Great Point Partners LLC decreased its stake in Ionis Pharmaceuticals, Inc. (NASDAQ:IONS - Free Report) by 22.7% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 255,000 shares of the company's stock after selling 75,000 shares during the quarter. Ionis Pharmaceuticals makes up about 3.0% of Great Point Partners LLC's investment portfolio, making the stock its 14th largest position. Great Point Partners LLC owned 0.16% of Ionis Pharmaceuticals worth $10,215,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

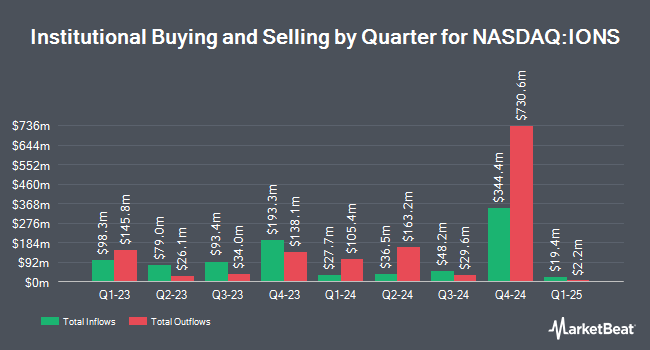

A number of other large investors have also recently bought and sold shares of IONS. Mather Group LLC. boosted its stake in shares of Ionis Pharmaceuticals by 35.8% in the 2nd quarter. Mather Group LLC. now owns 911 shares of the company's stock valued at $39,000 after purchasing an additional 240 shares in the last quarter. Vanguard Personalized Indexing Management LLC boosted its position in Ionis Pharmaceuticals by 3.5% in the second quarter. Vanguard Personalized Indexing Management LLC now owns 7,624 shares of the company's stock valued at $363,000 after buying an additional 261 shares in the last quarter. Nicollet Investment Management Inc. boosted its position in Ionis Pharmaceuticals by 1.5% in the third quarter. Nicollet Investment Management Inc. now owns 20,402 shares of the company's stock valued at $817,000 after buying an additional 294 shares in the last quarter. Amalgamated Bank grew its stake in Ionis Pharmaceuticals by 3.1% during the third quarter. Amalgamated Bank now owns 9,957 shares of the company's stock worth $399,000 after buying an additional 300 shares during the last quarter. Finally, GAMMA Investing LLC increased its holdings in shares of Ionis Pharmaceuticals by 83.9% during the third quarter. GAMMA Investing LLC now owns 664 shares of the company's stock worth $27,000 after buying an additional 303 shares in the last quarter. 93.86% of the stock is currently owned by institutional investors.

Insider Activity

In other Ionis Pharmaceuticals news, EVP Eric Swayze sold 1,194 shares of the business's stock in a transaction dated Tuesday, November 12th. The stock was sold at an average price of $37.92, for a total value of $45,276.48. Following the completion of the transaction, the executive vice president now directly owns 33,713 shares of the company's stock, valued at approximately $1,278,396.96. The trade was a 3.42 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, CEO Brett P. Monia sold 6,630 shares of the firm's stock in a transaction dated Tuesday, November 12th. The stock was sold at an average price of $38.05, for a total value of $252,271.50. Following the sale, the chief executive officer now directly owns 167,393 shares in the company, valued at approximately $6,369,303.65. This represents a 3.81 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 7,877 shares of company stock valued at $299,578 in the last ninety days. 2.71% of the stock is owned by insiders.

Ionis Pharmaceuticals Trading Up 1.5 %

NASDAQ IONS traded up $0.53 on Wednesday, reaching $35.90. The company had a trading volume of 950,603 shares, compared to its average volume of 1,333,372. The company has a quick ratio of 8.82, a current ratio of 8.91 and a debt-to-equity ratio of 1.86. Ionis Pharmaceuticals, Inc. has a 52 week low of $33.33 and a 52 week high of $54.44. The stock has a market cap of $5.67 billion, a price-to-earnings ratio of -14.50 and a beta of 0.39. The stock's 50 day moving average is $38.48 and its 200-day moving average is $42.44.

Analyst Upgrades and Downgrades

Several research analysts have recently commented on the company. Piper Sandler reduced their target price on Ionis Pharmaceuticals from $65.00 to $62.00 and set an "overweight" rating on the stock in a report on Thursday, November 14th. The Goldman Sachs Group boosted their price objective on Ionis Pharmaceuticals from $33.00 to $37.00 and gave the stock a "sell" rating in a research note on Friday, August 2nd. StockNews.com cut Ionis Pharmaceuticals from a "hold" rating to a "sell" rating in a report on Tuesday, November 12th. JPMorgan Chase & Co. lifted their price target on Ionis Pharmaceuticals from $50.00 to $55.00 and gave the company a "neutral" rating in a report on Monday, August 26th. Finally, Royal Bank of Canada reissued an "outperform" rating and set a $70.00 price objective on shares of Ionis Pharmaceuticals in a report on Thursday, September 26th. Two equities research analysts have rated the stock with a sell rating, five have given a hold rating, twelve have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat.com, Ionis Pharmaceuticals currently has a consensus rating of "Moderate Buy" and a consensus price target of $60.65.

View Our Latest Report on Ionis Pharmaceuticals

About Ionis Pharmaceuticals

(

Free Report)

Ionis Pharmaceuticals, Inc discovers and develops RNA-targeted therapeutics in the United States. The company offers SPINRAZA for spinal muscular atrophy (SMA) in pediatric and adult patients; TEGSEDI, an antisense injection for the treatment of polyneuropathy caused by hereditary transthyretin amyloidosis in adults; and WAYLIVRA, an antisense medicine for treatment for familial chylomicronemia syndrome (FCS) and familial partial lipodystrophy.

Featured Stories

Before you consider Ionis Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ionis Pharmaceuticals wasn't on the list.

While Ionis Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.