Great Point Wealth Advisors LLC cut its holdings in shares of On Holding AG (NYSE:ONON - Free Report) by 46.1% in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 37,946 shares of the company's stock after selling 32,441 shares during the period. Great Point Wealth Advisors LLC's holdings in ON were worth $2,078,000 as of its most recent SEC filing.

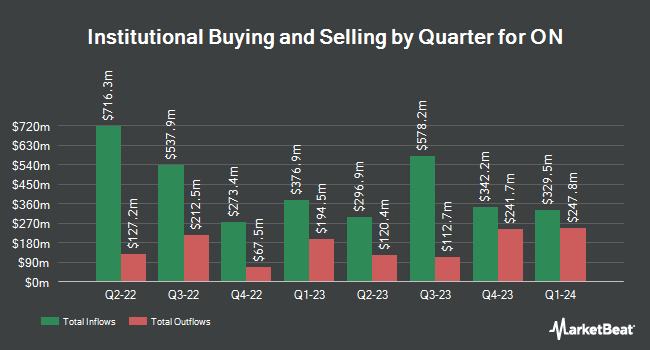

Several other hedge funds and other institutional investors also recently bought and sold shares of ONON. Private Trust Co. NA acquired a new stake in shares of ON in the third quarter valued at approximately $26,000. Blue Trust Inc. lifted its position in shares of ON by 319.8% during the 3rd quarter. Blue Trust Inc. now owns 529 shares of the company's stock valued at $27,000 after acquiring an additional 403 shares during the last quarter. MidAtlantic Capital Management Inc. purchased a new position in ON in the 3rd quarter worth about $29,000. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA boosted its holdings in shares of ON by 210.5% in the third quarter. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA now owns 590 shares of the company's stock worth $28,000 after buying an additional 400 shares during the period. Finally, Legacy Bridge LLC purchased a new stake in shares of ON in the 4th quarter valued at approximately $43,000. 36.39% of the stock is currently owned by hedge funds and other institutional investors.

ON Price Performance

ONON stock traded up $0.67 during trading on Wednesday, hitting $59.01. The stock had a trading volume of 1,824,753 shares, compared to its average volume of 3,327,887. The company's 50-day moving average price is $57.40 and its two-hundred day moving average price is $50.77. On Holding AG has a twelve month low of $27.02 and a twelve month high of $64.05. The stock has a market capitalization of $37.15 billion, a P/E ratio of 137.11, a PEG ratio of 1.21 and a beta of 2.30.

Analysts Set New Price Targets

ONON has been the subject of a number of analyst reports. Bank of America initiated coverage on shares of ON in a research note on Tuesday, January 7th. They issued a "buy" rating and a $73.00 target price for the company. The Goldman Sachs Group lifted their price target on ON from $50.00 to $57.00 and gave the stock a "buy" rating in a research report on Wednesday, November 13th. Raymond James raised ON from an "outperform" rating to a "strong-buy" rating and lifted their price objective for the stock from $58.00 to $63.00 in a report on Thursday, November 21st. KeyCorp raised their target price on ON from $60.00 to $68.00 and gave the stock an "overweight" rating in a research report on Thursday, January 23rd. Finally, UBS Group reissued a "buy" rating and issued a $63.00 price objective on shares of ON in a research note on Friday, December 27th. Four research analysts have rated the stock with a hold rating, nineteen have given a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $59.73.

View Our Latest Stock Report on ON

ON Company Profile

(

Free Report)

On Holding AG engages in the development and distribution of sports products such as footwear, apparel, and accessories for high-performance running, outdoor, and all-day activities. It sells its products worldwide through independent retailers and global distributors, its own online presence, and its own high-end stores.

Featured Articles

Before you consider ON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ON wasn't on the list.

While ON currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.