock Up 0.2 %

Shares of Gray Television stock traded up $0.01 during trading on Monday, reaching $4.11. The company had a trading volume of 714,458 shares, compared to its average volume of 1,268,128. The company has a market cap of $409.64 million, a price-to-earnings ratio of 2.73, a price-to-earnings-growth ratio of 0.14 and a beta of 1.36. Gray Television has a fifty-two week low of $3.95 and a fifty-two week high of $10.07. The firm's fifty day moving average is $5.08 and its 200-day moving average is $5.17. The company has a debt-to-equity ratio of 2.76, a quick ratio of 1.13 and a current ratio of 1.13.

Gray Television (NYSE:GTN - Get Free Report) last announced its quarterly earnings data on Friday, November 8th. The company reported $0.86 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.94 by ($0.08). The firm had revenue of $950.00 million for the quarter, compared to analyst estimates of $967.49 million. Gray Television had a net margin of 5.69% and a return on equity of 9.60%. The company's quarterly revenue was up 18.3% compared to the same quarter last year. During the same quarter in the previous year, the company earned ($0.57) EPS. On average, analysts anticipate that Gray Television will post 2.88 EPS for the current year.

Gray Television Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Investors of record on Friday, December 13th will be issued a $0.08 dividend. The ex-dividend date of this dividend is Friday, December 13th. This represents a $0.32 dividend on an annualized basis and a dividend yield of 7.79%. Gray Television's dividend payout ratio (DPR) is presently 21.33%.

Insider Activity at Gray Television

In related news, EVP Kevin Paul Latek sold 150,216 shares of the firm's stock in a transaction that occurred on Monday, December 2nd. The stock was sold at an average price of $4.37, for a total value of $656,443.92. Following the sale, the executive vice president now directly owns 509,212 shares in the company, valued at $2,225,256.44. This trade represents a 22.78 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. 13.83% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently modified their holdings of the business. Capital Management Corp VA boosted its holdings in shares of Gray Television by 27.6% in the third quarter. Capital Management Corp VA now owns 5,408,269 shares of the company's stock valued at $28,988,000 after acquiring an additional 1,170,990 shares in the last quarter. State Street Corp boosted its stake in Gray Television by 1.9% during the 3rd quarter. State Street Corp now owns 2,009,896 shares of the company's stock valued at $10,773,000 after purchasing an additional 36,541 shares in the last quarter. Geode Capital Management LLC boosted its stake in Gray Television by 3.0% during the 3rd quarter. Geode Capital Management LLC now owns 1,971,374 shares of the company's stock valued at $10,568,000 after purchasing an additional 57,481 shares in the last quarter. Tributary Capital Management LLC increased its position in shares of Gray Television by 0.8% during the 2nd quarter. Tributary Capital Management LLC now owns 1,334,714 shares of the company's stock valued at $6,941,000 after purchasing an additional 10,093 shares during the period. Finally, AQR Capital Management LLC raised its stake in shares of Gray Television by 4.8% in the 2nd quarter. AQR Capital Management LLC now owns 1,055,389 shares of the company's stock worth $5,488,000 after buying an additional 48,623 shares in the last quarter. Institutional investors own 78.64% of the company's stock.

About Gray Television

(

Get Free ReportGray Television, Inc, a television broadcasting company, owns and/or operates television stations and digital assets in the United States. It also broadcasts secondary digital channels affiliated to ABC, CBS, NBC, and FOX, as well as various other networks and program services, including CW Plus Network, MY Network, the MeTV Network, Circle, Telemundo, THE365, and Outlaw; and local news/weather channels in various markets.

See Also

Before you consider Gray Television, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gray Television wasn't on the list.

While Gray Television currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.